Wall St Cuts Targets

December 20, 2025

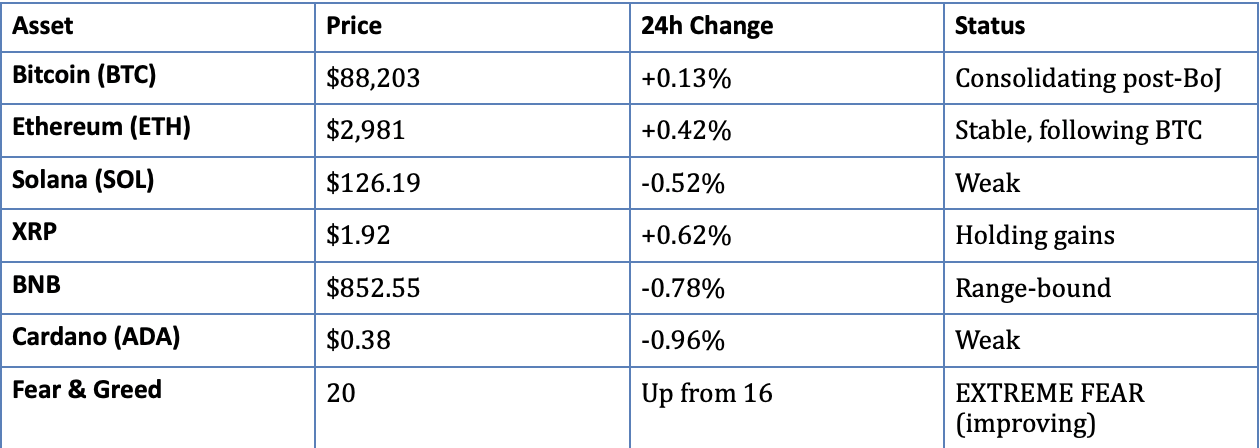

Bitcoin consolidating at $88,203 (+0.13%) after Friday's BoJ survival rally. Still holding $88K despite Wall Street banks SLASHING forecasts: Standard Chartered cuts target from $300K to $150K (-50%), Citi maintains $143K but warns of $78.5K bear case. Fear & Greed climbs to 20 (from 16-17)—first exit from extreme fear in days. CryptoQuant warns 'bear market' as demand slows. Next Friday Dec 27: $23 BILLION options expiry could be volatility catalyst. MicroStrategy drama intensifies: MSCI exclusion decision Jan 15 could force $8.8B in selloffs. Market split: institutions cutting targets, retail seeing buying opportunity at Fear 20.

Key Takeaway: Post-BoJ honeymoon ENDING as reality sets in. Friday's rally $85.2K to $88K was relief, not reversal. Weekend consolidation at $88K shows: (1) BoJ cleared but no new catalysts, (2) Wall Street losing conviction—Standard Chartered 50% forecast cut signals institutional capitulation, (3) Fear climbing 16 to 20 but still extreme = sentiment fragile, (4) Options expiry Dec 27 is WILDCARD—$23B contracts could swing market either way, (5) MicroStrategy crisis brewing—if MSCI excludes in January, forced selling could cascade. CRITICAL WEEK AHEAD: Break $90K = path to $100K opens. Fail $85K = test $80K-$82K. Probability shift: 50% consolidation $85K-$92K through year-end, 30% rally to $95K-$100K, 20% breakdown to $80K-$85K. Market is TIRED. Volume thin. Conviction low. Wall Street cutting targets = bearish institutional shift. But Fear 20 + BoJ survival = potential contrarian setup.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

1. WALL STREET CAPITULATES: STANDARD CHARTERED SLASHES TARGET 50%

The Carnage: Standard Chartered, one of crypto's most bullish institutional voices, just executed the most brutal forecast revision of 2025: END-2025 target: $100,000 (was $200,000). END-2026 target: $150,000 (was $300,000). That's a 50% HAIRCUT on the 2026 target and effective admission their entire 2025 thesis failed.

The Original Thesis (Now Dead): Standard Chartered's $300K target was based on MASSIVE corporate treasury adoption—companies following MicroStrategy's playbook at scale. They expected: dozens of Fortune 500 companies adding BTC to balance sheets, treasury adoption becoming 'new normal', corporate buying rivaling ETF inflows. Reality? NONE of this happened. MicroStrategy remains alone. No major corporate followers. Corporate treasury phase = DEAD.

