$27Bn Option Expiry - Santa Rally Time?

December 22, 2025

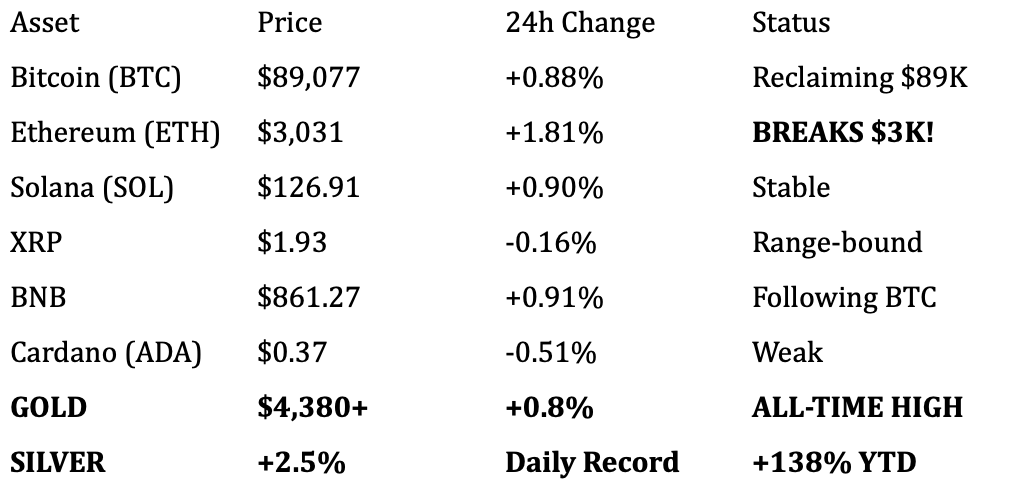

Bitcoin at $89,077 (+0.88%) reclaims $89K but the celebration is hollow. While BTC clings to $88K-$89K, GOLD EXPLODES to $4,380+ (new all-time high, +68% YTD).

THE WEEKEND CARNAGE: - $576 MILLION in liquidations (Friday-Monday volatility wave) - Gold: +68% YTD vs Bitcoin: -5% YTD - Friday Dec 27: $27 BILLION options expiry (revised from $23B) - Max Pain: $96,000 (BTC trading $7K below = dealer dream) - Put/Call Ratio: 0.38 (calls outweigh puts 3-to-1 = BULLISH positioning) - ETH breaks $3,000 for first time since correction (+1.81%)

Galaxy Digital’s 2026 Warning: “2026 may be most difficult year to forecast for Bitcoin. Too chaotic to predict.” Maintains long-term $250K target by end-2027, but admits near-term is “unprecedented uncertainty.”

I. BREAKING HEADLINES & CRITICAL MARKET SHIFTS

1. The BTC/Gold Ratio Collapse:

December 2024: 40 ounces of gold = 1 Bitcoin

December 2025: 20 ounces of gold = 1 Bitcoin

That’s a 50% collapse in one year. Bitcoin lost half its value relative to gold. This isn’t noise—it’s structural rejection of BTC as inflation hedge.

What Drove Gold’s Supremacy:

1. Central Bank Buying:

- 254 tonnes accumulated through October

- Global gold ETF holdings: +397 tonnes H1 2025

- Sovereign flight from USD-denominated assets post-Russia sanctions

- China, India, Turkey leading buyers

2. Geopolitical Risk Premium:

- Ukraine war escalation

- Middle East tensions

- US-China trade war

- VIX averaged 18.2 in 2025 (vs 14.3 in 2024)

- Geopolitical risk indices: +34%

3. Real Rates Paradox:

Gold rallied DESPITE elevated nominal rates. Historically impossible. This signals investors pricing in credit risk of the fiat system itself, not just opportunity cost. Gold is no longer just inflation hedge—it’s solvency hedge.

4. Bitcoin’s Correlation Failure:

When VIX spiked (tariff scares, BoJ hikes), algorithms dumped BTC alongside Nasdaq while capital fled to gold. Bitcoin proved it’s correlated with liquidity cycle (risk-on), not fear cycle (risk-off). Gold is the latter. Bitcoin failed the safe-haven test.

Why This Matters for Bitcoin:

Some analysts crying “Bitcoin endgame.” Peter Schiff: “Bitcoin preventing people from buying gold/silver. Unfortunate they’ll lose money in Bitcoin instead of making even more in precious metals.”

