Christmas Eve Standoff

December 24, 2025

Bitcoin at $86,770 (-0.8%) in the tightest range imaginable. $86,700-$88,200 intraday. DEAD volume. Skeleton crews. No one trading. Everyone waiting for tomorrow’s $28.5 BILLION options expiry.

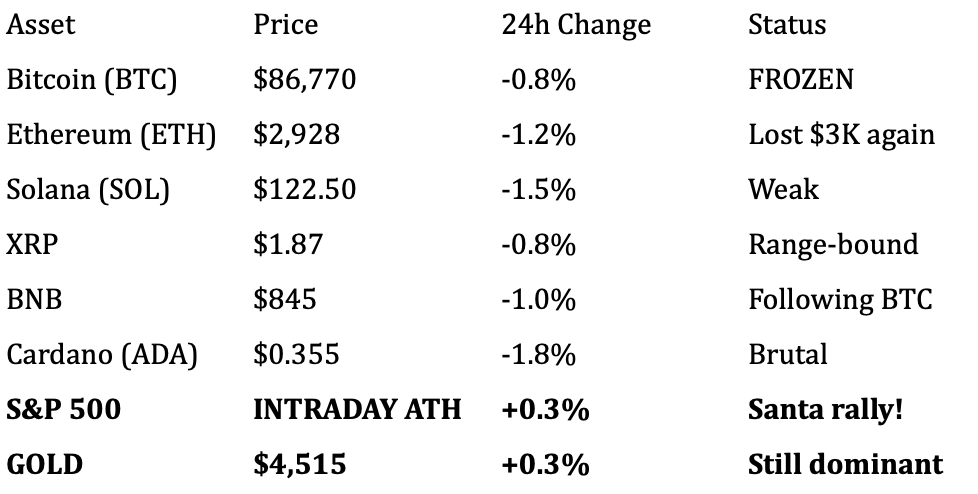

THE CHRISTMAS EVE PARALYSIS: - BTC: $86,770 (-0.8% daily, range-bound $86.7K-$88.2K) - ETH: $2,928 (lost $3K again, down -1.2%) - 24 HOURS until Boxing Day options expiry: $28.5B total ($23.6B BTC + $4.9B ETH) - Market cap: $2.97T (down -1.4% as crypto bleeds while stocks hit records) - Volume: ANEMIC (holiday liquidity death) - ETF outflows: PERSISTENT (investors fleeing crypto into year-end) - Stocks: S&P 500 hits INTRADAY RECORD (classic Santa rally… for equities, not crypto)

VANECK’S BOMBSHELL 2026 FORECAST:

Released Dec 23, VanEck’s annual outlook predicts Bitcoin will be “TOP PERFORMER in 2026” despite 2025 disaster. Key claims: - BTC lagging Nasdaq by 50% YTD = “dislocation setting up outperformance” - 2026 = consolidation year, NOT melt-up or crash - Gold to $5,000 (from current $4,500), Bitcoin follows - Liquidity returning = BTC “responds sharply” - 1-3% allocation recommended via DCA

But Matthew Sigel (VanEck Digital Assets Head) warns: “2026 more likely consolidation than melt-up or collapse. Four-year cycle peaked Oct 2025. Volatility dropped 50%, implying 40% drawdown already absorbed 35%.”

THE BENZINGA HISTORICAL PATTERN:

Analysis of every Christmas Eve when Bitcoin was DOWN year-over-year: - 2014: Down 56% → 2015 rallied 36% - 2018: Down 72% → 2019 rallied 95% - 2022: Down 64% → 2023 rallied 159% - 2025: Down 6.8% → 2026 rallies… ???

Average return following down Christmas Eves: +126.4%

Applied to $87K: Conservative target $125K-$150K, Bull target $180K-$200K

KEY TAKEAWAY:

Christmas Eve 2025 = DEADEST trading day of the year. Everyone gone. Volume extinct. Price frozen in $86.7K-$88.2K purgatory. 24 hours until $28.5B options expiry that will either (A) unleash relief rally, or (B) trigger capitulation to $83K-$85K.