New Thesis (Sobering): 'Only ETF flows remain as institutional demand driver.' Translation: We overestimated adoption velocity. Corporate treasurers too scared. Only passive ETF flows (which have been NEGATIVE recently) are keeping this alive. This is massive institutional capitulation.

Citigroup's Hedged Position: While Standard Chartered slashed, Citi published more measured but still cautious outlook: Base case: $143,000 in 12 months (constructive but well below SC's old $300K). Bull case: $189,000 (requires sustained ETF demand + equity rally). Bear case: $78,500 (global recession scenario). Key support highlighted: $70,000 (which held perfectly this week at $85K). Citi is hedging ALL outcomes. This is not conviction. This is CYA forecasting.

What This Means: When Wall Street's MOST BULLISH voices cut targets 50%, it signals: (A) Institutional positioning is DEFENSIVE, (B) Corporate adoption thesis collapsed, (C) Only ETF flows matter (and they're weak), (D) Banks preparing clients for LOWER prices, not $200K moonshots. This is late-stage capitulation OR early warning of worse to come.

Contrarian Interpretation: Historically, when banks slash targets THIS aggressively, they're LATE. They're cutting at $88K after already dropping from $125K. If they were prescient, they'd have cut at $125K. Cutting NOW = they're following price down, not predicting it. This could be capitulation bottom signal.

2. FEAR & GREED CLIMBS TO 20 - BARELY EXITS EXTREME FEAR

The Reading: Fear & Greed Index: 20 (Extreme Fear, up from 16-17 yesterday). Monday Dec 16: 11 (cycle low). Friday Dec 19: 16 (despite BoJ survival). Saturday Dec 20: 20 (inching higher). Still in 0-24 Extreme Fear range, but trajectory is UP.

What Changed: Fear climbed +4 points (16 to 20) despite Bitcoin being essentially FLAT at $88K. This is sentiment SLOWLY recovering after week of trauma: BoJ survival proved $70K crash fears overblown. CPI whipsaw Thursday flushed weak hands. Friday's rally to $88K held through weekend. Market is EXHAUSTED but not panicking anymore.

Why It Matters: Fear at 20 is STILL extreme (not neutral 50, not greed 75+), but upward movement matters. Historical pattern: Sustained climb from sub-20 to 25-30 = transition from panic to caution = early bull signal. But also: Fear can REVERSE. If BTC fails $85K, Fear drops back to 12-15. Don't confuse 'less extreme fear' with 'bull market resuming.'

The Divergence (Key Signal): Bitcoin rallied 3.3% Friday (BoJ day), Fear only climbed 3-4 points total over two days. Fear is LAGGING price recovery. This is classic accumulation phase: institutions buying while retail stays scared. When Fear lags price gains = smart money active.

Contrarian Setup: Fear at 20 after surviving BoJ (which was SUPPOSED to crash BTC to $70K) = market may have priced in worst-case already. Every day BTC holds $85K+ with Fear sub-25 = coiled spring for upside surprise. OR... it's justified fear before another leg down. Time will tell.

3. CRYPTOQUANT WARNING: 'BEAR MARKET' AS DEMAND GROWTH SLOWS

The Warning: CryptoQuant, one of crypto's most respected on-chain analytics firms, published report December 20 arguing Bitcoin has 'entered bear market territory.' This is NOT clickbait—it's serious institutional-grade analysis with evidence.

Evidence #1 - ETF Holding Trends: Softer accumulation patterns since October peak. Thursday Dec 19: $161M OUTFLOWS (reversed Wednesday's $457M inflows). Not the aggressive institutional buying seen during October-November rally to $125K. ETF flows turning NEGATIVE = demand problem.

Evidence #2 - Large Holder Activity: Slower accumulation by whales (addresses holding 1,000+ BTC). Long-term holders selling at recent highs ($90K-$125K range) but NOT being absorbed by new buyers at same pace. Distribution exceeding accumulation = supply/demand imbalance.