BUT - Contrarian view: When gold hits ATH and Bitcoin is declared dead, that’s historically been THE bottom. Bitcoin bottomed at $16K in Dec 2022 when everyone said “it’s over.” Rallied 700%+ to $125K by Oct 2025. Current correction (125K → $89K = -29%) is NORMAL in bull cycles.

The 2026 Setup:

If Bitcoin is risk-on asset correlated with liquidity, and Fed cuts begin Q1 2026 (consensus expectation), then liquidity returns = Bitcoin catches bid. Gold won 2025. Doesn’t mean Bitcoin can’t win 2026.

2. $27 BILLION OPTIONS EXPIRY FRIDAY - MAX PAIN $96K, DEALERS WANT BTC HIGHER

The “Boxing Day Bonanza”:

Friday December 27 (Boxing Day in many countries): $27 BILLION in Bitcoin and Ethereum options expire on Deribit. This is BIGGER than previously reported ($23.6B Bitcoin + $3.8B Ethereum).

Bitcoin Options Breakdown: - Notional Value: $23.6B

- Contracts: 50%+ of Deribit’s total open interest

- Max Pain Price: $96,000

- Current BTC Price: $89,077

- Gap to Max Pain: +$7,000 (+7.8%)

- Put/Call Ratio: 0.38 (for every 100 calls, only 38 puts)

- Calls outnumber puts: 2.6-to-1

What This Means:

Max Pain Theory: Options sellers (dealers, market makers) profit most when options expire worthless. Max pain is where MOST options (both calls and puts) expire worthless. At $96K: - Most call options below $96K expire in-the-money (ITM) = dealers pay out

- Most put options above $96K expire worthless = dealers keep premiums

- But with 2.6x more calls than puts, dealers are NET SHORT calls

Translation: Dealers LOSE if BTC stays at $89K. They WIN if BTC goes to $96K. This creates gravitational pull UPWARD.

Call Open Interest Concentration: - Strikes: $100,000 to $116,000 (HEAVY positioning)

- Most popular: $100K strike

- Dealers sold these calls expecting BTC wouldn’t reach

- If BTC surges above $96K into expiry, dealers forced to buy spot to hedge = gamma squeeze

Put Open Interest: - Most popular: $85,000 strike

- Currently $4K above ($89K vs $85K) = puts expiring worthless

- Some puts at $70K-$85K being rolled into January (bearish position extensions)

Sidrah Fariq (Deribit’s Global Head): “Max pain sits near $96,000, put-call ratio of 0.38 reflects positioning skewed toward calls and bullish bias. Market’s panic has subsided, looming expiry likely to be much more orderly than last year.”

The Scenarios:

SCENARIO A - Rally to Max Pain (45%):

- Mon-Thu: BTC grinds from $89K → $94K-$96K

- Dealers actively buying spot to move price to max pain

- Friday: Expiry at $96K = maximum dealer profit

- Post-expiry: Relief, continuation to $100K-$105K

SCENARIO B - Pin Below $90K (35%):

- Resistance too strong, stays $88K-$90K range

- Friday: Expiry at $88K-$90K

- Dealers lose on calls but not catastrophically

- Post-expiry: Slow grind to $95K-$100K

SCENARIO C - Gamma Squeeze to $100K+ (20%):

- Early week break above $92K with volume

- Dealers forced to hedge by buying spot

- Positive feedback loop to $100K-$105K before Friday

- Post-expiry: Consolidation or continued rally

Why This Week is CRITICAL:

With $27B expiring (1.5% of BTC’s entire $1.8T market cap), this is structural event. Price action Mon-Thu will determine if dealers can manipulate to max pain or if market breaks free.

Historical Pattern: Large expiries with bullish positioning (calls > puts) typically see upward drift into expiry, then explosive post-expiry rallies as hedging pressure removed.

Trading Implication: Don’t fade this. If BTC holds $88K-$90K Mon-Thu, Friday expiry likely releases upward pressure. Post-Friday = prime Santa rally window.

3. $576 MILLION LIQUIDATIONS - WEEKEND VOLATILITY CRUSHES LEVERAGED POSITIONS

The Carnage:

Over the past 48 hours (Friday-Monday): $576 million in crypto futures/perpetuals liquidated. This is MASSIVE for holiday weekend trading.

