The $90K Rejection

December 23, 2025

Bitcoin at $87,511 (-2%) after BRUTAL $90K rejection Monday. Tried to break above $90K, hit $90,353, REJECTED HARD, collapsed back to $87K-$88K range. Meanwhile, GOLD EXPLODES to $4,497 (near $4,500!), silver hits $70+ (new ATH), and precious metals mock crypto’s weakness.

MicroStrategy PAUSED Bitcoin buying: Despite raising $747.8M, bought ZERO BTC last week. Holdings flat at 446,400 BTC. Most visible corporate buyer PAUSED = psychological blow to bulls. MSTR shares down 50% in 2025. - Fear & Greed: 24 (still extreme fear, dropped from Monday’s improvement) - 48 hours until $27B options expiry (Thursday Dec 26)

US-VENEZUELA CRISIS: Trump ordered naval blockade of Venezuelan oil tankers, seized vessels, threatens war. This geopolitical shock sent gold/silver to records while Bitcoin DUMPED—proving once again BTC is risk-on, NOT safe haven.

WORST Q4 SINCE 2018: Bitcoin down -22% in Q4 2025—worst fourth quarter performance outside major bear markets. The quarter that historically produces strongest rallies became 2025’s graveyard. Oct peak $125K → Dec low $87K = -30% correction.

KEY TAKEAWAY:

Bitcoin tried to be brave Monday, touched $90K, got SMACKED back to reality. Gold/silver exploding to records on Venezuela crisis while BTC dumps proves safe-haven narrative DEAD. MicroStrategy pausing buys removes most visible demand driver. 48h until $27B options expiry with BTC $9K below max pain ($96K). Christmas thin liquidity + geopolitical crisis + no corporate buying = RECIPE FOR DISASTER. But: This is extreme capitulation. When MicroStrategy stops buying, gold hits ATH, Q4 worst since 2018, Fear at 24—that’s historically THE bottom. Question is timing: Bottom NOW at $87K? Or one more flush to $83K-$85K after Thursday options expiry?

CRITICAL: If BTC can’t reclaim $90K before Thursday expiry, max pain failure = dealers lose BILLIONS on worthless calls. Post-expiry could trigger capitulation dump to $83K-$85K. BUT if holds $87K through Thursday, post-expiry relief rally to $95K-$100K still possible.

I. BREAKING HEADLINES & THE CHRISTMAS CRISIS

What Happened:

1. Gold Stole the Show:

As BTC tested $90K, GOLD EXPLODED to $4,497 (nearly $4,500!). This is gold’s 50th record high of 2025. Silver broke $70 for FIRST TIME EVER. When safe-haven assets rally and risk assets dump, that’s RISK-OFF environment. Bitcoin got classified as RISK-ON and sold off.

2. Venezuela Geopolitical Shock:

Trump administration’s naval blockade of Venezuela, seizure of oil tankers, threats of war = classic geopolitical crisis. Historically, this sends capital to GOLD (proven safe haven) and OUT of Bitcoin (unproven, volatile, risk asset). Exactly what happened.

3. Thin Holiday Liquidity:

Christmas week. Many institutional desks running skeleton crews. Low volume = easy to manipulate price down. Whales sold into $90K resistance, triggered stops, cascaded to $87K. Classic thin-liquidity dump.

4. MicroStrategy Pause:

News broke Monday evening: Strategy bought ZERO Bitcoin Dec 15-21 despite raising $748M. Most visible corporate buyer STOPPED buying right as BTC tested resistance. Psychological blow to bulls. “If Saylor won’t buy at $90K, why should we?”

Technical Damage:

$90K: Tested 3x in 48 hours. Failed ALL three. Now HEAVY resistance.

$88K-$89K: Former support now resistance. Can’t reclaim.

$87K-$87.5K: Current precarious support. Break = $85K-$86K quick.

$96K max pain: Now looks IMPOSSIBLE. BTC is $9,000 below with 48 hours until expiry.

The Bearish Case Strengthens:

With $90K rejection, technical picture DETERIORATED: - Failed breakout = bull trap - Lower highs forming ($90.4K Mon → $89.4K Tue) - Options max pain failure = dealers lose on calls - Post-Thursday expiry could see capitulation to $83K-$85K

The Bull Case Weakens:

Bulls needed $90K break to validate “max pain rally” thesis. Failure means: - Upward pressure from options NOT strong enough - Selling pressure (Venezuela crisis, thin liquidity, MSTR pause) DOMINANT - Santa rally narrative dead - Best hope now: Survive $87K, post-expiry relief bounce

2. GOLD HITS $4,497 - THE 50TH RECORD HIGH OF 2025

The Supremacy Continues:

Tuesday morning: Gold touched $4,497.55 (all-time high), came within $2.45 of the psychological $4,500 barrier. This is gold’s 50th record-breaking session of 2025—a year for the history books.