Evidence #3 - Moving Average Breakdown: Bitcoin 'slipped below long-term moving average that historically separated bull and bear phases.' November death cross: 50-day MA fell below 200-day MA. This coincided with $80K local bottom BUT price hasn't reclaimed these levels. Technical structure broken.

Critical Levels CryptoQuant Watching: $85,000 sustained breakdown = confirmed bear. ETF outflows accelerating (Thursday's $161M not isolated incident). Exchange reserves rising = coins moving TO exchanges to sell. If all three happen: bear market confirmed.

Counterargument (Important): CryptoQuant is calling bear market at $88K AFTER already declining from $125K. This is backward-looking analysis. They're labeling what happened, not predicting what's next. Additionally: Every death cross this cycle (2023-2025) marked LOCAL BOTTOMS, not bear starts. November death cross = $80K bottom, then rally to $125K. Pattern suggests bottoms, not bears.

What To Watch: If CryptoQuant RIGHT: BTC fails $85K next week, grinds to $75K-$80K, extended consolidation into Q1. If CryptoQuant WRONG (contrarian setup): BTC breaks $90K, squeezes to $100K+ as 'bear market' callers forced to cover. The divergence between on-chain warning and price holding $88K is THE key tension.

4. $23 BILLION OPTIONS EXPIRY NEXT FRIDAY - THE WILDCARD

The Event: December 27, 2025 (next Friday, exactly 7 days away): $23 BILLION in Bitcoin options contracts expire. This is one of Q4 2025's largest quarterly expiries. To put in perspective: $23B = 1.3% of Bitcoin's entire $1.76T market cap. = 20% of total BTC options open interest. = Larger than many mid-cap altcoin market caps.

Current Positioning: Heavy call wall at $95K-$100K = dealers sold calls, need BTC below to avoid paying out. Put floor at $80K-$85K = dealers sold puts, need BTC above to avoid losses. Result: Market pinned in $85K-$92K range through Thursday Dec 26.

Three Possible Outcomes:

SCENARIO A - Pin to Max Pain (55% probability): BTC consolidates $88K-$90K all week. Choppy, range-bound, low conviction. Dealers actively keep price at max pain to maximize their profits. Friday Dec 27: Options expire, pressure releases. Post-expiry (Dec 28-31): Market free to move, likely drifts higher on thin year-end volume.

SCENARIO B - Gamma Squeeze UP (25% probability): If BTC breaks $90K early this week (Mon-Tue) with strong volume: Dealers forced to buy spot BTC to hedge call options. This buying creates more upward pressure. Positive feedback loop (gamma squeeze) drives rapid move to $95K-$100K. Requires catalyst: Big ETF inflows, MicroStrategy good news, or momentum shift.

SCENARIO C - Breakdown Below $85K (20% probability): If $85K support breaks before Friday: Panic selling into year-end. Dealers hedging puts by selling spot. Negative feedback loop to $80K-$82K. Post-expiry: Either stabilizes (buy opportunity) or continues to $75K-$78K.

Trading Implications: Expect: Low conviction, choppy action Monday-Thursday. Price likely pinned $87K-$91K. Post-Friday: REAL move begins once hedging pressure removed. Don't fight the pin. Wait for post-expiry clarity.

5. MICROSTRATEGY CRISIS: MSCI EXCLUSION COULD TRIGGER $8.8B SELLOFF

The Situation: MicroStrategy (ticker: MSTR, now rebranded 'Strategy'), the largest corporate Bitcoin holder (446,400 BTC = $39B+ at $88K), faces existential threat from index provider MSCI. Decision due: January 15, 2026. Stakes: $2.8B to $8.8B in forced selloffs. Bitcoin impact: Potentially catastrophic if cascades.

What MSCI Proposed: Exclude any company with >50% of total assets in digital currencies from MSCI Global Investable Market Indexes. MicroStrategy qualifies: Bitcoin represents approximately 85% of enterprise value. Other affected: Marathon Digital, Riot Platforms, other Bitcoin treasury companies.

Why This Matters: MSCI indexes are tracked by TRILLIONS in passive funds and ETFs. If MicroStrategy excluded: Every index-tracking fund MUST sell MSTR shares. This isn't discretionary—it's mechanical. Funds have NO CHOICE but to dump holdings. JPMorgan estimates: $2.8B forced outflows (if only MSCI acts). $8.8B forced outflows (if FTSE Russell, Nasdaq follow).