Breakdown: - Timing: Friday evening through Monday morning

- Direction: Both longs AND shorts (whipsaw liquidations)

- Primary victims: Over-leveraged traders expecting directional move

- BTC range: $87.6K - $89.5K (only $1.9K range but enough to wreck accounts)

4. ETHEREUM RECLAIMS $3,000 - FIRST TIME SINCE CORRECTION

The Milestone:

Monday morning: ETH breaks $3,000, trading at $3,031 (+1.81%). First time above this psychological level since the November correction that sent ETH from $4,200 to $2,800.

ETH/BTC Ratio: 0.034 (improving from 0.032 low). Ethereum showing INDEPENDENT strength for first time in months. Usually ETH follows BTC. When ETH LEADS, it signals: 1. Risk appetite returning

2. Alt season potentially beginning

3. Institutional rotation into ETH (lower entry vs BTC)

ETH Options Expiry Friday: $3.8B in Ethereum options expire alongside Bitcoin’s $23.6B. Max pain for ETH: $3,100 (just $69 above current price). Dealers may push ETH to $3,100 by Friday.

Institutional Positioning:

Tom Lee’s Bitmine just bought 13,412 ETH, adding to already-massive corporate holdings. When institutions accumulate during corrections, it’s SIGNAL. They’re not buying to flip—they’re positioning for 2026.

Staking Yields: ETH staking (~3-4% APY) now competitive with government bonds. As rates fall in 2026, ETH’s yield becomes MORE attractive relatively.

The Setup: If BTC rallies post-Friday expiry, ETH typically follows with 1.5-2x leverage. BTC $89K → $105K (+18%) could mean ETH $3,000 → $3,600-$3,900 (+20-30%).

5. GALAXY DIGITAL’S 2026 WARNING: “MOST DIFFICULT YEAR TO FORECAST”

The Admission:

Galaxy Digital (GLXY), one of crypto’s most sophisticated institutional players, published Dec 21 research note from Alex Thorn (Head of Firmwide Research):

“2026 may be one of the most difficult years to forecast for Bitcoin. Too chaotic to predict.”

This is NOT bearish—it’s HONEST. Galaxy maintains $250,000 target by end-2027 but admits 2026 path is “unprecedented uncertainty.”

Why 2026 is “Chaotic”:

1. Macro Uncertainty:

- Fed rate cut path unclear (1 cut? 3 cuts? Re-tightening?)

- Inflation sticky at 3-4% (new normal?)

- Recession risk vs soft landing debate

- Trump tariff policies (wild card)

2. Political Risk:

- US election year (2026 midterms)

- Crypto regulation clarity or continued chaos?

- Strategic Bitcoin Reserve proposal (real or political theater?)

- SEC leadership change impacts

3. Crypto Market Structure:

- ETF flows unstable ($152B peak → $112B current)

- Corporate treasury adoption stalled (MicroStrategy alone)

- Leverage reduced but not eliminated

- Correlation with equities vs gold still unclear

4. Bitcoin Maturing as Asset:

Galaxy notes: “Options pricing and volatility trends indicate Bitcoin maturing into more macro-like asset rather than high-growth trade.”

Translation: Bitcoin is LESS volatile now, trades more like gold/commodities than tech stocks. This is MATURATION but also means lower potential for parabolic rallies.

Galaxy’s Long-Term Thesis (Still Bullish):

Despite 2026 uncertainty, they maintain: - $250,000 by end-2027 (from current $89K = 180% gain)

- $50B+ ETF inflows in 2026 (vs $23B in 2025)

- Model portfolio inclusion at 1-2% weight (institutional default)

- Wirehouses lifting advisor restrictions (Vanguard adding crypto)

Key Quote: “The final step is inclusion in model portfolios, which typically requires higher fund AUM and sustained liquidity, but we expect BTC funds to clear those thresholds and enter models at 1-2% strategic weight.”

What This Means:

Galaxy is saying: “We don’t know what 2026 looks like month-to-month, but by 2027 Bitcoin is meaningfully higher. Buckle up.”

This is HONEST institutional positioning. Not moonboy “$500K in 6 months” nonsense. It’s “unclear path but destination is up.”

For Traders: Expect volatility, choppy action, false breakouts in 2026. For HODLers: Doesn’t matter. $89K → $250K by end-2027 is the thesis.

