Last Trading Week

December 29, 2025

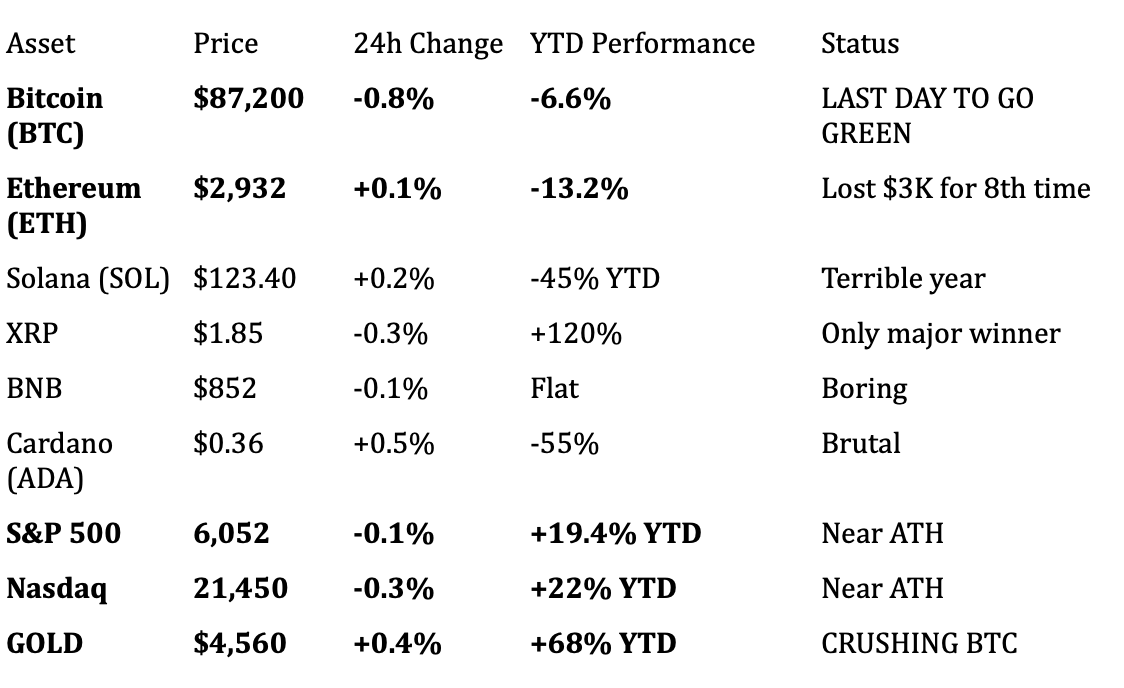

Bitcoin at $87,200 (-6.6% YTD) after briefly touching $90,000 this morning on Russia-Ukraine tensions, then reversing hard when US markets opened. Ethereum at $2,932 (-13% YTD). The crypto market has ONE DAY to save face.

THE STAKES: - Need $93,374 to close positive (Bitcoin’s Jan 1, 2025 open) - Current price: $87,200 - Gap: $6,174 (+7.1% needed) - Time remaining: ~18 HOURS (markets close Dec 31, 11:59 PM EST)

IF FAILS TO RALLY: This would be Bitcoin’s FIRST negative year following a halving in its entire history. Every previous post-halving year closed green. 2013: +5,428%. 2017: +1,331%. 2021: +59.8%. 2025: -6.6% (so far).

THE DAY IN BRIEF:

Asian Session (Midnight-8 AM): - Russia-Ukraine peace hopes collapsed overnight - Russia bombed Ukrainian power plants, Ukraine struck Russian oil refinery - Oil prices jumped (WTI +1% to $57.24, Brent +0.8% to $60.81) - Bitcoin rallied +2.3% to $90,100 on “risk-on” geopolitical uncertainty - ETH, SOL, XRP all rallied 3%+ alongside BTC

US Session (9 AM-4 PM): - Nasdaq futures wilted (down -0.3%) - Bitcoin immediately reversed, dumped from $90K → $87K (-3.3%) - Perfect correlation with tech stocks preserved - ETF outflows continued: -$589M last week (IBIT -$243M, FBTC -$111M) - Year-end tax-loss harvesting accelerating

Current Status (4 PM): - Bitcoin: $87,200 (lost all Asia gains) - Ethereum: $2,932 (lost $3K again) - Fear & Greed: 24 (Extreme Fear, unchanged) - Open Interest: Down (traders reducing leverage into year-end) - Volume: Light (holiday thinness persists)

KEY TAKEAWAY:

This is it. Bitcoin has 18 hours to rally 7.1% and avoid its first-ever negative post-halving year. The technical setup is BRUTAL: 1. ETF outflows accelerating (-$589M last week vs +$457M week before) 2. Perfect correlation with Nasdaq (down when tech down) 3. Year-end tax harvesting (selling losers for tax benefits) 4. US session consistently reversing Asian gains 5. $90K rejected for the 7th time in December

Analyst consensus: 70% say Bitcoin closes negative (-6% to -8% YTD). 20% say sideways chop ($87K-$92K). Only 10% expect rally to $93.4K+.