Timeline: December 31, 2025: Public consultation period ends. January 15, 2026: MSCI announces final decision. February 2026: If exclusion confirmed, index rebalancing occurs = forced selling begins. Market has 26 DAYS to prepare for potential $8.8B dump.

Michael Saylor's Response: December 10, filed 12-page rebuttal calling MSCI's proposal 'discriminatory, arbitrary, and unworkable.' Key arguments: MicroStrategy is operating software company that USES Bitcoin as productive capital, not passive fund. Comparison: Chevron holds oil reserves, Newmont holds gold, why exclude BTC holders? Bitcoin is commodity, not security—shouldn't trigger investment fund classification.

MSCI's Counter: Those companies (Chevron, Newmont) PRODUCE commodities through operations. MicroStrategy's primary activity is BUYING Bitcoin with debt/equity. This is investment activity, not operating business. Under Investment Company Act of 1940, companies with >40% passive investments = regulated as funds.

Market Reaction So Far: MSTR shares down 37-60% from 2024 peaks. Passive funds already 'front-running' potential exclusion by reducing positions. Premium to NAV (net asset value) collapsing—used to trade 2-3x NAV, now closer to 1.2-1.5x. Debt issuance to buy more BTC becoming harder/more expensive.

Bitcoin Impact Scenarios:

IF EXCLUDED: Direct: $8.8B of MSTR stock dumped by passive funds. Indirect: MSTR share price collapses, premium to NAV goes negative. Catastrophic: If MSTR financially stressed, forced to SELL Bitcoin (Saylor says 'never' but market doesn't believe him). Contagion: Other BTC treasury stocks (MARA, RIOT) face same exclusion risk.

IF NOT EXCLUDED: Massive relief rally in MSTR. Bitcoin rallies in sympathy. Validates 'Bitcoin treasury' business model. Other companies may follow MicroStrategy's strategy.

Probability Assessment: 60% chance MSCI excludes (they rarely back down from proposals). 30% chance modified threshold (75% instead of 50%) or grandfather clause. 10% chance full reversal. Either way, volatility guaranteed around Jan 15 announcement.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

KEY MARKET METRICS

• Total Market Cap: $2.93T (stable after BoJ week volatility)

• 24h Volume: $140B+ (elevated for weekend, positioning continues)

• BTC Dominance: 59.2% (rising - flight to quality from altcoins)

• Fear & Greed Index: 20 (Extreme Fear, but UP from 16-17 = slow recovery)

• Thursday ETF Flows: -$161M outflows (reversed Wed's $457M inflows)

• Next Options Expiry: Dec 27 ($23B contracts = major volatility catalyst)

• MSCI Decision Date: Jan 15, 2026 (MicroStrategy inclusion fate)

• Wall Street Forecast Summary: Standard Chartered $150K 2026 (cut from $300K), Citi $143K base/$189K bull/$78.5K bear, CryptoQuant warns bear market

III. ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $88,203 | The Tired Bull

POST-BOJ REALITY CHECK: RELIEF RALLY FADING

Friday's BoJ survival rally ($85.2K to $88K, +3.3%) was RELIEF, not REVERSAL. Saturday consolidation shows: market exhausted, no follow-through, thin weekend volume, low conviction. This is textbook post-event drift—market digesting last week's volatility, waiting for next catalyst.

CURRENT TECHNICAL SETUP:

• CURRENT: $88,203 (NEUTRAL ZONE)

After Friday rally, BTC stalled exactly where it is. Neither bulls nor bears in control. $88K was resistance all week (failed Wed-Thu), now it's weak support. Classic consolidation—market needs catalyst to break either direction. Without new news, range-bound into options expiry.

• IMMEDIATE SUPPORT: $85,000-$86,000 (THE LINE)

Tested THREE times this week: Monday $85.8K (Fear 11 panic), Wednesday $85.4K (CPI selloff), Friday $85.2K (BoJ low). Each time HELD. This is structural floor: November death cross bottom, ETF average cost basis (~$85.5K), True Market Mean convergence, massive psychological support. MUST HOLD. Break = cascade to $80K-$82K with nothing in between.