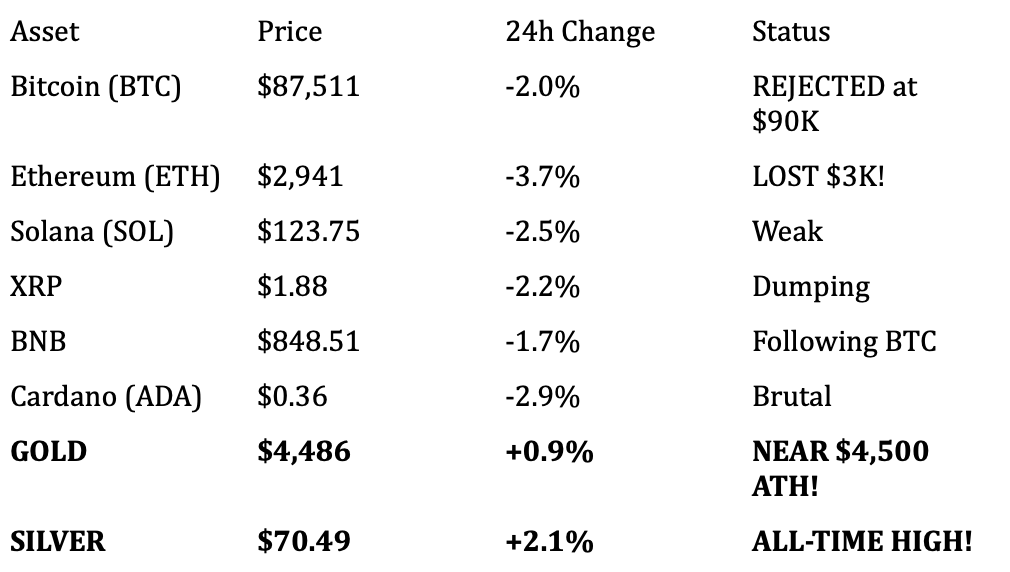

Current Levels: - Spot Gold: $4,486/oz (+0.9% today, +70% YTD) - Gold Futures: $4,519/oz (February contract) - Silver: $70.49/oz (+2.1% today, +140% YTD, ALL-TIME HIGH) - Platinum: Up 45% YTD, nearing its own ATH

2025 Performance BRUTAL Comparison: - Gold: +70% YTD - Silver: +140% YTD - Bitcoin: -5% YTD (and today -2%, making it worse) - BTC/Gold Ratio: 19.5 ounces (was 40 in Dec 2024)

What’s Driving Gold’s Parabolic Move:

Venezuela Crisis (Primary Catalyst):

Trump administration’s aggressive Venezuela policy: - Naval blockade of sanctioned oil tankers - US Coast Guard seized super tanker this month - Attempted interception of 2 more vessels over weekend - Trump: “Not ruling out war with Venezuela”

This is TEXTBOOK geopolitical crisis = gold rally. Investors flee to 5,000-year proven safe haven when war threats emerge.

Central Bank Buying (Structural Support):

- 2025: Central banks on track to buy 850 tonnes of gold - Gold ETFs: $82 billion inflows (749 tonnes, largest since 2020) - China, India, Turkey, Russia leading sovereign purchases - De-dollarization trend accelerating post-Russia sanctions

Fed Rate Cut Expectations:

Markets pricing 2 rate cuts in 2026. Lower rates = lower opportunity cost of holding gold (which pays no yield). Plus expectations Trump may appoint dovish Fed chair in 2026 when Powell’s term ends.

Dollar Weakness:

Dollar Index down -0.20% today, making gold cheaper in foreign currencies. Capital rotation OUT of USD-denominated assets INTO gold.

Technical Momentum:

Gold’s 50th record high = EXTREME momentum. When an asset hits new highs repeatedly without major corrections, it signals structural revaluation, not temporary spike. This is 2025’s DEFINING trade.

Why This Crushes Bitcoin’s Narrative:

Every time gold rallies on geopolitical fear, Bitcoin sells off. This PROVES: - Bitcoin is NOT “digital gold” - Bitcoin is risk-on growth asset correlated with Nasdaq - When shit hits the fan, investors choose proven 5,000-year safe haven over 16-year experiment - “Store of value” narrative demolished

The Contrarian Take:

When gold is THIS overheated (50 records, +70% in one year, silver +140%), and Bitcoin is THIS beaten down (-5% YTD, rejected at $90K, Q4 -22%), the relative value trade FLIPS.

