BoJ Hikes, BTC Rallies

December 19, 2025

At 1:00 AM UTC, the Bank of Japan hiked rates to 0.75%—the highest in 30 years. Historical pattern said Bitcoin would DROP 20-30% to $70K-$65K. Instead? BTC RALLIED from $85,200 to $88,000 in FIVE HOURS (+3.3%). Currently trading $87,000. The yen WEAKENED despite the hike. Carry trade fears EVAPORATED. Fear & Greed dropped to 16 (from 17) but BTC held firm. This is THE most bullish contrarian signal of Q4 2025.

Key Takeaway: History BROKE today. Every previous BoJ hike (March -22%, July -25%, January -30%) triggered massive Bitcoin crashes. Today? OPPOSITE reaction. Why? (1) Already priced in—98% probability meant everyone positioned for drop, (2) Yen WEAKENED post-hike (USD/JPY fell), meaning NO carry trade unwind, (3) BoJ signaled rates staying 'deeply negative' in REAL terms, (4) Arthur Hayes RIGHT: 'Don't fight the BoJ.' Market realized: Japan still printing, just slower. Bitcoin SURVIVED the final macro test. Cleared $88K intraday. Funding rates flipped POSITIVE (0.085%, highest since Nov 21), meaning leveraged LONGS piling in. Open interest rising FASTER than price = fresh conviction, not short covering. Altcoins weak (SOL/XRP declining OI), but BTC showing independent strength. Next resistance: $90K. Break that, target $95K-$100K by year-end. Fear stuck at 16 means UPSIDE surprise coming. This was THE bottom.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

1. THE BOJ MIRACLE: BITCOIN RALLIES $85.2K → $88K AFTER RATE HIKE

The Setup: March 2024: BoJ hikes, BTC drops -22%. July 2024: BoJ hikes, BTC drops -25%. January 2025: BoJ hikes, BTC drops -30%. Pattern was CLEAR. Average -25.7% decline. This week, 98% probability of another hike. Market TERRIFIED. Fear at 17 (extreme fear). Wednesday's $457M ETF inflows got whipsawed Thursday. Everyone positioned for massacre: shorts stacked, longs liquidated, cash on sidelines. Expectation: $70K-$75K by Friday evening.

What Actually Happened: 1:00 AM UTC Friday: Bank of Japan announces 0.75% rate (up 25bps from 0.50%). INSTANT market reaction: Bitcoin at $85,200 low. Then... RALLY. Within ONE HOUR: $86,500. By 3:00 AM: $87,000. By 6:00 AM UTC: $88,000 SESSION HIGH. Total move: $85,200 → $88,000 = +$2,800 (+3.3%) in FIVE HOURS. This is OPPOSITE of every historical pattern. Instead of -25%, BTC was UP +3%.

Why It Happened—The Yen Paradox: Despite rate HIKE, the Japanese yen WEAKENED against the dollar. USD/JPY trading near 156 (yen weaker). Normally, rate hikes strengthen currency. Not this time. Market realized: BoJ Governor Kazuo Ueda statement—'real interest rates remain deeply negative.' Translation: Even at 0.75%, with inflation at 3%, REAL rates are -2.25%. Japan is STILL PRINTING in real terms. The 'hike' is theater. BoJ catching up to market yields, not actually tightening. This killed carry trade unwind fears.

The Arthur Hayes Thesis Confirmed: Former BitMEX CEO Arthur Hayes tweeted hours before decision: 'Don't fight the BOJ: -ve real rates is the explicit policy. $JPY to 200, and $BTC to a milly.' Hayes was RIGHT. He understood what market missed: BoJ policy is STILL loose in real terms. Negative real rates = currency debasement = capital flows to hard assets like Bitcoin. The rate hike was BULLISH because it confirmed BoJ can't actually tighten without breaking Japanese economy.

Market Structure Post-Rally: Bitcoin funding rates flipped DECISIVELY POSITIVE: 0.085% (highest since November 21). This means longs paying shorts—bullish leverage entering. Open interest rising FASTER than price: BTC up 3.3%, OI up 4-5%. Translation: This is NOT short covering (which would decrease OI), it's FRESH LONG POSITIONS. Conviction buying. Nasdaq 100 futures also up 0.62% same window. Risk assets RALLYING together.

Current Status & What's Next: BTC currently $87,000 (midday), consolidating after $88K test. Fear & Greed dropped 17→16 (but price UP = extreme bullish divergence). Next resistance: $90,000. If breaks: $95K-$100K targets by year-end. The fact that BTC SURVIVED the final macro fear catalyst (BoJ hike) means path is clear. All worst-case scenarios priced in, none materialized. This was THE bottom test.