II. MARKET DATA & DERIVATIVES INTELLIGENCE

KEY METRICS

Market Structure: - Total Market Cap: $2.95T (stable after weekend)

- 24h Volume: $145B+ (elevated for Monday)

- BTC Dominance: 59.4% (rising = flight to quality)

- Fear & Greed: Estimated 22-24 (improving from 20)

- Weekend Liquidations: $576M (leverage flushed)

ETF Intelligence: - Current AUM: ~$112B (down from $152B peak July)

- Average Entry: ~$83,000 (ETF buyers underwater at $89K)

- Institutional Positioning: Ran Neuner expects “pump between now and year-end” as funds show performance

Gold vs Bitcoin 2025: - Gold Performance: +68% YTD

- Bitcoin Performance: -5% YTD

- BTC/Gold Ratio: 20 ounces (was 40 Dec 2024)

- Gold Market Cap: ~$17 trillion

- Bitcoin Market Cap: $1.77 trillion

III. ACTIONABLE TECHNICAL ANALYSIS & DERIVATIVES POSITIONING

BITCOIN - $89,077

MONDAY MORNING REALITY:

Bitcoin reclaimed $89K overnight but the context is CRITICAL: - Gold at all-time highs ($4,380+)

- $576M liquidations (weekend carnage)

- $27B options expiring Friday (max pain $96K)

- Calls outweigh puts 2.6-to-1 (bullish positioning)

This is NOT weak structure. This is COILED spring waiting for catalyst.

CURRENT TECHNICAL SETUP:

• CURRENT: $89,077 (SLIGHTLY BULLISH)

Reclaimed $89K Monday morning after weekend dip to $87.6K. Holding above $88.5K support. Small win, but momentum improving. ETH breaking $3K is CONFIRMATION—risk appetite returning.

• IMMEDIATE SUPPORT: $87,500-$88,500 (MUST HOLD)

Tested 4x in past 7 days. Held every time. This is $85K support from last week + new buyers at $88K. Break = cascade to $85K-$86K. UNLIKELY with Friday’s $96K max pain creating upward pressure.

• RESISTANCE: $90,500-$92,000 (THE GATEWAY)

Failed last week but with options expiry dynamics shifting, this level is VULNERABLE. Break above $91K with volume = dealers forced to hedge calls = gamma squeeze begins. Target: $96K by Friday.

• OPTIONS MAX PAIN: $96,000 (DEALER TARGET)

With $23.6B BTC options expiring Friday and calls outweighing puts 2.6-to-1, dealers are incentivized to push price TO $96K not below. This creates mechanical buying pressure Mon-Thu.

• BULL CASE: $100,000-$105,000 (Post-Expiry Target)

If BTC reaches $96K-$98K by Friday, post-expiry removal of hedging pressure could spark Santa rally to $100K+ before year-end. Probability: 35-40%.

• BEAR CASE: $85,000-$87,000 (If Max Pain Fails)

If resistance at $92K too strong and BTC can’t reach $96K, dealers accept losses and price drifts to $85K-$87K. From there, either holds (base) or tests $80K-$82K. Probability: 25-30%.

DERIVATIVES POSITIONING ANALYSIS:

Funding Rates: 0.01-0.02% (neutral)

After $576M liquidations, leverage is CLEAN. No extreme positioning either direction. Market reset and ready for directional move.

Open Interest: Declining into Friday

Typical pre-expiry behavior. Some positions closing, some rolling to January. The $70K-$85K puts being rolled = bears extending timeframe (they expect drop but not this week).

Call Concentration: $100K-$116K strikes

HEAVY positioning above $100K. If BTC breaks $96K into expiry, these calls come into play. Dealers would be forced to buy massive spot to hedge. This is the GAMMA SQUEEZE setup.

Put Concentration: $85K strike most popular

Currently $4K above ($89K vs $85K). These puts expiring worthless = dealers keep premiums. Bears positioned for bigger drop than materializing.

Max Pain Mechanics:

With 2.6x more calls than puts, dealers are NET SHORT VOLATILITY to the upside. They LOSE if BTC rallies above $96K. They WIN if BTC lands at $96K Friday. They lose LESS if BTC stays at $89K vs rallying to $110K.

Strategy implication: Dealers will likely attempt to drift price from $89K → $94K-$96K by Thursday, then pin it Friday. This creates SLOW GRIND UP rather than explosive rally.