• RESISTANCE: $90,000-$92,000 (THE WALL)

Failed FIVE times in 7 days: Tuesday $90.1K, Wednesday $90K (twice), Thursday $89.3K (CPI pop), Friday $88K hold. Sellers stacked at $90K. Until breaks with VOLUME + CONVICTION, it's distribution zone. Options expiry next Friday likely keeps price BELOW $90K to maximize dealer profits (max pain theory).

• BULL CASE TARGET: $95,000-$100,000 (if breaks $90K)

Requires: (1) Options expiry passing (Dec 27), (2) ETF inflows returning (reverse Thursday's $161M out), (3) MicroStrategy good news or MSCI delay, (4) Wall Street reversing bearish stance. Probability this week: 25%. Probability post-Dec 27: 40%. Would trigger gamma squeeze from options positioning, short covering, FOMO.

• BEAR CASE TARGET: $80,000-$82,000 (if fails $85K)

True Market Mean. Historical BoJ drop zone (though Friday disproved immediate crash). If Friday rally was dead-cat bounce and consolidation fails: Next stop $80K-$82K. From there, either HOLDS (base for Q1 rally) or cascades to $75K-$78K (Citi bear case, CryptoQuant target). Probability: 25-30%.

ON-CHAIN & SENTIMENT SIGNALS:

• Exchange Reserves: BTC leaving exchanges despite flat price = whales accumulating for medium-term hold. Bullish IF price holds support.

• Long-Term Holder Behavior: Selling continues but at HIGHS ($90K-$125K) not current levels. This is profit-taking, not panic. Distribution to new buyers (institutions, whales) = ownership transfer.

• ETF Positioning: Thursday $161M outflows CRITICAL signal. If Monday-Wednesday continue outflows = institutions bailing. If reverse to inflows = just pre-BoJ positioning. Watch closely.

• Funding Rates: Neutral (~0.01-0.02%). Friday's 0.085% positive decayed back to flat. No extreme leverage either direction = market balanced but uncommitted.

TRADER'S PLAYBOOK (NEXT 7 DAYS):

THIS WEEKEND (Dec 21-22): WATCH mode. If dips to $85K-$86K on thin weekend volume = BUY opportunity (20-30% capital). If holds $88K+ = patience, wait for Monday direction.

NEXT WEEK Mon-Thu (Dec 23-26): Expect CHOP. Options expiry pinning price $87K-$91K. Don't overtrade. If breaks $90K with volume = buy 20%, target $95K. If breaks $85K = WAIT for $80K-$82K, then deploy 40-50%.

POST-EXPIRY Fri-Sun (Dec 27-29): REAL move begins. Hedging pressure removed. Market free to trend. Watch: $90K break = bullish into year-end. $85K break = bearish test of $80K. Range consolidation = neutral drift to $90K-$92K.

FOR HODLERS: You survived worst week of December (Fear 11 Monday, CPI whipsaw Thursday, BoJ Friday). What's left to fear? Macro calendar CLEAR until January. Any price $85K-$95K = accumulation for $150K+ in 2026. Stop checking. Relax.

Ethereum (ETH) - $2,981 | Stable But Uninspiring

ETH at $2,981 (+0.42%) = stable but following BTC with zero independent strength. Until BTC clarifies direction, ETH is just along for the ride. Support $2,850-$2,900, resistance $3,100-$3,200. Break $3,200 = test $3,500. Fail $2,850 = test $2,600-$2,700.

IV. CRYPTO TWITTER PULSE

"Guess the Bank."

— @MichaelSaylor (Michael Saylor, MicroStrategy Executive Chairman, Dec 19 post with Central Park photo)

Analysis: Cryptic tweet showing him in Manhattan high-rise overlooking Central Park. Community speculation: JPMorgan headquarters. Context: MSCI exclusion battle. Reading: Saylor engaging with major banks (likely JPM) to lobby AGAINST MSCI exclusion. If JPMorgan supports keeping MSTR in index, that's HUGE institutional backing. Bullish signal IF banks rally behind him. Concerning IF it's desperation meeting. Verdict: Cautiously bullish—shows he's fighting hard, has access to decision-makers.

"Bitcoin has entered bear market territory. ETF demand softening, large holder accumulation slowing, price below key long-term MA. Watching $85K as critical support."