If Venezuela tensions ease OR Fed doesn’t cut as much as expected OR gold profit-taking begins, capital could rotate FROM precious metals TO beaten-down risk assets like Bitcoin. This is how cycles turn.

But timing is everything. And right now, gold is DOMINATING.

3. MICROSTRATEGY’S SHOCKING PAUSE - ZERO BITCOIN PURCHASES DESPITE $748M RAISED

The Bombshell:

Monday Dec 22 SEC filing: Strategy (MSTR) bought ZERO Bitcoin from Dec 15-21, despite raising $747.8 million in stock sales that week.

MicroStrategy has been THE most visible, aggressive corporate Bitcoin buyer: - Bought BTC every week Nov-early Dec (three-week buying spree) - Accumulated 446,400 BTC ($33B+ at current prices) - Saylor’s “Bitcoin treasury strategy” inspired corporate adoption narrative - Each purchase announcement = headline, price bump, institutional FOMO

Why Did Strategy Pause?

Theory 1 - Price Too High:

Strategy’s average cost is $74,972. Bitcoin at $87K-$90K = 16-20% above their basis. Maybe they’re waiting for better entry ($80K-$85K)?

Theory 2 - MSCI Exclusion Risk:

MSCI decision Jan 15 on whether to exclude MSTR from indexes. If excluded, forced selling = share price crash. Strategy may be preserving cash for that scenario.

Theory 3 - Balance Sheet Management:

After aggressive Nov-Dec purchases, Strategy building cash reserves for flexibility. $2.19B cash = optionality if market crashes or opportunity emerges.

Theory 4 - Market Timing:

Saylor might believe $87K-$90K is temporary resistance. Why buy here when $27B options expiry Thursday could crash price to $83K-$85K? Wait for better entry.

Market Reaction:

MSTR shares: Down 50% in 2025 (ouch)

Bitcoin: Monday’s $90K rejection accelerated by this news

Sentiment: Bulls demoralized. “Even Saylor stopped buying”

Narrative: Corporate Bitcoin treasury adoption STALLED

4. BITCOIN’S WORST Q4 SINCE 2018 - DOWN 22% THIS QUARTER

The Stat That Hurts:

Bitcoin is down -22% in Q4 2025 (Oct-Dec), making this the worst fourth quarter performance since 2018’s bear market (-45% that Q4).

Q4 2025 Price Action: - October Peak: $125,000 (all-time high, Oct 7) - November Low: $85,800 (BoJ hike 1, -31% from peak) - December Range: $85K-$90K (choppy, no momentum) - Current: $87,511 (down -30% from Oct peak, -22% for Q4)

Historical Context:

Strong Q4s: - Q4 2020: +170% (COVID recovery, institutions entering) - Q4 2021: +20% (despite Dec correction from Nov $69K peak) - Q4 2023: +55% (bear market bottom forming) - Q4 2024: +45% (halving rally, ETF euphoria)

Weak Q4s: - Q4 2018: -45% (brutal bear market, $6K → $3K) - Q4 2022: -17% (FTX collapse, bear market bottom) - Q4 2025: -22% (gold supremacy, options manipulation, liquidity crisis)

Why This Matters:

Q4 is SUPPOSED to be Bitcoin’s strongest quarter: - Santa rally seasonality - Year-end portfolio rebalancing - Tax-loss harvesting into early Jan buying - Post-halving momentum (2024 was halving year)

For Q4 2025 to be THIS weak means: - Structural issues, not just short-term volatility - Something fundamentally broken in 2025 bull thesis - Either this is the END of bull cycle OR massive reset before 2026 rally

CoinDesk Analysis:

“Bitcoin remains roughly 30% below its 2025 peak and is trading below levels seen at start of year. Attempts to bring year-to-date performance back to zero are little consolation. Disappointment has replaced optimism that dominated markets earlier this year.”

FX analyst Kuptsikevich:

“Short-term momentum could prove misleading, especially given broader context. Seasonal patterns reinforce caution. While Q4 has historically produced strongest rallies, it has also delivered sharp drawdowns during years marked by tightening liquidity and macro uncertainty.”

The Contrarian View:

Q4 2018 (-45%) marked THE bottom. Dec 2018 low $3,200 = generational buying opportunity before rally to $64K (2000%+ gain over 2.5 years).

Q4 2025 (-22%) COULD be similar setup. Worst Q4 outside bear markets = capitulation. When even MicroStrategy stops buying and gold hits 50 records, that’s PEAK despair.

If this is repeat of Q4 2018, then $87K-$85K = THE bottom before multi-year rally.

5. 48 HOURS UNTIL $27B OPTIONS EXPIRY - MAX PAIN FAILURE IMMINENT

The Reckoning Approaches:

Thursday Dec 26 (Boxing Day): $27 billion in Bitcoin and Ethereum options expire on Deribit. Originally thought to create upward pressure to $96K max pain.