Post-Expiry Dynamics:

Once Friday passes: - Hedging pressure removed

- $27B in contracts off the board

- Market free to trend

- Historical pattern: Post-large-expiry rallies common

- Santa Claus Rally window (Dec 24-Jan 5) begins

- Low liquidity = moves amplified

ETHEREUM - $3,031

ETH BREAKS $3,000:

For the first time since November correction, Ethereum is above $3,000. This is SIGNIFICANT:

Technical Levels: - Current: $3,031 (BULLISH break)

- Resistance: $3,100 (max pain for Friday options), $3,200 (major), $3,500 (next target)

- Support: $2,950-$3,000 (former resistance now support), $2,850 (strong floor)

ETH/BTC Dynamics:

ETH is moving INDEPENDENTLY of BTC (rare). Usually ETH follows BTC with lag. When ETH LEADS, it signals: 1. Risk-on appetite returning (investors willing to move down cap ladder)

2. Altcoin season potentially beginning (ETH is gateway drug to alts)

3. Institutional rotation (some funds prefer ETH’s lower entry vs BTC’s $89K)

ETH Options Friday: $3.8B expiring, max pain $3,100. Only $69 above current price. Dealers will try to push to $3,100 by Friday. If successful: ETH $3,000 → $3,100 = +3.3% this week.

Post-Expiry Setup: If BTC rallies to $100K-$105K post-Friday (+12-18%), ETH typically follows with 1.5-2x beta. ETH $3,000 → $3,600-$4,000 would be normal in that scenario.

TRADER’S PLAYBOOK (DEC 22-27)

THIS WEEK (Mon-Thu Dec 22-25):

Monday-Tuesday (Dec 22-23):

- Bias: Cautiously BULLISH

- Action: If BTC dips to $87.5K-$88.5K = BUY 20-30% capital

- Reason: Options max pain at $96K creates upward pressure, liquidations cleared, ETH showing strength

- Stop: Below $87K (would invalidate bullish setup)

Wednesday-Thursday (Dec 24-25):

- Bias: NEUTRAL (Christmas Eve/Day, thin liquidity)

- Action: WATCH. Don’t overtrade. Liquidity evaporates.

- Target: Observe if BTC can reach $94K-$96K before Friday

FRIDAY (Dec 26 - Boxing Day):

- Bias: VOLATILE (options expiry)

- Action: Let expiry pass. Don’t trade INTO it.

- Post-Expiry (Friday afternoon): If BTC above $92K = BUY 20-30%, target $100K-$105K Santa rally

WEEKEND (Dec 27-29):

- Bias: BULLISH (post-expiry, Santa rally window begins)

- Action: If BTC breaks $95K = add 20%, ride to $100K

- Stop: $90K (if falls back below round number, setup failed)

FOR HODLERS:

You’ve survived: - Fear 11 (Dec 16)

- CPI whipsaw (Dec 18)

- BoJ rate hike (Dec 19)

- Gold crushing BTC narrative (Dec 22)

- $576M liquidations (weekend)

IV. X/TWITTER SENTIMENT ANALYSIS - WHAT THE SMART MONEY IS SAYING

CRYPTO TWITTER PULSE - DECEMBER 22, 2025

“I’m still expecting a pump between now and the end of the year! The average price of ETF buyers is around $83,000 and there are many people incentivized to show performance! I expect us to close very close if not above $100k.”

— @cryptomanran (Ran Neuner, CEO Crypto Banter, Dec 22)

Analysis: Ran makes CRITICAL point—ETF buyers entered average $83K. They’re barely profitable at $89K. Fund managers have INCENTIVE to show positive year-end performance. This creates institutional buying pressure last 9 days of year. If every fund tries to buy to mark up their books = reflexive rally. Verdict: BULLISH and logically sound.

“$BTC liquidity keeps building up at ~$90,800. When Bitcoin grabs this liquidity and rejects, it’s a perfect opportunity for quality shorts after the failure. If the short squeeze is enough fuel and we reclaim key ~$94,000 resistance, I’ll look for longs after the gain.”

— @LennaertSnyder (Lennaert Snyder, Derivatives Analyst, Dec 21)

Analysis: Snyder identifies $90,800 as critical liquidity cluster. Two scenarios: (1) BTC hits $90.8K, fails, shorts profitable to $85K. (2) BTC breaks $90.8K, squeezes to $94K+, then longs make sense. This is smart positioning—waiting for breakout/breakdown confirmation rather than guessing. Verdict: NEUTRAL but provides clear tradeable levels.