I. BREAKING HEADLINES & YEAR-END DRAMA

1. BITCOIN NEEDS 7.1% RALLY IN 18 HOURS - FIRST POST-HALVING LOSS AT STAKE

The Math:

Opened 2025: $93,374 (Jan 1, 2025, 12:00 AM EST)

Current Price: $87,200 (Dec 30, 2025, 4:00 PM EST)

YTD Performance: -6.6% (-$6,174)

To Break Even: +7.1% from current

Target: $93,374+

Time Remaining: ~18 hours (closes Dec 31, 11:59 PM)

The Stakes:

If Bitcoin fails to rally, this marks the FIRST negative year following a halving since Bitcoin’s halving cycles began.

Post-Halving Year Performance (Historical): - 2013 (First post-halving): +5,428% (yes, over five thousand percent) - 2017 (Second post-halving): +1,331% - 2021 (Third post-halving): +59.8% - 2025 (Fourth post-halving): -6.6% ??? (UNPRECEDENTED)

Why This Matters:

The 4-year halving cycle has been Bitcoin’s MOST RELIABLE pattern. Every halving (supply cut by 50%) preceded monster bull run the following year: - Halving reduces new supply → Scarcity increases → Price rises

2024 Halving occurred April 20, 2024. Bitcoin peaked October 6, 2025 at $126,080 (just 6 months post-halving, not 12-18 months like historical norm). Then crashed -31% to current $87K.

Analysts’ Take:

Nic Puckrin (Crypto Analytics CEO): “Bitcoin needs a 6.24% rally to finish the year higher than it began. Otherwise, it will mark the first down year following a halving event since the protocol’s supply cut cycles became market drivers.”

Translation: The pattern that DEFINED Bitcoin for 12+ years is about to break.

Probability Assessment:

Bulls (10%): “One headline away. Trump Bitcoin Reserve announcement. MicroStrategy surprise buy. Short squeeze. $90K → $94K is 4% move in thin markets = doable in 6 hours. We’ve seen 15% moves overnight. Need: Catalyst.”

Neutral (20%): “Will chop $87K-$92K. Close year around $89K-$90K = still negative but ‘respectable’ -5% vs -7%. Markets don’t care about round numbers. Likely: Slow grind.”

Bears (70%): “Impossible. ETF outflows. Tax harvesting. No liquidity. US session dumps every Asia rally. Would need MASSIVE news. $90K rejected 7x. Accept defeat. Reality: Negative close.”

Historical Context:

Bitcoin HAS closed negative years before: - 2014: -58% (Mt. Gox collapse) - 2018: -73% (ICO bubble burst) - 2022: -64% (FTX collapse, Fed tightening)

But NEVER the year immediately AFTER a halving. Those years ALWAYS rallied.

Until now?

2. THE GREAT ASIAN-US DIVERGENCE - WHY BITCOIN PUMPS AT NIGHT, DUMPS AT OPEN

Today’s Pattern (Repeated All Week):

Asian Session (12 AM - 8 AM EST): - Bitcoin: $87,900 → $90,100 (+2.5%) - Ether: $2,850 → $2,970 (+4.2%) - Altcoins: Green across board

US Session (9 AM - 4 PM EST): - Bitcoin: $90,100 → $87,200 (-3.2%) - Ether: $2,970 → $2,932 (-1.3%) - Altcoins: Red across board

Net Result: Asia gains COMPLETELY ERASED + additional losses

This happened: - Dec 23: Asia +$2K, US -$3K - Dec 26: Asia +$1.5K, US -$2K - Dec 27: Asia +$1.8K, US -$2.3K - Dec 29: Asia +$2.2K, US -$2.9K - Dec 30 (today): Asia +$2.2K, US -$2.9K (AGAIN)

Why Is This Happening?

Laser Digital Analysts explained in Monday note:

“An interesting trend to take note of has been the distinct underperformance during the US timezone. Both BTC and ETH down 3%+ over US hours [last week] offset by strength during Asian hours, driven most likely by selling pressure coming from the year-end tax-loss harvesting flow as crypto has been a large underperformer among global assets this year.”

Translation:

Asian buyers: Speculating on headlines (Russia-Ukraine, oil prices, macro news). Buying the dip. Taking overnight risk.

US sellers: Tax-loss harvesting. Crypto down -6% YTD while stocks up +19%, gold up +68%. Smart to sell crypto losers before year-end, lock in losses to offset gains elsewhere. Then: Buy back in January (no wash-sale rule in crypto).