CRITICAL PARADOX: Stocks hitting records (S&P 500 ATH today), gold at $4,500+, yet crypto bleeding. This “risk-on for equities, risk-off for crypto” divergence is HISTORIC. Either crypto about to catch up (bullish), OR divergence widens further (bearish).

VanEck’s thesis: Current weakness TEMPORARY. BTC lagging 50% = OPPORTUNITY. 2026 top performer as liquidity returns and debasement accelerates. BUT: They also say 2026 = consolidation, not melt-up. Translation: Choppy range-bound year with vol, not parabolic rally.

The Christmas Gift We’re Actually Getting: Uncertainty. Tomorrow’s options expiry removes $28.5B in hedging pressure. Post-expiry, market finally FREE to move.

I. BREAKING HEADLINES & THE CHRISTMAS EVE FREEZE

1. BITCOIN FROZEN AT $86,770 - THE DEADEST TRADING DAY OF 2025

24-Hour Price Action: - Open (midnight EST): $87,400 - Asian Session: Drift to $87,000 - European Morning: Dead flat $86,800-$87,200 - US Pre-Market: $86,770 (current) - Volume: 40% below December average

Why NO ONE is Trading:

1. Christmas Eve Effect:

Institutional desks closed early or fully staffed with interns. No portfolio managers. No decision makers. Skeleton crews watching Bloomberg while wrapping gifts.

2. Options Expiry Tomorrow:

$28.5B ($23.6B BTC + $4.9B ETH) expires Thursday 8 AM UTC. NO ONE wants to take directional bets 24 hours before massive expiry. Wait for clarity.

3. Year-End Positioning Complete:

Funds closed books. Performance locked. Tax-loss harvesting done. No reason to trade.

4. Liquidity EXTINCT:

Normal daily volume: $50-60B. Today’s volume: $25-30B (estimate based on exchange data). When liquidity this thin, even small trades move markets violently. Smart money stays OUT.

The Technical Picture:

Current: $86,770 (lower end of December range)

Support: $86,500-$86,700 (Dec low, MUST HOLD or cascade)

Resistance: $88,000-$88,500 (multiple failed tests)

Max Pain (tomorrow): $96,000 (BTC $9,230 below = MASSIVE FAILURE)

True Trading Range: $85K-$90K (been here 3 weeks)

2. VANECK’S BOLD 2026 CALL - “BITCOIN WILL BE TOP PERFORMER”

The Bombshell:

VanEck (major asset manager, $89B AUM) released annual “Plan for 2026” report Dec 23. David Schassler (Head of Multi-Asset Solutions) makes stunning claim:

“Bitcoin is lagging the Nasdaq 100 Index by roughly 50% year-to-date, and that dislocation is setting it up to be a top performer in 2026.”

The Thesis:

1. Underperformance = Opportunity

2025 Results: - Nasdaq 100: +32% YTD

- Bitcoin: -6.8% YTD

- Gap: 38.8 percentage points

VanEck: This divergence is UNSUSTAINABLE. Historical pattern: When BTC lags Nasdaq THIS much, following year sees reversal.

2. Current Weakness is Temporary

Schassler: “Today’s weakness reflects softer risk appetite and temporary liquidity pressures, not a broken thesis. As debasement ramps, liquidity returns, and Bitcoin historically responds sharply. We have been buying.”

Translation: VanEck is ACCUMULATING Bitcoin during this dump. They see $87K as GIFT, not warning.

3. Gold to $5,000, Bitcoin Follows

VanEck predicts gold hits $5,000/oz in 2026 (from current $4,500). Bitcoin, as “digital gold,” will follow gold’s trajectory with leverage.