“Realized price shows the average price where Bitcoin was last bought. Current levels: BTC price $88K, Realized price $56K, 2x realized (mid band) $112K, 4x realized (upper band) $225K. Historically BTC has met resistance near mid band and cycle tops closer to upper band.”

— @kyledoops (Kyle Doops, On-Chain Analyst, Dec 22)

Analysis: Kyle uses realized price (average cost basis of all BTC) to identify cycle position. At $88K, BTC is trading 1.57x realized price ($56K). Mid-band ($112K) typically marks resistance in bull runs. Upper band ($225K) marks cycle tops. Current price suggests: (1) NOT overheated (well below mid-band), (2) Room to run to $112K+, (3) Short-term volatility but structure healthy. Verdict: BULLISH medium-term.

“$24bn expiring with Calls outweighing Puts by 2.6x. Keep an eye on ‘Max Pain’ price at $96k. Theory goes dealers attempt to pin spot at this price to inflict losses on buyers. Either way, could get volatile in low liquidity Xmas hours.”

— @nicrypto (Nic Puckrin, CEO Coin Bureau, Dec 22)

Analysis: Nic highlights exact dynamic we’ve discussed—$24B expiry (actually $27B with ETH), max pain $96K, calls dominate 2.6-to-1. He notes Christmas low liquidity could amplify volatility. Warning: Dealers will fight to control price into Friday. Post-Friday = anyone’s game. Verdict: NEUTRAL with volatility warning.

“Galaxy Research: 2026 may be one of the most difficult years to forecast for Bitcoin. Too chaotic to predict. Overlapping macro and market risks make Bitcoin unusually difficult. Options pricing and volatility indicate Bitcoin maturing into macro-like asset.”

— Galaxy Digital Research (Alex Thorn, Dec 21)

Analysis: Galaxy’s HONESTY is refreshing. They’re not selling hopium. They admit 2026 is unpredictable but maintain $250K by end-2027 long-term target. This is sophisticated institutional thinking: acknowledge near-term chaos, maintain long-term conviction. Verdict: NEUTRAL short-term, BULLISH long-term.

“L1 tokens broadly underperformed in 2025 despite regulatory and institutional wins. Structural progress collided with stagnant price action. Institutional milestones reached, TVL increased, yet majority of L1 tokens finished year negative or flat returns.”

— CoinDesk Research Report (Dec 22)

Analysis: CoinDesk identifies KEY 2025 paradox—fundamentals improved (ETFs, regulation, adoption) but prices stagnated/declined. This is actually BULLISH setup for 2026. When fundamentals improve but price doesn’t = accumulation phase. Price eventually catches up to fundamentals. Verdict: BEARISH 2025, BULLISH 2026 setup.

SENTIMENT SUMMARY:

CONSENSUS: Near-term (this week) = UNCERTAIN due to options expiry and holiday liquidity. Medium-term (Q1 2026) = CAUTIOUSLY BULLISH if macro conditions (Fed cuts, liquidity) materialize. Long-term (2026-2027) = BULLISH on fundamentals eventually pricing in.

Key Takeaway: Smart money is NOT panic-selling. They’re acknowledging 2025 was tough but positioning for 2026 recovery. Gold winning THIS year doesn’t mean Bitcoin can’t win NEXT year.

V. FORWARD OUTLOOK & PROBABILITY SCENARIOS

SCENARIO ANALYSIS: THIS WEEK → YEAR-END → Q1 2026

BASE CASE (45%): Grind to $94K-$98K by Friday, Post-Expiry Rally to $100K-$105K

THIS WEEK (Dec 22-27):

- Mon-Tue: BTC consolidates $88K-$90K, slight upward bias

- Wed-Thu: Christmas volatility, thin liquidity, drift to $92K-$94K

- Friday: Options expiry at $94K-$98K (near max pain $96K)

- Dealers successfully guide price to profit zone

YEAR-END (Dec 28-31):

- Post-expiry relief, hedging pressure removed

- Santa Claus Rally begins (Dec 24-Jan 5 window)

- BTC rallies to $100K-$105K on low volume

- Fear climbs to 28-32 (neutral territory)

- ETH follows to $3,400-$3,700

- Close 2025 at $102K-$105K

Q1 2026 (Jan-Mar):