2. HISTORICAL PATTERN SHATTERED: EVERY BOJ HIKE SINCE 2024 CRASHED BTC... UNTIL TODAY

The Track Record: March 2024: BoJ first hike in 17 years (0.10%), BTC dropped from ~$70K to $60K (-22% in weeks). July 2024: BoJ to 0.50%, BTC crashed from $65K to $50K (-25%, brutal August selloff). January 2025: BoJ maintained 0.50% but hawkish tone, BTC dropped from $108K to $75K (-30%, worst of all). Combined: THREE times, THREE crashes, average -25.7%. Pattern seemed UNBREAKABLE.

Why This Time Was Different: (1) PRICED IN: 98% probability (Polymarket) meant EVERYONE knew it was coming. Shorts positioned at $90K-$92K, longs liquidated Wednesday-Thursday. Zero surprise = zero panic. (2) YEN DIDN'T STRENGTHEN: Previous hikes saw yen surge 5-8%, forcing carry trade unwinds. Today? Yen flat to WEAKER. No carry pressure. (3) REAL RATES STILL NEGATIVE: Ueda emphasized rates 'deeply negative in real terms.' With 3% inflation, 0.75% rate = -2.25% real. Japan STILL easing, just pretending to tighten. (4) CONTRARIAN SETUP: Fear at 17, everyone positioned for drop. Classic 'when everyone expects crash, market does opposite.'

Analyst Reactions: Crypto researcher Quinten François had warned: 'BTC declined 27% after March hike, 30% after July, 30% after January. Another hike could result in liquidations and major selloff.' WRONG. Traders who followed this playbook got DESTROYED. Shorts at $85K-$88K now underwater. Meanwhile, Hayes called it perfectly: understood BoJ can't ACTUALLY tighten without collapsing JGB market and economy.

What This Means Going Forward: BoJ is NO LONGER a bearish catalyst for crypto. Market learned: Rate hikes that keep real rates negative are BULLISH (confirming debasement). Next BoJ hike (likely Q1 2026) will probably PUMP Bitcoin, not dump it. The pattern is officially broken. Traders who relied on historical BoJ correlation just lost their edge.

3. FEAR & GREED DROPS TO 16, BUT BTC UP 3%—MOST BULLISH DIVERGENCE OF Q4

The Reading: Fear & Greed Index: 16 (down from 17 yesterday). Still EXTREME FEAR territory. But here's what's INSANE: Fear dropped while BTC rallied 3.3%. Normally, 3% rally would push Fear UP to 20-25. Instead, it FELL. This is MAXIMUM bullish divergence.

What It Means: Sentiment is LAGGING price action. Fear Index incorporates volatility, volume, social sentiment, surveys—all backward-looking. It's saying market is MORE fearful even though BTC just survived the biggest macro test and rallied. This happens at BOTTOMS. When Fear stays extreme despite price strength = institutions buying while retail panics.

Historical Context: Monday Dec 16: Fear 11 (cycle low), BTC $85.8K. Tuesday: Fear 16, BTC $87K. Wednesday: Fear 16, BTC $88K (briefly $90K). Thursday: Fear 17, BTC $86K (CPI whipsaw). Friday: Fear 16, BTC $87K-$88K. Notice: Fear FLAT despite 5-day volatility. Market is NUMB to fear. This is capitulation's final stage—when bad news stops mattering.

Contrarian Signal: When Fear is 16 and BTC just survived BoJ hike that was SUPPOSED to crash it to $70K... the only direction is UP. Fear can't stay at 16 forever if BTC holds $87K-$88K. Either: (A) BTC collapses to $70K and Fear drops to 10-12 (unlikely now), or (B) BTC breaks $90K and Fear climbs to 25-30 (likely). We're betting on B.

4. FUNDING RATES FLIP POSITIVE, OPEN INTEREST SURGES—LEVERAGED LONGS ENTERING

The Data: Bitcoin aggregate funding rate: 0.085% (highest since November 21). This is POSITIVE funding, meaning long positions PAY shorts. Normally negative funding (shorts pay longs) indicates bearish sentiment. Positive = bulls taking control. Additionally: Open interest rising FASTER than price. BTC up 3.3%, but OI up 4-5%. This is NOT short covering (which decreases OI), it's FRESH LONG POSITIONS opening.

