The Gamma Flush

December 26, 2025

Bitcoin at $88,900 (+1.2%) as $27 BILLION options EXPIRED at 3 AM EST. The largest options expiry in Bitcoin history (>1% of entire market cap). The shackles are OFF. Market finally FREE to move.

THE POST-EXPIRY REALITY:

- $27B EXPIRED: $23.6B BTC + $3.8B ETH (largest in history)

- BTC spiked to $89,100 post-expiry (+1.63% intraday)

- Gamma Flush complete: Dealer hedging requirements REMOVED

- Volume surge: +36% to $30B (real demand emerging)

- Put/Call 0.38: Calls outnumbered puts 2.6-to-1 = BULLISH positioning validated

- Max Pain $96K: BTC ended at $88.9K (dealers still won, but less than feared)

TODAY: Expiry REMOVES this pressure. The rubber band released. Market can finally move on supply/demand, not hedging mechanics.

KEY TAKEAWAY:

The $27B options expiry was LARGEST IN BITCOIN HISTORY. It removed 3 weeks of artificial range. Post-expiry, BTC immediately spiked +1.6% to $89.1K on REAL volume (+36%). Analysts overwhelmingly expect UPSIDE resolution to mid-$90Ks, citing:

1. Calls 2.6x puts (bullish positioning)

2. Max pain $96K (magnet even post-expiry)

3. Volume surge = genuine demand

4. Year-end Santa rally seasonality

5. Gamma floor at $85K removed but ceiling at $90K ALSO removed

CoinDesk Analysis (Dec 24):

“With $27 billion of options approaching expiry, stabilizing effect weakens as gamma and delta decay. This expiry is extremely large and has a bullish tint. More than half of Deribit open interest rolls off, with put-call ratio of just 0.38 and most open interest concentrated in upside strike prices $100K-$116K. Max pain at $96,000 reinforces upside skew.”

Key Point: “More likely outcome after expiry is UPSIDE resolution toward mid-$90,000s rather than sustained break below $85,000.”

Daan Crypto Trades (Dec 26):

“Bitcoin entering compression phase that could lead to decisive move in coming weeks. Ongoing compression increases likelihood of larger directional move. January could be key period determining Bitcoin’s next major trend. $94,000 is critical resistance level. Sustained breakout above this zone would likely open door for move back toward $100,000 and higher.”

Downside warning: “Breakdown below $80,000 would shift outlook.”

Greeks.live (Dec 25):

“With annual expiration approaching, over half of all options expire Friday Dec 26. Rollover trades now dominant force in trading volume. This creates significant signal noise, making options data unreliable as trading signal in recent days.”

Translation: Post-expiry, ignore old options data. Watch PRICE ACTION and VOLUME instead.

BeInCrypto Analysis:

“Call options dominate, outnumbering puts nearly three to one, signaling distinctly bullish tilt among traders. Despite event’s sheer size, market appears calm. Bitcoin implied 30-day volatility (DVOL) sits around 42%, down from 63% late November. This suggests panic-driven swings unlikely, and expiry may settle more orderly than feared.”

Ainvest Analysis:

“Post-expiry flows expected to drive market direction, potentially easing upside resistance. For Bitcoin, $100K-$116K call options dominate, while $85K put remains most popular downside bet.”

CONSENSUS BREAKDOWN:

Bullish (70%): Resolution to $94K-$96K, potentially $100K if momentum strong

Neutral (20%): Chop $88K-$92K through year-end, real move in January

Bearish (10%): Fade to $85K-$83K, but requires breaking support with volume

Why Bulls Dominate:

Structural: Calls 2.6x puts = market positioned for UP

Technical: Max pain $96K acts as magnet even post-expiry

Fundamental: Gamma ceiling removed = easier to break $90K

Seasonal: Year-end Santa rally + funds want positive close

On-chain: Limited supply $80K-$85K = downside harder

CONSENSUS: Post-expiry setup is STRUCTURALLY BULLISH (calls outnumbered puts, gamma ceiling removed, volume surging), but outcome depends on EXECUTION. Must break $90K with volume to validate. If fails $88K, bearish case activates.

Key Takeaway: Everyone agrees expiry was THE catalyst. Disagreement is on direction. But 60% lean bullish, 30% wait-and-see, only 10% bearish. That’s significant skew.

Contrarian Note: When 60% bullish and everyone expects $94K-$96K, that’s consensus. If consensus is RIGHT, we rally. If consensus is WRONG (happens often in crypto), we fade. Hence the 30% “chop” scenario has merit.