- Jan 15 MSCI decision on MicroStrategy = volatility spike

- If MSTR stays in index: Rally continues to $110K-$120K

- If MSTR excluded: Dip to $95K-$100K, digest, recover

- Feb-Mar: Fed signals March rate cut, liquidity improves

- BTC reaches $115K-$125K by end Q1

- Altcoin season begins, ETH outperforms

WHY BASE CASE:

(1) Options mechanics favor upward drift to $96K max pain

(2) Calls outweigh puts 2.6-to-1 = bullish positioning

(3) ETF managers incentivized to mark up books for year-end

(4) Post-expiry = historical pattern of relief rallies

(5) Santa Rally seasonality strong (82% success rate since 2014)

(6) Galaxy’s long-term $250K target requires positive 2026 start

BULL CASE (30%): Gamma Squeeze to $110K-$120K Before Year-End

THE CATALYST:

- Early week: Strong institutional buying (ETF managers marking books)

- Tuesday-Wednesday: BTC breaks $92K with VOLUME

- Gamma squeeze triggers as dealers hedge calls

- Shorts covering accelerates move

THE MOVE:

- $89K → $95K by Wednesday (options expiry dynamics)

- $95K → $100K by Friday (max pain exceeded, dealers scrambling)

- $100K → $110K-$120K by Dec 31 (FOMO + Santa rally)

- Fear spikes to 45-55 (greed territory)

- ETH explodes to $4,000-$4,500

- Altcoins wake up violently

WHY POSSIBLE (But Less Likely):

- Calls concentrated $100K-$116K strikes create squeeze potential

- If $96K broken with momentum, dealers forced to buy

- Low holiday liquidity = moves amplified

- Historical: Dec is 2nd best month for BTC (+13.16% avg)

- Post-halving years (2024/2025) show strong Dec-Jan

WHY NOT BASE CASE:

- Requires early week catalyst (no clear catalyst visible)

- Market is tired after BoJ week volatility

- Gold narrative dominant = attention divided

- Institutions may wait until 2026 to deploy capital

IF IT HAPPENS:

Don’t fade it. Buy $95K-$100K breakout. Targets $110K-$120K. This would be early 2026 rally coming in late 2025. Stop loss $92K.

BEAR CASE (25%): Fail $92K, Drift to $85K-$88K, Extended Consolidation

THE TRIGGER:

- Monday-Tuesday: BTC fails to break $90K with conviction

- Wednesday: Christmas Eve volume collapses, drifts lower

- Thursday-Friday: Options expiry below $90K (dealers accept losses)

- Gold continues rallying, BTC narrative stays broken

THE MOVE:

- $89K → $87K-$88K by Wednesday (failed breakout)

- $87K → $85K-$86K by Friday (option expiry low)

- Weekend: Test $83K-$85K (True Market Mean)

- Year-end close: $85K-$88K (negative momentum)

- Fear drops back to 18-20 (extreme fear returns)

- ETH falls to $2,800-$2,900

Q1 2026 BEAR EXTENSION:

- January: MSCI excludes MicroStrategy = forced selling

- $85K → $80K-$82K cascade

- Extended consolidation $78K-$88K through March

- Fed delays rate cuts due to sticky inflation

- Risk-off continues, gold keeps rallying

- BTC doesn’t bottom until April

WHY UNLIKELY:

(1) $87.5K-$88.5K support held 4x (strong floor)

(2) Options max pain at $96K = dealers want higher not lower

(3) $576M liquidations cleared leverage (less downside cascade risk)

(4) ETH breaking $3K = risk appetite improving

(5) Institutional ETF positioning (avg $83K) creates support

IF IT HAPPENS:

BUY AGGRESSIVELY. $83K-$85K after surviving BoJ + gold ATH = generational opportunity. Deploy 50%: 30% at $85K, 30% at $83K, 20% at $80K if reached. Hold for $150K-$250K in 2026-2027.

VI. KEY TAKEAWAYS & ACTION ITEMS

1. GOLD WON 2025, BITCOIN SURVIVED

Gold +68% YTD vs Bitcoin -5% YTD = BRUTAL reality check. BTC/Gold ratio collapsed from 40 to 20 ounces. “Digital gold” narrative DIED this year. But: Contrarian setup. When gold hits ATH and Bitcoin declared dead, historically marks BTC bottoms. Don’t confuse 1-year performance with long-term thesis.