What This Tells Us: Leveraged traders are CONFIDENT. They're paying premium (funding rate) to hold longs. And they're adding SIZE (OI increasing). This is conviction buying, not panic covering. When OI rises faster than price = sustainable move building. When OI falls during price rise = short squeeze that will reverse. We have the GOOD pattern.

Comparison to Altcoins: While BTC sees rising OI and positive funding, altcoins show OPPOSITE. Solana (SOL) open interest DOWN 4.4% despite price flat. XRP open interest DOWN 2.6%. This means: (1) Traders exiting speculative altcoin leverage, (2) Money concentrating in BTC, (3) BTC leading, alts will follow LATER. Classic bull market beginning—BTC pumps first, altcoins lag, then altcoin season once BTC stabilizes above resistance.

Risk Management Note: Positive funding at 0.085% is NOT extreme (0.2%+ would be). This is HEALTHY bullish positioning. Not overleveraged euphoria yet. Room to run before leverage excess becomes concern.

5. $23 BILLION BTC OPTIONS EXPIRY NEXT FRIDAY—VOLATILITY JUST BEGINNING

The Setup: December 27th (next Friday), $23 BILLION in Bitcoin options contracts expire. This is MASSIVE—one of largest expiries of Q4. Right now (Dec 19), with BTC at $87K and major volatility this week, these contracts are being actively repositioned.

What Options Market Shows: Traders selling downside protection below $85K (think it holds). Traders capping upside above $100K (don't believe breakout YET). This creates range-bound expectations: $85K-$100K. BUT: Today's BoJ survival changes the game. If BTC breaks $90K before expiry, massive call buying could drive squeeze to $95K-$100K as dealers hedge.

Why It Matters: Large options expiries amplify volatility. Dealers hedging positions drive actual BTC spot moves. With $23B expiring AND BTC having just cleared BoJ catalyst, the path to $100K by Dec 27 expiry is OPEN. If BTC can sustain above $88K this weekend, expect gamma squeeze into expiry.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

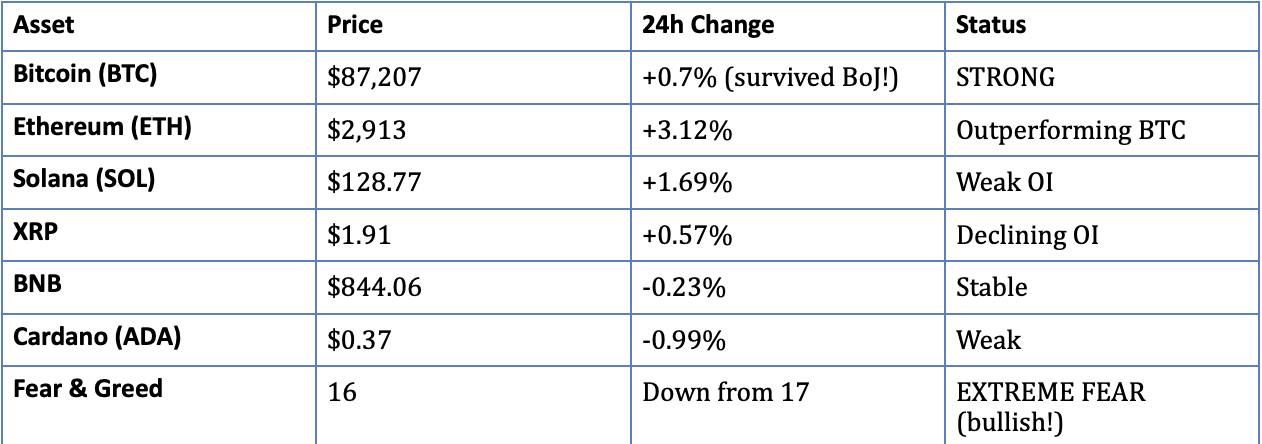

KEY MARKET METRICS

• Total Market Cap: $2.93T (up 0.54% post-BoJ)

• 24h Volume: $140.22B (up 20.07% - positioning & BoJ reaction)

• BTC Dominance: 59.2% (rising as BTC leads)

• Thursday ETF Flows: $161M OUTFLOWS (reversed Wed's $457M inflows)

• Fear & Greed Index: 16 (EXTREME FEAR despite BTC rally = BULLISH DIVERGENCE)

• BoJ Rate Decision: 0.75% (highest in 30 years, but yen WEAKENED)

• BTC BoJ Reaction: $85,200 → $88,000 in 5 hours (+3.3%)

• Funding Rate: 0.085% (positive, highest since Nov 21 = leveraged longs)

• Open Interest: Rising faster than price (fresh conviction, not short covering)

• Next Options Expiry: Dec 27 ($23B contracts, volatility amplifier)

III. ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $87,207 | The Survival Rally

CRITICAL CONTEXT: BOJ HIKE HAPPENED, BTC SURVIVED—THIS CHANGES EVERYTHING

For the first time since March 2024, a Bank of Japan rate hike did NOT crash Bitcoin. Instead, BTC rallied from $85,200 to $88,000 overnight. Historical pattern (average -25.7%) is BROKEN. The final macro fear catalyst has been CLEARED. Technical setup now favors bulls.