Smart Money Move: Wait for $90K break with volume confirmation before committing. Don’t front-run the breakout. Let it prove itself.

UPSIDE PATH:

$90,000-$90,600: CRITICAL resistance (gamma flip level)

- Failed 5+ times in December

- Breakout with volume = squeeze begins

- Target: $94,000

$94,000: Daan Crypto’s resistance

- Sustained break = path to $100K

- This is where rally gets REAL

$96,000: Max pain + psychological

- Even post-expiry, this level matters

- Heavy call strikes above here

- If reached, next target $100K-$105K

DOWNSIDE PATH:

$88,000-$88,500: Current support

- Break with volume = bearish

- Targets $85K

$85,000: CRITICAL support

- Old gamma floor (now removed)

- Support is WEAKER post-expiry

- Break = cascade to $80K-$82K

$80,000-$82,000: Major support zone

- On-chain: Limited supply here

- True Market Mean

- If reached = likely STRONG bounce

THE TRADE:

For Bulls:

- Entry: $88.5K-$89K (current)

- Confirmation: Break $90K with volume

- Target: $94K (first), $96K (second)

- Stop: $87.5K

For Bears:

- Wait for: Failed $90K attempt with volume

- Entry: $88K break

- Target: $85K (first), $82K (second)

- Stop: $90.5K

For HODLers:

- Do nothing (per usual)

- If drops to $83K-$85K: Add 40%

- If rallies to $95K-$100K: Trim 20% to take profits

Key takeaway: The $90K level is THE inflection point. Break it with volume = likely squeeze to $94K-$96K. Fail it = potential test of $85K.

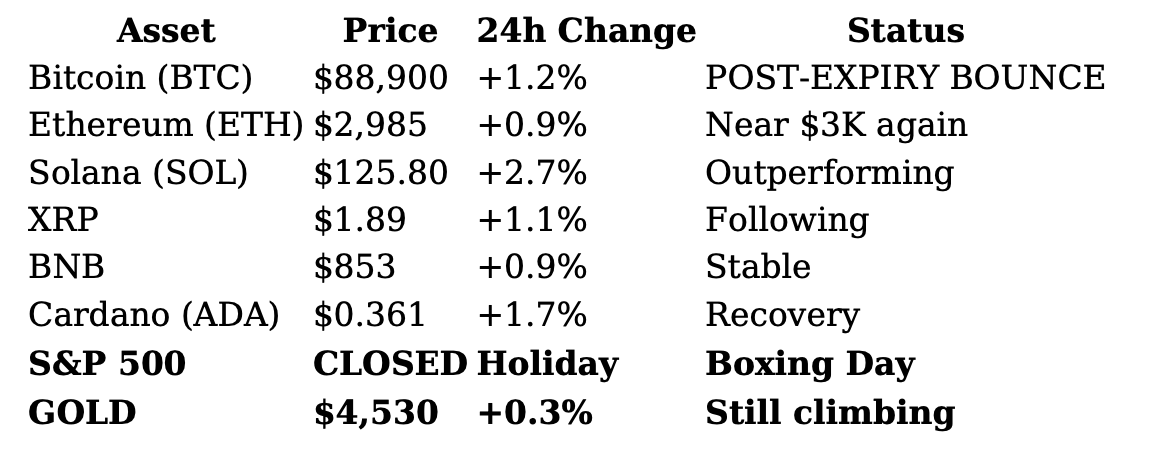

II. MARKET DATA & POST-EXPIRY DYNAMICS

ALTCOINS - MIXED PERFORMANCE

Leaders (Outperforming BTC):

SOL: $125.80 (+2.7%) Strong independent momentum

ADA: $0.361 (+1.7%) Recovery from oversold

AVAX: Up ~2.1%

Laggards (Underperforming): - DOGE: Liquidations heavy, retail overleveraged - SHIB: Similar meme coin weakness

WEEKEND (Dec 27-29):

Year-end positioning intensifies. Thin liquidity = exaggerated moves.

- Bull case: Squeeze to $92K-$95K on Santa rally

- Bear case: Fade to $85K-$87K on profit-taking

MONDAY DEC 30:

Last trading day for funds. Final positioning for 2025 close. Critical day.