Current Status: - BTC Price: $87,511 - Max Pain: $96,000 - Gap: -$8,489 (-8.9%) - Time Remaining: 48 hours - Probability of Reaching $96K: <5%

What This Means:

For Call Buyers (Bulls):

REKT. Calls concentrated at $100K-$116K strikes. With BTC at $87.5K, these expire WORTHLESS. Billions lost.

For Put Buyers (Bears):

Some wins. $85K puts are near-the-money. But put-call ratio was 0.38 (calls 2.6x puts), so fewer bears positioned.

For Dealers (Market Makers):

MIXED. They sold calls expecting BTC wouldn’t reach $96K. Correct. They keep premiums. BUT they may have hedged by buying spot BTC, which is now underwater if they bought $88K-$90K expecting rally to $96K.

Post-Expiry Scenarios:

SCENARIO A - Capitulation Dump (40%):

- Thursday expiry at $87K-$88K (below max pain) - Dealers unwind long hedges = sell spot BTC - Liquidations accelerate - BTC drops to $83K-$85K (True Market Mean) - Friday-Sunday: Consolidation, potential bottom formation

SCENARIO B - Relief Bounce (35%):

- Thursday expiry removes $27B hedging pressure - No more dealer manipulation to control price - Natural buying emerges (ETF year-end positioning, Santa rally) - BTC bounces to $90K-$93K - Not strong rally, just relief from options weight

SCENARIO C - Continued Chop (25%):

- Thursday expiry, nothing happens - BTC stays $87K-$90K range through year-end - Thin Christmas liquidity = no directional momentum - Real move postponed to January post-holidays

The Key Question:

If BTC FAILS to reach $96K (now certain), does that invalidate entire “options create upward pressure” thesis? Or was the thesis correct but OTHER factors (Venezuela, MSTR pause, gold rally, thin liquidity) overwhelmed it?

II. MARKET DATA & THE CHRISTMAS CRUNCH

KEY METRICS - THE DETERIORATION

Market Structure: - Total Market Cap: $3.07T (down -0.8% from Monday) - 24h Volume: $145B (thin for this volatility) - BTC Dominance: 59.4% (holding but BTC weak) - Fear & Greed: 24 (EXTREME FEAR, down from Monday’s 22-24 range) - 24h Liquidations: $222M (bulls REKT at $90K rejection)

Derivatives Carnage: - Thursday Options Expiry: $27-$28.5B ($23.6B BTC + $3.8-$4.9B ETH) - BTC Max Pain: $96,000 (BTC $8.5K below = FAILURE) - Put/Call Ratio: 0.38 (calls 2.6x puts = bulls positioned WRONG) - Open Interest: $129B (up 1.1% as leverage rebuilds despite fear) - Funding Rates: Slightly negative (-0.01%) = bears paying longs (reversal from neutral)

ETF Disaster: - Recent Flows: Negative (outflows accelerating) - MicroStrategy: ZERO purchases Dec 15-21 despite $748M raised - Current AUM: ~$112B (down from $152B peak) - Institutional Sentiment: DEFENSIVE (holiday positioning, risk-off)

Gold vs Bitcoin 2025 UPDATED: - Gold: +70% YTD (and still going!) - Bitcoin: -5% YTD (getting worse) - BTC/Gold Ratio: 19.5 ounces (was 40 Dec 2024, now 19.5 = 51% COLLAPSE) - Silver: +140% YTD (just keeps winning)

III. ACTIONABLE TECHNICAL ANALYSIS & SURVIVAL MODE

BITCOIN - $87,511 | The Broken Dream

TUESDAY MORNING CARNAGE:

Monday’s $90K hope CRUSHED. Violent rejection. Back to $87.5K. Technical structure DETERIORATING. 48 hours until options expiry. No momentum. Thin liquidity. Gold mocking us.

This is NOT bullish.

CURRENT TECHNICAL SETUP:

• CURRENT: $87,511 (DANGER ZONE)

Failed $90K breakout = bull trap. Lower highs forming. Support at $87K-$87.5K is LAST LINE before cascade to $85K-$86K. Every bounce gets sold. No conviction.

• IMMEDIATE SUPPORT: $86,500-$87,500 (BREAKING = CAPITULATION)

Tested overnight, held barely. This is THE floor. Break = waterfall to $83K-$85K with nothing in between. Given options expiry Thursday + thin liquidity + Venezuela crisis, break is HIGH RISK.