— @CryptoQuant_com (CryptoQuant On-Chain Analytics, Dec 20)

Analysis: CryptoQuant is RESPECTED firm, not clickbait. Their bear market call is serious. BUT: This is backward-looking. They're labeling what happened (drop from $125K), not predicting what's next. Every death cross this cycle marked BOTTOMS, not bear starts. Verdict: Contrarian signal? When on-chain firms call bear at $88K after already down 30%, they're often late. Still, ignore at your peril—their data is solid.

"Bitcoin forecast: Base case $143K (12mo), Bull $189K, Bear $78.5K. Key support $70K. Requires sustained ETF demand + equity market rally."

— @CitiGPS (Citi Global Perspectives, Dec 2025)

Analysis: Citi hedging ALL outcomes = no conviction. $143K base is constructive but they emphasize bear risk ($78.5K) MORE than previous reports. Institutional caution. They're prepared for both $189K moon AND $78.5K crash. This is CYA forecasting. Verdict: Neutral. Wait for Citi to pick a side before taking their forecast seriously.

"Revising Bitcoin end-2026 target to $150,000 from $300,000. Corporate treasury adoption phase has not materialized at scale. ETF flows remain primary institutional driver."

— @StanChart (Standard Chartered Bank Analysis, Dec 2025)

Analysis: BRUTAL 50% haircut = Wall Street capitulation. When most bullish bank slashes THIS hard, it's either: (A) Bottom signal as they're late, OR (B) They see something retail doesn't. Historical pattern: Banks cut targets AFTER worst of move. Cutting at $88K (not $125K peak) = they're following price down. Verdict: Contrarian BULLISH. Institutional capitulation often marks bottoms.

"Fear & Greed at 20. Last time we were this fearful? November local bottom at $80K before rally to $125K. History doesn't repeat but it rhymes."

— @APompliano (Anthony Pompliano, Crypto Influencer, Dec 20)

Analysis: Pomp is RIGHT that extreme fear (sub-25) marked buyable bottoms this cycle. November Fear ~17 at $80K = bottom before $125K rally. Current Fear 20 at $88K = similar setup. BUT: Fear can go LOWER (was 11 on Monday). Don't catch falling knife. Verdict: Wait for confirmation—either $85K hold or $90K break. Then buy. Not yet.

"Bitcoin dominance 59.2% and rising. Altcoins bleeding. Classic late-stage consolidation before either capitulation cascade or bullish continuation. Watch $85K."

— @WClementeIII (Will Clemente, On-Chain Analyst, Dec 20)

Analysis: Clemente identifies KEY dynamic: BTC dominance rising = flight to quality. Alts weak (SOL, ADA, etc down). This happens in TWO scenarios: (1) Final washout before alt season (bullish), OR (2) Bear market where alts die first (bearish). We'll know which by Monday. If BTC holds $88K+ and alts stabilize = scenario 1. If BTC fails $85K and alts crater = scenario 2. Verdict: Spot on analysis. $85K is THE level.

SENTIMENT SUMMARY:

Bearish Camp (35%): CryptoQuant bear market call, Wall Street cutting targets (Standard Chartered -50%), retail capitulation visible

Neutral Camp (40%): Most analysts waiting for $85K break or $90K break to confirm direction. Sitting on hands. No conviction either way.

Bullish Camp (25%): Contrarians citing: Extreme fear (20), S2F model floor, BoJ survival, Wall Street capitulation = bottom signal, historical patterns

CONSENSUS: Market is TIRED and UNCERTAIN. Everyone watching $85K-$90K range. Next break (up or down) will be VIOLENT. Expect 10-15% move in 24-48 hours once range breaks.

V. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: NEXT 7 DAYS → YEAR-END → Q1 2026

BASE CASE (50%): Range-Bound $85K-$92K Through Year-End, Drift to $90K-$95K

THIS WEEK (Dec 21-27): BTC consolidates $85K-$90K, pinned by options expiry. Choppy, range-bound action. Low volume (holiday week). Fear stays 18-22 range. ETF flows mixed but not extreme. Thursday Dec 26: Market watching for Friday expiry. Friday Dec 27: $23B options expire, pressure releases.