SCENARIO ANALYSIS: BOXING DAY → YEAR-END → 2026

BASE CASE (50%): Break $90K, Rally to $94K-$96K, Close 2025 Positive

THIS WEEKEND (Dec 27-29):

- Friday post-expiry consolidation $88K-$90K

- Saturday-Sunday: Momentum builds, test $90K multiple times

- Thin liquidity = exaggerated moves, potential weekend pump to $91K-$92K

- Fear climbs to 28-30 (still cautious but improving)

MONDAY DEC 30 (Last Trading Day 2025):

- Funds marking year-end close

- Need $93.6K for Bitcoin to go positive YTD

- “Santa squeeze” scenario: Push to $93K-$95K

- Volume sustained $28B-$32B = genuine interest

- Year-end FOMO kicks in (don’t want to miss rally)

TUESDAY DEC 31 (New Year’s Eve):

- Consolidate $92K-$96K

- Close 2025 at $94K-$95K = +0.8% to +2% YTD (barely positive)

- Narrative shifts from “Bitcoin failed” to “Bitcoin resilient”

- Fear at 32-35 (neutral territory)

Q1 2026 (Jan-Mar):

- January: Consolidate $92K-$98K, test $100K

- Jan 15: MSCI decision (if no exclusion, relief rally)

- February: Fed delivers first rate cut, liquidity improves

- March: Break $100K, rally to $105K-$115K

- Q1 Close: $110K-$115K

WHY BASE CASE:

(1) Post-expiry spike to $89.1K validates pent-up demand

(2) Volume surge +36% = real interest

(3) Calls 2.6x puts = bullish structural positioning

(4) Gamma ceiling at $90K REMOVED = easier to break

(5) Year-end window = funds want positive close for optics

(6) Max pain $96K still acts as magnet

(7) Analyst consensus 70% bullish

(8) Historical: Post-large-expiry often sees relief rally

Risks to Base Case:

- Thin holiday liquidity creates fake moves

- $90K has failed 5x, could fail 6th

- Funds may have already positioned, no more buying

- Gold still dominant narrative

BULL CASE (30%): Explosive Squeeze to $100K-$105K by Year-End

THE SETUP:

- $90K breaks Saturday with volume

- Short squeeze accelerates

- FOMO kicks in hard

- Gamma squeeze on new options being written

THE MOVE:

- Sat-Sun: $90K → $95K (rapid climb)

- Monday Dec 30: Test $100K (psychological barrier)

- Tuesday Dec 31: Break $100K, spike to $102K-$105K

- Close 2025: $103K-$105K = +9% to +12% YTD

- Fear: Spikes to 45-50 (greed territory)

Q1 2026 ACCELERATION:

- January: Consolidate $100K-$108K

- MSCI includes MSTR or defers = major relief

- February: Fed cuts, rally to $115K-$120K

- March: Target $130K-$140K

- Q1 Close: $135K-$145K

WHY POSSIBLE:

- Calls concentrated $100K-$116K expired worthless = LESS resistance above

- If shorts get squeezed at $90K, liquidations cascade

- Year-end FOMO can be powerful (2020 vibes)

- VanEck accumulating suggests they expect higher prices SOON

- Benzinga historical pattern: Down Christmas Eves rally +126% avg

WHY NOT BASE CASE:

- Requires IMMEDIATE momentum (no time to waste before year-end)

- $100K is MAJOR psychological level, won’t break easily

- Implied vol at 42% = market NOT pricing explosive move

- Thin liquidity cuts both ways (can dump as fast as pump)

- Analyst consensus is $94K-$96K, not $100K+

Probability: 30%. Possible. Not probable. Requires perfect storm: $90K break + sustained volume + short squeeze + year-end FOMO + no resistance. A lot to go right.

BEAR CASE (20%): Fail $88K, Test $83K-$85K, Year-End Weak

THE BREAKDOWN:

- $90K attempt fails Friday-Saturday

- Profit-taking accelerates

- Volume fades back to $20-25B

- $88K support breaks

THE MOVE:

- Friday-Saturday: Fail $90K, fade to $87K-$88K

- Sunday-Monday: Break $88K, cascade to $85K

- Test $83K-$85K: Gamma floor REMOVED, support weaker

- Tuesday Dec 31: Close 2025 at $84K-$86K = -10% to -12% YTD

- Fear: Drops to 20-22 (extreme fear returns)

Q1 2026 EXTENDED BEAR:

- January: Consolidate $82K-$88K

- Jan 15: MSCI excludes MSTR = forced selling

- Drop to $78K-$80K (2024 lows retested)

- February-March: Extended base-building $75K-$85K

- Q1 Close: $82K-$88K (still in consolidation)