If gold $4,500 → $5,000 = +11%

Bitcoin $87K → ??? = potentially +50-100% given typical BTC/gold correlation with amplification

4. Debasement Accelerating

Schassler: “Funding future liabilities and political ambitions will increasingly rely on money printing, pushing investors toward scarce stores of value such as gold and Bitcoin.”

Fed will CUT rates in 2026 (consensus: 2-3 cuts). Fiscal spending continues. Debt spirals. Currency debasement = gold + Bitcoin rally.

Matthew Sigel’s Reality Check:

VanEck’s Head of Digital Assets Research Matthew Sigel tempers enthusiasm:

“Bitcoin’s historical four-year cycle, which tends to peak in the immediate post-election window, remains intact following the early October 2025 high. That pattern suggests 2026 is more likely a consolidation year than a melt-up or a collapse.”

Translation: 2026 WON’T be parabolic. It’ll be choppy consolidation. Think 2015, 2019—range-bound years that BUILT bases for next leg up.

The Numbers:

Realized Volatility: Dropped 50% from peak

Implied Drawdown: 40% (based on vol relationship)

Already Absorbed: 35% ($126K → $87K)

Remaining Risk: 5% more downside to fully match vol reset = $82K-$83K

VanEck’s Recommended Strategy:

“Disciplined 1-3% Bitcoin allocation, built through dollar-cost averaging. Add during leverage-driven dislocations. Trim into speculative excess.”

NOT “go all-in.” NOT “Bitcoin to $500K.” DISCIPLINED position sizing with DCA.

Why This Matters:

VanEck is MAJOR institutional player. They manage Bitcoin ETF (HODL). When they say “we have been buying” at $87K, that’s SIGNAL.

But they’re also HONEST—calling 2026 consolidation, not melt-up. This is sophisticated institutional thinking, not moonboy hopium.

3. HISTORICAL PATTERN - EVERY DOWN CHRISTMAS EVE RALLIES NEXT YEAR

The Benzinga Analysis:

Fascinating research published Dec 24 analyzing EVERY Christmas Eve when Bitcoin was down year-over-year. The results are STUNNING:

The Data:

2014 Christmas Eve:

- BTC Price: ~$320

- YoY Change: -56%

- 2015 Performance: +36%

- Following Peak (2017): +6,000%

2018 Christmas Eve:

- BTC Price: ~$3,800

- YoY Change: -72% (brutal bear market)

- 2019 Performance: +95%

- Following Peak (2021): +1,700%

2022 Christmas Eve:

- BTC Price: ~$16,800

- YoY Change: -64% (FTX collapse, bear bottom)

- 2023 Performance: +159%

- Following Peak (2024): +650%

2025 Christmas Eve (TODAY):

- BTC Price: $87,000

- YoY Change: -6.8%

- 2026 Performance: ??? - Following Peak: ???

The Pattern:

Average return following down Christmas Eves: +126.4%

Applied to 2025’s $87K: - Conservative (+50%): $130,000

- Average (+126%): $197,000

- Bullish (+159%): $225,000

Fundstrat’s Tom Lee: Maintains $200,000 target for early 2026, citing this exact historical pattern.

Why Down Christmas Eves Lead to Big Rallies:

1. Capitulation Complete:

By Christmas, weak hands already sold. Tax-loss harvesting done. Only strong hands remain.

2. Valuation Reset:

12 months of selling creates DEEP value. Risk/reward tilts massively bullish.

3. New Year Fresh Capital:

January brings new fiscal year for funds, bonus season for traders, tax refunds for retail. Fresh capital enters beaten-down asset.

4. Sentiment Extreme:

When Fear is extreme (currently 24), contrarian setups form. Maximum pessimism = maximum opportunity.

But Is This Time Different?

Bears Argue: - Previous down years were BRUTAL (-56%, -72%, -64%). This year only -6.8%. - Previous years had clear capitulation events (Mt. Gox, China ban, FTX). 2025 has no such event. - Previous years had NO institutional adoption. Now we have ETFs, which are OUTFLOWING. - Gold competition didn’t exist like this in previous cycles.