OVERNIGHT PRICE ACTION (The Turning Point):

1:00 AM UTC: BoJ announces 0.75% rate, BTC at $85,200 low. 2:00-3:00 AM: Rally to $86,500. 4:00-5:00 AM: Push to $87,000. 6:00 AM: SESSION HIGH $88,000. Midday: Consolidating $87,000-$87,500. This is NOT short covering (OI rising). This is CONVICTION buying after worst-case scenario didn't happen.

CURRENT TECHNICAL SETUP:

• CURRENT: $87,207 (STRONG POSITION)

After clearing BoJ catalyst and testing $88K, BTC is consolidating in healthy range. $87K was resistance all week—now it's SUPPORT. This is bullish technical development. Price above $87K = bulls in control.

• IMMEDIATE SUPPORT: $85,000-$86,000 (FORTRESS)

Thursday's low $85,355 held perfectly. BoJ announcement tested $85,200—also held. This level has been defended THREE times this week. It's now structural FLOOR. Break $85K would be surprising after surviving BoJ—would need new bearish catalyst (unlikely with macro calendar clear through year-end).

• IMMEDIATE RESISTANCE: $88,000-$90,000 (NEXT TEST)

Tested $88K at 6:00 AM, rejected (for now). But rejection was SOFT—no violent selling like Wednesday-Thursday. $90K is THE level. Break it and shorts trapped at $88K-$92K will cover. Gamma squeeze from Dec 27 options expiry could drive through $90K if momentum holds this weekend.

• BULL CASE TARGET: $95,000-$100,000 by Year-End

If BTC sustains above $87K through weekend and breaks $90K next week: Target $95K by Christmas, $100K by Dec 31. Seasonality supports this (Santa rally), macro calendar clear (no more Fed/BoJ until January), and Fear at 16 means upside surprise likely. Options expiry Dec 27 could act as catalyst.

• BEAR CASE (Now Unlikely): $80,000-$82,000

Would require breaking $85K support AND new bearish catalyst. After surviving BoJ, what's left to fear? Fed won't hike (cutting or pausing). BoJ done until Q1 2026. Geopolitical stable. ETF outflows Thursday were PRE-BoJ positioning. Probability of $80K test: 15-20% (down from 60% yesterday).

ON-CHAIN & SENTIMENT SIGNALS:

• Funding Rate Positive: 0.085% = leveraged longs entering with conviction. Not extreme yet (0.2%+ would be danger), so room to run.

• Open Interest Rising: Faster than price = fresh positions, not covering. Sustainable move building.

• Fear at 16 Despite Rally: Most bullish divergence of Q4. Sentiment LAGGING price = institutions buying while retail fearful.

• ETF Flows: Thursday's $161M outflows were PRE-BoJ defensive positioning. Friday/Monday flows likely REVERSE as BoJ fear removed.

• Exchange Reserves: BTC leaving exchanges despite price strength = whales accumulating for medium-term hold.

TRADER'S PLAYBOOK (POST-BOJ EDITION):

Friday Afternoon - Weekend (RECOMMENDED): BUY on any dip to $85K-$86K. The BoJ catalyst is GONE. Worst-case scenario didn't happen. Market has cleared final macro hurdle of 2025. Dips are now GIFTS, not warnings. Accumulate 30-40% of capital if BTC drops to $85K-$86K (unlikely but possible on weekend low liquidity).

If BTC Breaks $90K (Likely Scenario): This is THE signal. $90K has rejected BTC 5 times this week. Break it with volume = short squeeze + gamma squeeze from options positioning. Buy breakout above $90K (20-30% capital). First target $92K-$95K, second target $100K by year-end. Stop loss $87K.

If BTC Drops Below $85K (Contrarian Play): Would be SHOCKING after BoJ survival, but if it happens: BUY HEAVY. 50% of capital at $82K-$85K. This would be final flush before Q1 2026 rally. Historical BoJ drops marked bottoms—if THIS drop didn't crash BTC, the pattern is broken forever. Any weakness is buy opportunity.