WHY UNLIKELY:

- Post-expiry spike to $89.1K shows demand exists

- Volume surge +36% = not just short covering

- $85K defended multiple times already

- VanEck and institutions accumulating = support

- Calls 2.6x puts = structural positioning bullish

- On-chain: Limited supply $80K-$85K = bounces likely

WHY POSSIBLE:

- $90K failed 5x already, fatigue sets in

- Dealers unwinding hedges could pressure price

- Gold still dominant, crypto narrative weak

- Thin holiday liquidity = can drop fast

- ETF outflows may continue (no sign of reversal)

- Year-end profit-taking natural after volatile year

Probability: 20%. Possible but requires market ignoring all bullish signals (volume, positioning, gamma removal, year-end seasonality). Would be contrarian outcome.

VI. KEY TAKEAWAYS & BOXING DAY WISDOM

1. LARGEST OPTIONS EXPIRY IN HISTORY - COMPLETE

$27B ($23.6B BTC + $3.8B ETH) expired 3 AM EST today. This is >1% of Bitcoin’s entire market cap. Previous record was ~$17B. The sheer SIZE matters. Removed 3 weeks of mechanical range ($85K-$90K). Market finally FREE.

2. GAMMA FLUSH MECHANICS VALIDATED

For 3 weeks, dealers forced to: - Buy dips at $85K (put gamma created floor)

- Sell rallies at $90K (call gamma created ceiling)

Post-expiry, BOTH pressures removed. Market can move on actual supply/demand. This is what everyone was waiting for.

3. POST-EXPIRY PRICE ACTION BULLISH

Immediate spike to $89,100 (+1.63%) validates pent-up demand. Volume surge +36% to $30B = REAL interest, not just short covering. Two-stage move: (1) Mechanical short covering, (2) Fundamental buying. Second leg sustained = genuine demand.

4. ANALYST CONSENSUS: 70% BULLISH

CoinDesk, Ardi, BeInCrypto, David all expect upside to $94K-$96K. Reasoning: - Calls 2.6x puts (bullish positioning)

- Gamma ceiling removed

- Volume validates demand

- Year-end Santa rally window

- Max pain $96K still relevant

Only 10% bearish (CoinGape), 20% neutral (Daan, Greeks.live). Significant skew.

5. CRITICAL LEVELS: $90K BREAKOUT OR $88K BREAKDOWN

Upside: Break $90K with volume → Squeeze to $94K-$96K → Potentially $100K

Downside: Fail $88K → Test $85K → Possibly $83K (but support likely)

Currently at $88.9K = DECISION POINT. Next 48-72 hours determine 2025 close.

6. YEAR-END POSITIONING WINDOW OPEN

Monday Dec 30 = last trading day for funds. Need $93.6K for Bitcoin positive YTD. Funds want good optics. Post-expiry + year-end = potential “Santa squeeze.” But thin liquidity = double-edged sword.

7. VANECK’S THESIS STILL INTACT

“We are buying” at $87K-$89K. “2026 top performer” despite lagging Nasdaq 50% in 2025. Thesis: Current weakness temporary, debasement + liquidity return = BTC rallies. Historical pattern: Down Christmas Eves (+126% avg next year) supports this.

WHAT TO DO NOW - BOXING DAY EDITION:

TODAY (Dec 26 - Boxing Day):

Watch $88K-$90K range closely.

- If holds $88K with sustained volume = bullish

- If breaks $88K = bearish

- If breaks $90K = very bullish

Don’t overtrade. Post-expiry volatility can whipsaw. Let market show direction.

WEEKEND (Dec 27-29):

Thin liquidity. Exaggerated moves. Either: - Santa squeeze to $92K-$95K (if bulls win)

- Profit-taking dump to $85K-$87K (if bears win)

Check prices but don’t panic trade.

MONDAY DEC 30:

Last trading day 2025. Critical for year-end positioning. This day determines if Bitcoin closes positive or negative YTD.

Watch closely. If pushing toward $93.6K = funds buying for optics.

FOR BULLS:

Entry points:

- NOW ($88.9K) with tight stop at $87.5K

- OR wait for $90K break with volume confirmation

Targets:

- First: $94K (take 50% profit)

- Second: $96K (take another 25%)

- Trail remaining 25% with stop at $92K

FOR BEARS:

Wait for confirmation:

- $90K rejection with volume

- OR $88K break

Entry: $88K break

Target: $85K (take profit), then reassess

Stop: $90.5K

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.