• FAILED RESISTANCE: $88,500-$90,000 (THE GRAVEYARD)

Three attempts in 48 hours: $90.4K Monday, $89.4K Mon night, $88.9K Tue morning. All FAILED. This is where bulls go to die. Until reclaims $90K with volume, assume downtrend.

• MAX PAIN FAILURE: $96,000 (IMPOSSIBLE NOW)

With 48 hours left and BTC at $87.5K, reaching $96K requires +9.7% move. In Christmas thin liquidity with gold rallying and MSTR not buying? ZERO CHANCE. Max pain thesis DEAD.

• BULL CASE SALVAGE: $91,000-$93,000 (Post-Expiry Target IF Survives)

Only hope: Hold $87K through Thursday, options pressure removed Friday, relief bounce to $91K-$93K. Not strong rally. Just exhale after expiry. Probability: 30%.

• BEAR CASE ACCELERATION: $83,000-$85,000 (High Probability)

If $87K breaks (40% chance), cascade to $83K-$85K. True Market Mean. Historical BoJ drop zone. Where BTC “should” have gone in Dec but delayed. Post-Thursday capitulation. Probability: 40%.

ON-CHAIN & DERIVATIVES SIGNALS:

Liquidations: $222M in 24h. Bulls liquidated at $90K rejection, bears covering at $87K dip. Market PUNISHING both sides = choppy hell.

Funding Rates: Turned slightly negative = bears paying longs. Means market expects DOWN but longs refusing to close. Classic late-cycle stubbornness before final flush.

Open Interest: UP 1.1% to $129B despite price down. DANGEROUS. Leverage rebuilding into Thursday expiry = powder keg. If BTC breaks $87K with high OI, liquidation cascade amplifies.

Options Positioning: Calls stacked $100K-$116K (worthless). Puts at $85K (near money). Post-expiry, dealers may DUMP spot if they’re long from hedging.

ETHEREUM - $2,941 | The $3K Dream Dies

ETH LOSES $3,000:

Monday’s break above $3K? GONE. ETH dumped -3.7% today to $2,941. That psychological level flipped from support to resistance in 24 hours.

Technical Levels: - Current: $2,941 (WEAK, lost $3K) - Resistance: $3,000 (failed), $3,050-$3,100 (max pain for ETH options) - Support: $2,900 (current), $2,850 (critical), $2,800 (former low)

ETH/BTC Correlation: ETH following BTC down but with WORSE performance (-3.7% vs BTC -2%). When ETH underperforms in dumps, that’s altcoin weakness = bearish for entire market.

ETH Options Thursday: $3.8-$4.9B expiring alongside BTC’s $23.6B. Max pain $3,100. ETH at $2,941 = also FAILING max pain. Same post-expiry dynamics as BTC.

TRADER’S PLAYBOOK - CHRISTMAS EVE EVE SURVIVAL GUIDE

TODAY (Tuesday Dec 23):

IF you’re LONG from $88K-$90K:

- Stop Loss: $86,500 (don’t let this become disaster)

- Target: $90K retest (if miracle happens)

- Reality: Probably getting stopped out. Better to preserve capital.

IF you’re SHORT from $90K:

- Take Profit: 50% at $87K (hit), 50% at $85K (if breaks)

- Stop: $91K (if reclaims, thesis wrong)

- Reality: You’re winning. Trail stops.

IF you’re WAITING (smartest position):

- Watch: $87K support. Break = $85K target.

- Options Expiry Thursday: Let it pass before taking positions.

- Best Entry: Post-Thursday IF BTC at $83K-$85K = buy 30-40%

WEDNESDAY (Christmas Eve - Dec 24):

- Markets: Skeleton crews, ultra-thin liquidity

- Expectation: CHOP or dump. Santa doesn’t come early.

- Action: DO NOT TRADE. Family > charts. Close laptop.

THURSDAY (Christmas - Dec 25 + Options Expiry Dec 26):

- Christmas Day: Markets technically open but DEAD volume

- Boxing Day (Dec 26): Options expiry at 8 AM UTC

- Action: Watch but don’t trade INTO expiry. Wait for dust to settle.

- Post-Expiry (Thu afternoon-Friday): IF BTC at $85K-$87K = assess bounce. IF at $83K-$85K = BUY 40%.

FRIDAY-WEEKEND (Dec 27-29):

- Post-Expiry Relief: If BTC holds $87K through Thursday, bounce to $90K-$93K possible

- Or Capitulation: If BTC breaks $85K, test $83K then stabilize

- Year-End Positioning: Some funds might buy to mark up Dec 31 close

FOR HODLERS:

Perspective: You survived Fear 11, CPI, BoJ, gold ATH, MSTR pause, $90K rejection, worst Q4 since 2018. What’s 2 more days?