2. $27B OPTIONS EXPIRY FRIDAY IS KEY CATALYST

Max pain $96K with calls outweighing puts 2.6-to-1 = dealers incentivized to push price HIGHER. This creates mechanical upward pressure Mon-Thu. Post-Friday = hedging removed, market free to trend. Historical pattern = post-expiry rallies.

3. $576M LIQUIDATIONS CLEARED THE DECK

Weekend carnage flushed over-leveraged positions. Market is NOW clean—funding neutral, leverage reset. This is HEALTHY. Post-liquidation markets typically bounce.

4. ETHEREUM’S $3K BREAK SIGNALS RISK-ON RETURN

ETH breaking $3,000 for first time since November = institutional risk appetite improving. When ETH shows independent strength (not just following BTC), it often precedes broader market strength.

5. GALAXY’S HONEST ASSESSMENT: 2026 CHAOTIC BUT DESTINATION HIGHER

Galaxy admits 2026 “most difficult year to forecast” but maintains $250K by end-2027. This is sophisticated institutional thinking: acknowledge near-term uncertainty, maintain long-term conviction. Volatility ≠ bearish. Volatility = opportunity.

WHAT TO DO NOW:

THIS WEEK (Dec 22-25):

Monday-Tuesday (Today-Tomorrow):

- IF BTC dips to $87.5K-$88.5K = BUY 20-30% capital

- Reason: Options max pain at $96K creates upward pressure

- Stop: $87K (invalidates setup)

Wednesday-Thursday (Christmas Eve/Day):

- WATCH mode. Liquidity evaporates. Don’t overtrade.

- Target: Observe if BTC reaches $94K-$96K before Friday

Friday (Boxing Day, Options Expiry):

- Let expiry pass. Don’t trade into it.

- Post-expiry (afternoon): If BTC above $92K = BUY 20-30%, target $100K

WEEKEND (Dec 27-29):

- IF BTC breaks $95K = add 20%, ride Santa rally to $100K+

- Stop: $90K (setup failed if falls back)

FINAL WORD:

Monday, December 22, 2025. The morning gold crushed Bitcoin’s narrative.

Gold at $4,380 all-time high (+68% YTD). Bitcoin at $89K (-5% YTD). The “digital gold” thesis? Dead. The BTC/Gold ratio? Collapsed 50%. Peter Schiff? Vindicated. For now.

But here’s what the headlines miss:

• $27B options expiring Friday (max pain $96K = upward pressure)

• Calls outweigh puts 2.6-to-1 (institutions bet on rally)

• $576M liquidations (leverage flushed = clean setup)

• ETH breaks $3K (risk appetite returning)

• Galaxy says $250K by end-2027 (long-term thesis intact)

Gold won the battle of 2025. Doesn’t mean Bitcoin can’t win the war of 2026-2027.

When everyone declares Bitcoin dead and gold supreme, that’s historically been THE bottom. Dec 2022: Bitcoin $16K, “it’s over.” Rallied 700%+ to $125K. Current correction (125K → $89K = -29%) is NORMAL.

The setup: Options expiry Friday removes $27B in hedging pressure. Santa Rally window begins Dec 24. Post-expiry markets typically rally. ETF managers want positive year-end performance. Macro calendar clear until January.

The risk: Gold narrative dominant. 2026 uncertainty high. Consolidation at $85K-$88K possible.

The opportunity: If you believe Bitcoin rebounds in 2026-2027 (as Galaxy, Citi, institutions forecast), then $89K is GIFT. Not as good as $85K or $80K, but better than $105K or $120K.

Five days until options expiry. Nine days until 2026. The hardest part of December is over (BoJ, CPI, liquidations, gold humiliation).

What’s next? Either: 1. Grind to $96K-$100K by year-end (base case)

2. Fail and consolidate $85K-$88K (bear case)

3. Gamma squeeze to $110K+ (bull case)

For traders: Watch $92K break or $87.5K fail. Trade accordingly.

For HODLers: Gold won 2025. You’re not investing in 2025. You’re investing in 2026-2027. Stop checking prices.

The Great Decoupling happened. Bitcoin proved it’s NOT gold. It’s something else—scarcer, more volatile, more asymmetric. Gold is the safe-haven for THIS crisis. Bitcoin might be the safe-haven for the NEXT one.

Or maybe Bitcoin is just the best asymmetric bet for the next decade. Either way, $89K with $27B options creating upward pressure into Friday doesn’t feel like the end.

It feels like the pause before the next chapter.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.