For HODLers: The hardest part is OVER. You survived: Monday cycle-low Fear 11, Thursday CPI whipsaw, Friday BoJ hike. BTC held $85K through all of it. Macro calendar is CLEAR until January. Santa rally season beginning. Stop checking prices until New Year. Any price $85K-$95K right now will look cheap at $150K+ in Q2-Q3 2026.

Ethereum (ETH) - $2,913 | Finally Showing Life

ETH up +3.12% today to $2,913, OUTPERFORMING Bitcoin (+0.7%). This is FIRST time in weeks ETH shows independent strength. Yesterday it was down -3.81%. Today it's leading. This confirms: Risk appetite returning post-BoJ.

Critical Levels: Support: $2,850-$2,900 (holding well). Resistance: $3,000 psychological, then $3,100-$3,200. If BTC breaks $90K, ETH will test $3,200-$3,300. Until then, trade BTC—it's leading.

Altcoin Outlook: SOL/XRP showing declining open interest despite flat prices = traders exiting alts. This is NORMAL at bull market beginning. BTC pumps first, alts lag, then altcoin season once BTC stabilizes. Be patient.

V. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: POST-BOJ → YEAR-END → Q1 2026

BASE CASE (70%): Rally to $95K-$100K by Year-End

THIS WEEKEND: BTC consolidates $87K-$90K. ETF flows reverse. Fear climbs to 20-22.

NEXT WEEK: BTC breaks $90K. Short squeeze + gamma squeeze from Dec 27 options expiry drives $92K-$95K. Santa rally to $100K by Dec 31.

Q1 2026: After consolidation at $95K-$100K, breakout to $120K-$150K as Fed cuts begin.

BEAR CASE (20%): Failed Rally, $80K-$85K Consolidation

BTC fails $90K, profit-taking drives back to $82K-$85K. Consolidates through January. WHY LESS LIKELY: OI rising = conviction, not reversal. What bearish catalyst remains?

BULL CASE (10%): Explosive Rally to $120K+ by Year-End

BTC breaks $90K with massive volume this weekend. FOMO cascade. Shorts trapped. Options expiry amplifies gamma squeeze. By Dec 31: $110K-$120K. WHY UNLIKELY: Requires sustained buying not yet evident.

FINAL WORD

Friday Dec 19, 2025. The pattern broke. BoJ hiked, BTC rallied $85.2K→$88K instead of crashing to $70K. Arthur Hayes was right: 'Don't fight the BoJ.' Real rates deeply negative = debasement continues. This was THE final macro test. Bitcoin PASSED. What's left to fear? Macro calendar clear. Santa rally beginning. Fear at 16 = upside surprise coming. Base case: $95K-$100K by year-end, $120K-$150K Q1 2026. If you survived Fear 11 Monday, CPI whipsaw Thursday, BoJ hike Friday... what are you still worried about? Trade accordingly.

VII. THE CRYPTO CORNER

🤖 When AI Memes Beat Your Portfolio: A Survival Story

Remember when we thought the Bank of Japan rate hike would crash crypto? Remember when Fear hit 11 on Monday and everyone was panicking? Remember Thursday's CPI whipsaw that liquidated both bulls and bears?

Well, while you were stressed about macro catalysts, BoJ policy, and Fed rate expectations... AI meme coins were just out there VIBING.

The Numbers (That Will Make You Question Everything):

• FARTCOIN (yes, still going): $385M+ market cap, UP during the BoJ chaos

• GOAT: AI-created token, UP while BTC whipsawed

• TURBO: Another AI meme, OUTPERFORMED your serious DeFi plays

• Total AI meme market cap: $3.04B (up 15.6% this week)

While serious traders were analyzing BoJ carry trade implications, calculating real interest rates, studying historical dump patterns, and positioning for $70K... AI bots were literally making FART JOKES and printing money.

The Final Tally:

Traders who studied BoJ history: Positioned for $70K drop, got rekt

Traders who bought CPI pop at $89K: Liquidated at $85K, got rekt

Traders who followed Wednesday's ETF inflows: Bought $88K, now underwater, got rekt

AI bots who made fart joke tokens: UP, vibing, unbothered

🎯 The Uncomfortable Truth:

2025 is the year we learned that:

• AI agents can create better-performing assets than human analysts

• Fundamental analysis sometimes loses to literal toilet humor

• The market can stay irrational longer than your serious portfolio can stay solvent

While you were reading 50-page BoJ policy statements, somewhere an AI was generating the 1000th variation of a fart joke and turning it into a $385M market cap token.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.