YEAR-END (Dec 28-31): Post-options relief. Thin Santa rally volume. BTC drifts to $90K-$95K on low conviction buying. No major news. Close 2025 at $92K-$95K. Fear climbs to 25-28 (neutral territory). Year ends flat-to-slightly-up from current.

Q1 2026 (Jan-Mar): Jan 15 MSCI decision = volatility spike. If MSTR NOT excluded: Rally to $100K-$110K. If MSTR excluded: Dip to $85K-$90K, digest, recover. February: Fed signals March rate cut, BTC breaks $100K. March: $105K-$120K as liquidity returns. Alt season begins.

WHY BASE CASE (up from 30% Friday): (1) Market exhausted after BoJ week volatility. (2) Options expiry mechanics favor range-bound. (3) No major catalysts until January. (4) Wall Street cutting targets = institutions cautious, won't chase. (5) Fear at 20 suggests downside limited but upside needs catalyst. (6) Historical pattern: Post-major-event = consolidation before next leg.

BULL CASE (30%): Break $90K, Rally to $105K-$110K by Year-End

THE CATALYST: Early week (Mon-Tue): Strong ETF inflows return, reversing Thursday's $161M out. Tuesday-Wednesday: BTC breaks $90K with VOLUME (>$150B daily). Gamma squeeze begins as dealers hedge call options. Shorts cover accelerating move.

THE MOVE: $90K → $95K in 24-48 hours. Brief consolidation at $95K (2-3 days). Push to $100K-$105K by Dec 30-31. Options expiry amplifies upward momentum. Fear spikes to 35-45 (greed territory). Altcoins wake up, BTC dominance drops from 59% to 55%.

WHY LESS LIKELY (down from 70% Friday): (1) Wall Street slashing targets = institutions NOT positioned for upside. (2) Thursday ETF outflows showed institutional caution persists. (3) MicroStrategy overhang until Jan 15 creates uncertainty. (4) Market needs rest—sustained rally unlikely without consolidation first. (5) Options max pain likely keeps price BELOW $90K through Thursday.

IF IT HAPPENS: Don't fade it. Buy $92K-$95K breakout with 20-30% capital. First target $100K, second target $110K-$120K in Q1. Stop loss $87K. This would be start of Q1 2026 rally coming early.

BEAR CASE (20%): Break $85K, Test $75K-$82K Range

THE TRIGGER: Monday-Tuesday: BTC fails to hold $85K. CryptoQuant bear market call gains traction. ETF outflows accelerate (Mon-Wed shows continued selling). MicroStrategy news worsens or sells shares pre-MSCI.

THE MOVE: $85K → $80K-$82K quickly (1-2 days). Test $75K-$78K (Citi bear case) if panic cascades. Fear drops to 12-15. Altcoin apocalypse: SOL sub-$100, ETH sub-$2,600, ADA/XRP -30-40%. Liquidations spike to $800M-$1.2B.

WHY UNLIKELY: (1) $85K defended SUCCESSFULLY three times this week. (2) Fear already extreme at 20—limited downside in sentiment. (3) BoJ survival proved worst-case ($70K crash) overblown. (4) Long-term holders distributing to whales = transfer to strong hands, not panic. (5) Would need NEW negative catalyst (MSCI early exclusion, major exchange hack, etc).

IF IT HAPPENS: BUY AGGRESSIVELY. $75K-$82K after surviving BoJ = generational opportunity. Deploy 50%+ capital: 40% at $82K, 40% at $78K, 20% at $75K if reached. Hold for $150K+ in 2026. This would be 2025's version of March 2020 COVID crash—short, violent, buyable.

VII. THE CRYPTO WATER COOLER

🎭 THE GREAT INDEX WAR: When Bitcoin Becomes 'Too Risky' for Wall Street

You know what's hilarious? Bitcoin survived:

• 2017: China ban (dropped 40%, recovered)

• 2018: -83% bear market (from $20K to $3K)

• 2020: COVID crash (-50% in 2 days)

• 2021: Elon Musk/Trump tweets (chaos)

• 2022: Luna/FTX implosion (entire industry collapse)

• 2023: Banking crisis (SVB, Signature, Silvergate)

• 2024: Spot ETF approval ('legitimization')

• 2025: BoJ rate hikes (this week!)