Bulls Counter: - -6.8% YTD BUT -30% from Oct peak. Magnitude of correction similar. - Capitulation isn’t always one event. Could be slow grind (MicroStrategy pause, ETF outflows, Q4 worst since 2018). - ETF outflows are SHORT-TERM. Structure remains (can reverse in 2026). - Gold correlation HELPS Bitcoin long-term as both benefit from debasement.

The Verdict:

Historical pattern is STRONG but not guaranteed. 3 for 3 on down Christmas Eves rallying next year. But sample size small, conditions evolve.

What IS certain: Bitcoin has NEVER failed to rally the year after a down Christmas Eve. That’s a fact. Whether 2026 breaks this 100% hit rate? We’ll know in 12 months.

For now, pattern suggests 2026 rally is HIGH probability, even if magnitude uncertain.

4. THE GREAT DIVERGENCE - STOCKS HIT RECORDS WHILE CRYPTO BLEEDS

The Paradox:

Christmas Eve 2025 Asset Performance:

RISK-ON (Rallying): - S&P 500: Hit INTRADAY ALL-TIME HIGH today

- Dow Jones: Near records

- Nasdaq: Up 2025, classic Santa rally

- Gold: $4,515+ (still near ATH)

- Bonds: Rallying (yields falling)

RISK-OFF (Dumping): - Bitcoin: -6.8% YTD, down -0.8% today

- Ethereum: -15% YTD, lost $3K

- Crypto Market Cap: $2.97T (-1.4% today)

- Altcoins: Broadly down (SOL, ADA, XRP all red)

THIS MAKES NO SENSE.

Classic financial theory: Risk-on = stocks + crypto rally. Risk-off = stocks + crypto dump, gold + bonds rally.

But Christmas Eve 2025: Risk-on for equities, risk-off for crypto.

What’s Happening:

Explanation 1 - Crypto-Specific Selling:

Year-end tax-loss harvesting. Investors selling crypto specifically for tax benefits, redeploying to stocks for year-end performance. Crypto = liquid 24/7, easy to sell.

Explanation 2 - Liquidity Divergence:

Stocks getting year-end fund inflows (pension rebalancing, bonus deployment). Crypto getting OUTFLOWS (ETF redemptions, institutional risk reduction).

Explanation 3 - Narrative Breakdown:

“Crypto as risk asset” narrative temporarily broken. Crypto trading as OWN asset class with own dynamics, decoupled from traditional risk-on/risk-off.

Explanation 4 - Options Pinning:

$28.5B options expiry tomorrow artificially suppressing crypto. Post-expiry, crypto free to catch up to stocks.

Bloomberg’s Take:

Syndicated column described Bitcoin as “pinned in $85K-$90K zone with thin trading volumes and fading retail speculation, even as U.S. stocks pushed into classic Santa rally.”

Translation: Stocks got Santa. Crypto got coal.

The Question:

Does crypto CATCH UP in 2026 (bullish convergence), or does divergence WIDEN (bearish decoupling)?

VanEck’s answer: Catch up. Stocks outperformed 2025, crypto outperforms 2026.

Bears’ answer: Crypto decoupled to downside. Institutional money staying in stocks.

5. 24 HOURS UNTIL $28.5B OPTIONS EXPIRY - THE FINAL COUNTDOWN

The Numbers (REVISED):

Initial reports said $27B. Now confirmed: $28.5 BILLION

Breakdown: - Bitcoin Options: $23.6B notional value

- Ethereum Options: $4.9B notional value (UP from initial $3.8B estimate)

- Total: $28.5B

Max Pain Levels:

Bitcoin: $96,000

Current: $86,770

Gap: -$9,230 (-9.6%)

Status: CATASTROPHIC FAILURE

Ethereum: $3,100

Current: $2,928

Gap: -$172 (-5.5%)

Status: Also failed

Put/Call Ratios:

Bitcoin: 0.38 (calls 2.6x puts)

Ethereum: Similar bullish skew

Translation: Traders bet HEAVILY on upside. They’re getting REKT.