Reality: $87K might not be the bottom. Could be $83K-$85K after Thursday. But you’re not selling HERE after holding through all that.

Action: Close charts. Enjoy Christmas. Check back January 2. Either BTC is $95K and you’re happy, or $80K and you’re averaging down. You’re not day-trading this chop.

IV. X/TWITTER SENTIMENT - CAPITULATION OR BOTTOM?

CRYPTO TWITTER PULSE - DECEMBER 23, 2025

“Bitcoin attempted to bring year-to-date performance back to zero but remains roughly 30% below its 2025 peak and trading below levels seen at start of year. Disappointment has replaced the optimism that dominated markets earlier this year.”

— FXPro analyst Alex Kuptsikevich (Dec 23)

Analysis: BRUTAL honesty. BTC started 2025 at ~$93K, now $87.5K = underwater on the YEAR. “Disappointment replaced optimism” = sentiment death. When analysts stop sugarcoating, it’s either (A) bottom signal as negativity peaks, or (B) honest assessment of broken bull market. Verdict: BEARISH near-term, potentially contrarian setup.

“Bitcoin is down more than 22% so far in Q4, making 2025 one of the weakest year-end periods outside of major bear markets. While Q4 has historically produced strongest rallies, it has also delivered sharp drawdowns during years marked by tightening liquidity and macro uncertainty.”

— CoinGlass Data Analysis (Dec 23)

Analysis: Q4 2025 = worst since 2018. The comparison to bear markets is damning. But note: Q4 2018 (-45%) was THE bottom before 2000%+ rally to $64K. If Q4 2025 is similar, current prices = generational opportunity. Verdict: Context-dependent. Bear market OR bottom. TBD.

“Strategy paused BTC purchases last week even after raising about $747.8M in stock sale, following prior three-week buying spree. One of market’s most visible ‘always buy Bitcoin’ institutions has become more tactical. That shift removes a psychological tailwind.”

— Market Analysis (Dec 23)

Analysis: When Michael Saylor STOPS buying, it’s seismic. His entire identity is “never selling, always buying.” Pause at $87K-$90K after raising $748M signals either (A) he thinks it’s going lower and waiting for better entry, or (B) MSCI exclusion risk forcing capital preservation. Either way, removes biggest corporate demand headline. Verdict: BEARISH for near-term sentiment.

“U.S.-Venezuelan tensions are keeping gold on the radar for investors as an uncertainty hedge. Gold had surged this week as part of broader positioning shift with U.S. interest rates projected to ease further. I don’t think we are at the high watermark yet for gold or silver.”

— Tim Waterer, Chief Market Analyst KCM Trade (Dec 23)

Analysis: Gold analyst saying MORE UPSIDE for gold/silver. Classic late-stage momentum call. Could be right (gold to $5K, silver to $80) OR late-cycle euphoria before top. Either way, as long as gold dominant narrative, Bitcoin struggles. When gold analyst says “not at high watermark,” that’s EXTREME bullishness on PMs = BEARISH for BTC. Verdict: Gold narrative still dominant, bad for Bitcoin.

“Closing above $108,000 could challenge assumptions that Bitcoin’s 2025 peak marks a long-term top. Until the Fed receives several months of uninterrupted inflation readings, market participants unlikely to commit fully to risk assets like Bitcoin.”

— Gabriel Selby, CF Benchmark Head of Research (Dec 23)

Analysis: Two key points: (1) Need $108K to invalidate “$125K was the top” thesis. We’re at $87.5K = LONG way away. (2) Fed data delayed by government shutdown = uncertainty = no capital commitment. This explains weak Q4—institutions waiting for clarity. Verdict: NEUTRAL but highlights $108K as CRITICAL level for 2026. Below that = bear case strengthens.

“Traders are preparing for major options expiry, with $27-28.5 billion in Bitcoin and Ethereum contracts set to expire Dec 26. While underlying volatility has been building, price action remained relatively tight due to heavy positioning around major strike prices. Many traders holding off on new trades, waiting to see how market behaves after expiry.”

— Crypto News Analysis (Dec 23)

Analysis: EVERYONE waiting for Thursday expiry. No one wants to trade into it. This creates VACUUM of conviction. Post-expiry either (A) relief as pressure removed, or (B) capitulation as dealers unwind hedges. With BTC at $87.5K vs $96K max pain, leaning toward (B). Verdict: NEUTRAL but emphasizes Thursday as KEY date. Don’t trade before it.

“Expectations for dovish Fed, markets losing confidence in greenback, geopolitical tensions, central bank buying—investors’ lust of gold remains massive due to mix of all factors. Both gold and silver continue to attract buying strength.”