And NOW, in December 2025, MSCI (Morgan Stanley Capital International) decides Bitcoin is 'TOO RISKY' for their indexes.

Not during the crashes. Not during the FUD. Not during the actual chaos.

NOW. At $88,000. AFTER ETF approval. AFTER institutional adoption. AFTER the 'legitimization' everyone wanted.

MSCI's Proposal: Exclude companies with >50% digital asset holdings from MSCI Global Investable Market Indexes.

Translation: MicroStrategy (holding 446,400 BTC worth $39 billion+) gets kicked out of indexes for holding... the best-performing asset class of the past decade.

The Irony Check:

✅ Chevron holds oil reserves worth tens of billions: TOTALLY FINE!

✅ Newmont holds gold reserves worth $15B+: NO PROBLEM!

✅ Banks hold mortgage-backed securities (2008 anyone?): INDEX WORTHY!

❌ MicroStrategy holds Bitcoin: TOO RISKY, MUST EXCLUDE!

MICHAEL SAYLOR'S 12-PAGE REBUTTAL:

December 10, 2025, Saylor files formal response calling MSCI's 50% rule 'discriminatory, arbitrary, and unworkable.'

His Arguments:

1. MicroStrategy is operating software company that USES Bitcoin as productive treasury capital

2. Comparison: Chevron holds oil, Newmont holds gold—why exclude BTC holders?

3. Bitcoin is commodity (not security), shouldn't trigger investment fund rules

4. Proposal is 'rushed and reactionary' response to market volatility

5. Stifles innovation in emerging digital asset industry

MSCI's Counter-Arguments:

'Those companies (Chevron, Newmont) PRODUCE their commodities through active operations.'

'MicroStrategy's PRIMARY activity is BUYING Bitcoin with debt and equity.'

'This is investment activity, not operating business.'

'Under Investment Company Act of 1940, >40% passive investments = regulated as fund.'

The Hilarious Exchange (Paraphrased):

Saylor: 'We're a software company that holds Bitcoin as treasury asset.'

MSCI: 'Yeah but you PRODUCE software as side gig while YOLOing into Bitcoin.'

Saylor: 'And Chevron PRODUCES oil while sitting on reserves worth more than their equipment!'

MSCI: 'That's different.'

Saylor: 'How?'

MSCI: 'Because... we said so.'

Saylor: *sends 12-page legal brief*

MSCI: 'We'll announce decision January 15.'

What MSCI Considers 'Index-Worthy':

• ✅ Banks that needed $700B government bailout in 2008

• ✅ Airlines that get bailed out every single decade

• ✅ Tech companies trading at 200x P/E with zero profits

• ✅ SPACs (remember those disasters?)

• ✅ Leveraged buyout firms

• ✅ Companies with 90% debt-to-equity ratios

But apparently NOT:

• ❌ Company holding deflationary digital asset up 400,000% since 2010

THE REAL STORY - It's About Control:

Bitcoin represents money that:

✓ Can't be printed (21M cap)

✓ Can't be confiscated (self-custody)

✓ Can't be debased (algorithmic issuance)

✓ Can't be controlled (decentralized network)

And Wall Street's traditional gatekeepers (index providers, ratings agencies, clearinghouses) are TERRIFIED that their relevance is evaporating.

So yeah, Bitcoin at $88K with $1.76 trillion market cap, spot ETFs holding $100B+, and institutional custody infrastructure is 'too risky.'

Makes TOTAL sense. 🙄

The Beautiful Part?

It doesn't matter.

Bitcoin doesn't NEED MSCI's approval.

MicroStrategy doesn't NEED index inclusion.

The whole POINT of Bitcoin is existing OUTSIDE traditional financial gatekeepers.

But watching Wall Street tie itself in knots trying to apply 20th-century investment rules to 21st-century digital assets is... *chef's kiss* 👌

P.S. For MicroStrategy Shareholders:

If you're stressed about January 15: REMEMBER - you're not investing in MSCI's opinion.

You're investing in 446,400 Bitcoin.

Those coins don't care about index rules.

They'll still exist at $88K... or $150K... or $500K.

Index inclusion is TEMPORARY convenience. Bitcoin scarcity is PERMANENT reality.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.