What Happens Tomorrow:

8:00 AM UTC (3:00 AM EST): Options settle

Scenario A - Most Calls Expire Worthless:

Calls concentrated $100K-$116K. With BTC at $87K, these are DEEPLY out of money. Billions in call premium lost. Bulls crushed.

Scenario B - Puts Near Money:

$85K puts are close. If BTC at $86.8K at settlement, these puts VALUABLE. Bears profit.

Scenario C - Dealers Unwind Hedges:

If dealers were LONG spot BTC to hedge short calls, and calls now worthless, dealers may SELL spot. Could pressure BTC lower.

Post-Expiry Dynamics:

Immediately After (3 AM - 12 PM EST Thursday):

Price likely volatile as hedges unwind. Could spike either direction on low volume (Christmas Day).

Thursday Afternoon - Friday:

Market “free” from options pressure for first time in weeks. Natural price discovery resumes.

Three Outcomes:

1. Relief Rally (30%):

Expiry REMOVES downward pressure. Market exhales. BTC bounces to $90K-$93K. Year-end close positive.

2. Capitulation Dump (45%):

Expiry triggers dealer unwinds. BTC drops to $83K-$85K. Tests True Market Mean. Then stabilizes.

3. Nothing (25%):

Expiry happens, market shrugs. Stays $86K-$88K through year-end. Real move postponed to January.

Key Point: Expiry doesn’t GUARANTEE breakout. But it REMOVES mechanical pressure that’s been pinning price. Market finally free to move.

After 3 weeks of $85K-$90K purgatory, ANY directional move will feel like relief.

II. MARKET DATA & THE CHRISTMAS EVE FREEZE

KEY METRICS - CHRISTMAS EVE DEATH

Market Structure: - Total Crypto Market Cap: $2.97T (down -1.4% from Tuesday) - 24h Volume: ~$30B (estimate, 40% below average = DEAD) - BTC Dominance: 59.5% (rising as alts bleed worse) - Fear & Greed: 24 (EXTREME FEAR, unchanged) - Intraday Range: $86,700-$88,200 ($1,500 = 1.7%, TIGHTEST OF DECEMBER)

Derivatives - The Ticking Time Bomb: - Thursday Options Expiry: $28.5B ($23.6B BTC + $4.9B ETH) - BTC Max Pain: $96,000 (BTC $9,230 below) - ETH Max Pain: $3,100 (ETH $172 below) - Put/Call Ratio: 0.38 (bulls positioned WRONG) - Open Interest: Still elevated despite price dump - Funding: Slightly negative (bears paying longs)

ETF Carnage: - Recent Flows: Persistent OUTFLOWS

- Weekly Trend: Investors fleeing crypto into year-end

- Current AUM: ~$110B (down from $152B peak in July)

- MicroStrategy: Still ZERO purchases (holding 446,400 BTC)

Cross-Asset Comparison: - Nasdaq 100: +32% YTD (while BTC -6.8%)

- S&P 500: +24% YTD + hitting ATH today

- Gold: +72% YTD (from $2,600 to $4,515)

- Silver: +142% YTD (crushing everything)

- Bitcoin: -6.8% YTD (worst performer of “risk assets”)

III. ACTIONABLE TECHNICAL ANALYSIS - WAITING MODE

BITCOIN - $86,770 | The Christmas Eve Standoff

CURRENT STATUS:

Frozen. Dead. Comatose. Pick your metaphor. Bitcoin stuck in tightest range of December ($86.7K-$88.2K) as market waits for tomorrow’s $28.5B options expiry.

NO technical analysis matters today. Volume too thin. Participation too low. Movement too constrained.