— Carlo Alberto De Casa, Swissquote Analyst (Dec 23)

Analysis: Perfect summary of gold bull case. Every factor aligned: dovish Fed, weak dollar, geopolitics, CB buying. This is WHY gold is crushing Bitcoin. When all macro factors favor one asset (gold) and punish another (BTC), don’t fight it. Verdict: BEARISH for Bitcoin until these factors reverse. Could be months.

SENTIMENT SUMMARY:

Bearish Camp (55%): Kuptsikevich disappointment, Q4 worst since 2018, MSTR pause, gold dominance narrative

Neutral Camp (30%): Waterer (gold more upside = bad for BTC), Selby (need $108K to prove bull), waiting for Thursday expiry

Bullish Camp (15%): Contrarians noting Q4 2018 parallel, extreme negativity = potential bottom

CONSENSUS: Near-term (this week) = BEARISH. Thursday expiry likely disappoints. Christmas week = no catalyst for rally. Gold dominance continues. Medium-term (2026) = UNCERTAIN. Depends on Fed cuts, Venezuela resolution, whether $87K holds or breaks to $83K.

Key Insight: When NO ONE is bullish and EVERYONE waiting for lower prices, that’s often THE bottom. But timing is everything. Could bottom Thursday at $85K. Could bottom in January at $80K. Sentiment at extreme negativity = contrarian setup forming.

V. FORWARD OUTLOOK - THE CHRISTMAS COIN FLIP

SCENARIO ANALYSIS: 48 HOURS → YEAR-END → 2026

BASE CASE (45%): Fail to Hold $87K, Capitulation to $83K-$86K, Consolidate

NEXT 48 HOURS (Tue-Thu):

- Wed (Christmas Eve): Ultra-thin liquidity, minor dump to $86K-$87K - Thu (Christmas + Expiry): Options expire at $87K-$88K (FAILURE vs $96K max pain) - Dealers unwind long hedges acquired during expiry week - BTC drops to $85K-$86K on low volume

POST-EXPIRY (Thu afternoon-Sunday):

- Initial drop to $83K-$85K (True Market Mean, everyone’s “wait for this” level) - Stabilization as fear peaks - Some buying emerges (contrarians, DCA believers, funds marking up year-end) - Weekend consolidation $83K-$87K range

YEAR-END (Dec 28-31):

- Close 2025 at $84K-$87K (negative YTD performance confirmed) - Fear stays 20-24 (extreme fear) - Gold continues rally to $4,600-$4,700 - Narrative: “Bitcoin bear market confirmed” - But: Hodlers who bought $16K-$30K in 2022-2023 still massively profitable

Q1 2026 (Jan-Mar):

- Jan 15: MSCI decision on MicroStrategy (if excluded, more selling) - January: BTC tests $80K-$83K (death cross territory) - Feb-Mar: Fed delivers first rate cut (as expected) - Liquidity improves, gold tops out, capital rotates back to growth - BTC bottoms $78K-$83K, rally begins to $95K-$105K by end Q1

WHY BASE CASE:

(1) $90K rejection confirmed weakness

(2) MSTR pause removes demand catalyst

(3) Options max pain failure = no mechanical support

(4) Venezuela crisis + gold ATH = risk-off environment

(5) Q4 worst since 2018 = capitulation not complete

(6) Historical pattern: Q4 capitulation → Q1 recovery

This is painful but HEALTHY. $83K-$85K shakes out final weak hands before 2026 rally.

BULL CASE (25%): Hold $87K, Post-Expiry Relief to $93K-$98K

THE MIRACLE:

- Tue-Wed: BTC holds $87K despite selling pressure - Thu: Options expiry, immediately stabilizes - Venezuela tensions ease (diplomatic resolution announced) - Gold profit-taking begins (overheated at $4,500)

THE MOVE:

- Thu afternoon-Fri: Relief rally to $90K-$92K as expiry pressure removed - Weekend: Push to $93K-$95K on “Santa rally” narrative resurrection - Dec 28-31: Touch $96K-$98K (finally reaching original max pain target, just late) - Close 2025 at $95K-$98K = positive YTD vs $93K open

Q1 2026 CONTINUATION:

- MSCI doesn’t exclude MSTR (or delays decision) = relief - Fed cuts in January = liquidity returns - Gold tops at $4,500-$4,700, capital rotates to BTC - March: BTC at $110K-$120K as risk-on dominates

WHY POSSIBLE (But Unlikely):

- $87K has held 3 attempts - Options expiry could remove DOWNWARD pressure (dealer hedges) - Extreme fear (24) = contrarian signal - MicroStrategy pause might be strategic (waiting for lower entry they didn’t get) - Q4 2018 parallel: worst Q4 = THE bottom

WHY NOT BASE CASE:

- Requires multiple things go RIGHT (Venezuela ease, gold top, BTC holds) - Currently everything going WRONG - No catalyst visible for turnaround - Would need to reclaim $90K with conviction = not seeing that strength

IF IT HAPPENS:

This would be VIOLENT short squeeze. Bears positioned for $83K-$85K, get squeezed at $90K break. Target $95K-$100K quick. But probability: 25%.