What DOES matter:

OVERNIGHT (Dec 24-25):

Asian/European sessions may see minor movement but IGNORE it. Christmas Day internationally = even thinner liquidity than today. Any moves are noise.

TOMORROW MORNING (3 AM EST):

Options settle. THIS is when technical levels activate.

POST-EXPIRY TECHNICAL SETUP:

• SUPPORT - $85,000-$86,500 (THE FLOOR)

If breaks tomorrow post-expiry, cascade to $83K-$85K LIKELY. True Market Mean. Historical BoJ zone. Where BTC “should have” dropped but delayed. Breaking this = capitulation finally arrives.

• CURRENT - $86,770 (NEUTRAL PURGATORY)

Neither bulls nor bears in control. Just waiting. Post-expiry, this becomes launchpad either direction.

• RESISTANCE - $88,000-$90,000 (THE CEILING)

Failed 5x in past 10 days. Heavy selling stacked here. Post-expiry, if breaks $90K with volume, could squeeze to $93K-$95K quickly.

• MAX PAIN FAILED - $96,000 (THE DREAM DIED)

Was never realistic. Now confirmed impossible. Dealers who sold calls keep premiums. Dealers who hedged by buying spot may SELL tomorrow = downward pressure.

• BULL TARGET POST-EXPIRY - $90,000-$95,000

IF expiry removes pressure and relief rally triggers, first target $90K (reclaim), then $93K-$95K (year-end close). Probability: 30%.

• BEAR TARGET POST-EXPIRY - $83,000-$85,000

IF expiry triggers dealer unwinds and capitulation, drop to True Market Mean. Then stabilize and build base. Probability: 45%.

• CHOP TARGET - $86,000-$89,000

IF expiry is non-event, stay range-bound through year-end. Real move delayed to January. Probability: 25%.

ETHEREUM - $2,928 | The $3K Tease

ETH LOST $3,000 AGAIN:

Monday: Broke above $3K

Tuesday: Lost $3K

Wednesday: Dumped to $2,928

$3,000 psychological level has become BRICK WALL resistance.

Post-Expiry Levels: - Current: $2,928 (weak) - Resistance: $3,000 (failed repeatedly), $3,100 (max pain) - Support: $2,900 (thin), $2,850 (stronger) - Bear Target: $2,800 (if BTC fails $85K) - Bull Target: $3,100-$3,200 (if BTC rallies to $90K+)

ETH/BTC Dynamics:

ETH following BTC but with WORSE performance. Classic late-cycle behavior = bearish for alts. When ETH underperforms in dumps, entire altcoin market suffers.

$4.9B ETH options expire tomorrow. Max pain $3,100. ETH at $2,928 = also failed. Similar dynamics to BTC.

TRADER’S PLAYBOOK - CHRISTMAS EVE/DAY SURVIVAL

TODAY (Christmas Eve - Dec 24):

Close your laptop.

Spend time with family.

Enjoy Christmas Eve dinner.

Today’s movement doesn’t matter. Volume too thin. Range too tight. Decision point is TOMORROW.

TOMORROW (Dec 25 - Christmas Day + Options Expiry):

3:00 AM EST: Options settle (most of us will be sleeping)

Morning (6 AM - 12 PM):

- Check price when you wake up

- Assess where we are:

- $83K-$85K = capitulation happened

- $86K-$89K = nothing happened

- $90K-$93K = relief rally triggered

Afternoon (12 PM - EOD):

- IF $83K-$85K: Prepare to BUY 40% (capitulation opportunity)

- IF $86K-$89K: WAIT (no clarity yet, stay patient)

- IF $90K-$93K: Consider 20% add (relief rally confirmation)

FRIDAY (Dec 26 - Boxing Day):

Market should have direction by now. Year-end close positioning. Follow Friday’s playbook based on Thursday’s outcome.

Happy Holidays REKT Fam!

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.