BEAR CASE (30%): Break $85K, Cascade to $75K-$80K, Extended Bear

THE NIGHTMARE:

- Tue-Wed: Can’t hold $87K, breaks to $85K-$86K - Thu: Options expiry, dealers dump hedges - Cascade to $83K, then $80K - Fear spikes to 15-18 (cycle low territory)

THE MOVE:

- $87K → $85K (support fails) - $85K → $80K-$82K (True Market Mean, historical support) - Test $78K-$80K (Citi bear case, CryptoQuant target) - If breaks $78K = $75K (death cross level, 2024 lows)

Q1 2026 BEAR EXTENSION:

- Jan 15: MSCI excludes MSTR = forced $8.8B selling - January: MicroStrategy dumps Bitcoin to meet obligations (Saylor’s nightmare) - BTC falls to $70K-$75K - Gold continues to $5,000+ - “Bitcoin dead” narrative peaks - Extended consolidation $70K-$85K through Q1

WHY UNLIKELY (Hopefully):

- $85K-$87K is STRONG support (tested 5+ times in Dec) - Fear already extreme (24) = hard to go much lower sentiment-wise - LTH haven’t panicked (yet) - Institutions with $83K avg cost unlikely to sell at loss

WHY POSSIBLE (Unfortunately):

- Technical structure broken ($90K rejection) - No demand catalysts (MSTR paused, ETF outflows) - Macro headwinds (Venezuela, gold, risk-off) - Options expiry could trigger liquidation spiral - Q4 worst since 2018 might mean more downside before bottom

IF IT HAPPENS:

This is 2022 redux. $75K-$80K = where diamond hands made fortunes. If you believe in 2026-2027 bull case (Galaxy $250K, Citi $143K+), then $75K-$80K = GENERATIONAL buy. Deploy 50-70% capital. Hold through 2026.

But could take 3-6 months to bottom. Not a quick bounce.

VI. KEY TAKEAWAYS & SURVIVAL GUIDE

1. THE $90K REJECTION CHANGED EVERYTHING

Monday’s failed breakout confirmed: Bears in control. Bulls bet on options max pain rally to $96K. FAILED. Now trapped underwater. Technical damage severe. Until reclaims $90K with volume, assume downtrend.

2. MICROSTRATEGY PAUSE = PSYCHOLOGICAL NUKE

When Bitcoin’s #1 corporate evangelist STOPS buying despite having $2.19B cash and raising $748M… that’s a SIGNAL. Either he expects lower prices OR MSCI exclusion risk too high. Either way, removes visible demand that bulls counted on.

3. GOLD’S 50TH RECORD HIGH = SAFE HAVEN SUPREMACY

$4,497 gold, $70 silver, both at ATHs while Bitcoin dumps on Venezuela crisis. This PROVES: BTC is risk-on asset, NOT safe haven. “Digital gold” narrative buried. Until gold tops, Bitcoin struggles.

4. WORST Q4 SINCE 2018 = EITHER BOTTOM OR BEGINNING

Q4 2025 (-22%) worst outside bear markets. Q4 2018 was THE bottom before epic rally. Q4 2025 could be similar… OR start of extended bear. Thursday’s options expiry + year-end close determines which.

5. 48 HOURS TO THURSDAY EXPIRY = DO NOTHING

$27B options expire Thursday. Max pain $96K. BTC at $87.5K = FAILURE. Post-expiry could be relief bounce OR capitulation dump. NO ONE KNOWS. Smart money is WAITING.

WHAT TO DO NOW:

TODAY-WEDNESDAY (Christmas Eve):

IF Long:

- Stop loss $86,500

- Pray for miracle

- Probably getting stopped

IF Short:

- Take 50% profit at $87K

- Trail stop to $89K

- Let rest run to $85K

IF Cash (Smartest):

- WAIT for Thursday

- Do NOT trade into options expiry

- Enjoy Christmas with family

THURSDAY (Christmas + Expiry):

- Options expire 8 AM UTC (3 AM EST)

- Wait for dust to settle (afternoon)

- IF BTC at $83K-$85K = prepare to BUY 40%

- IF BTC at $87K-$89K = WAIT for direction

FRIDAY-SUNDAY (Post-Expiry):

- Relief bounce to $90K-$93K = possible

- Capitulation to $83K-$85K = possible

- Either way, by Sunday know where we stand

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.