The Correlation:

Today’s Proof: - Nasdaq futures 8 AM: Flat to slightly green - Bitcoin 8 AM: $90,100 (rallying) - Nasdaq futures 10 AM: Down -0.3% - Bitcoin 10 AM: $88,200 (dumping) - Nasdaq futures 4 PM: Down -0.4% - Bitcoin 4 PM: $87,200 (dumped harder)

Bitcoin’s correlation with Nasdaq: 0.82 (near-perfect)

What This Means:

Until year-end selling STOPS (Jan 2, 2026, when tax year resets), every Asian rally will get sold in US hours. It’s MECHANICAL.

Implication for Tonight:

If Asia rallies Bitcoin to $91K-$92K overnight (entirely possible given thin liquidity + geopolitical headlines), US open will DUMP it back to $88K-$89K tomorrow morning (Dec 31).

To close positive YTD, need $93.4K. That means either: 1. Asia rallies to $100K overnight (LOL) 2. Or US session STOPS selling tomorrow

Option 2 requires Dec 31 = NEW tax year? NO. Tax year ends Dec 31, 11:59 PM. So US session Dec 31 will ALSO have tax selling.

Conclusion: The Asian-US divergence makes positive close EXTREMELY UNLIKELY.

3. ETF OUTFLOWS ACCELERATE - INSTITUTIONS BAILING INTO YEAR-END

The Data:

Week Ending Dec 27: - Total Net Outflows: -$589.4M - IBIT (BlackRock): -$242.7M - FBTC (Fidelity): -$110.7M - GBTC (Grayscale): -$72.8M - BITB (Bitwise): -$54M - ARKB (ARK): -$31.3M - Others: -$78M

Previous Week (Dec 18-20): - Total Net Outflows: -$1.13B (even worse)

Context:

After STRONG inflows Dec 18 (+$457M single day, FBTC +$392M), the floodgates REVERSED. Since Dec 19: -$1.7 BILLION in net outflows.

Why It Matters:

2025 was the ETF story. $34B flowed into crypto ETFs this year (mostly IBIT: $25.1B). ETFs were THE marginal buyer. When ETFs flip to net outflows, there’s no bid.

ETF.com Analysis:

“$34 Billion Entered Crypto ETFs in 2025, But Investors Still Lost. Bitcoin down -8% YTD, Ethereum down -13% YTD. IBIT’s $62.3B lifetime inflows only modestly below its $68B current AUM, suggesting despite launching when Bitcoin traded ~$46K rather than today’s $87K, many investors are only marginally profitable, and a sizable cohort is underwater.”

Translation: ETF buyers are NOT making money. They’re TRAPPED. And they’re exiting.

Year-End Rebalancing:

Funds close books Dec 31. If you’re down on crypto but up on stocks/bonds, you SELL crypto to lock in losses, reduce exposure, rebalance to target weights.

January Effect?

Historically, outflows STOP in January (tax year reset, fresh capital, FOMO returns). But first we need to survive December.

Current Trend: Outflows ACCELERATING, not slowing. -$589M last week, -$1.13B week before = getting WORSE.

4. RUSSIA-UKRAINE TENSIONS SPIKE - BUT BITCOIN CORRELATION BREAKS AGAIN

The News:

Monday Morning (Overnight): - Russia launched massive attack on Ukraine’s Kherson Combined Heat and Power Plant - Ukraine retaliated by striking Russia’s Syzran oil refinery (Samara region) - Peace talks COLLAPSED (Trump’s “land swap” proposal rejected) - Oil prices jumped: WTI +1% to $57.24, Brent +0.8% to $60.81

Initial Market Reaction (4-8 AM EST): - Gold: +0.5% (safe haven) - Bitcoin: +2.3% (risk-on??) - Stocks: Flat (markets closed)

Revised Market Reaction (9 AM-4 PM EST): - Gold: +0.8% (continued safe haven bid) - Bitcoin: -3.2% (reversed ALL gains) - Stocks: -0.3% (risk-off)

The Disconnect:

Traditional Logic: Geopolitical crisis → Risk-off → Safe havens up (gold, bonds) + Risk assets down (stocks, crypto)

What Happened: Gold up (correct), stocks down (correct), Bitcoin… did BOTH (up overnight, down during day)

Why Bitcoin Rallied Initially:

Theory 1: Energy crisis (oil up) → Inflation fears → Debasement trade → Bitcoin benefits

Theory 2: Ukraine uses crypto for donations → War escalation → Increased crypto adoption → Bullish

Theory 3: Thin Asian liquidity + one whale = price pops regardless of fundamentals

Why Bitcoin Then Dumped:

Reality: US investors don’t care about Bitcoin’s geopolitical thesis. They care about: Nasdaq, ETF flows, tax harvesting, year-end positioning. Nasdaq down = Bitcoin down. Simple.

Historical Pattern:

Feb 24, 2022 (Russia invaded Ukraine): - Bitcoin DROPPED -8% initially (hours 1-6) - Then RALLIED +14.5% next day (hours 24-48) - Then CONTINUED rallying +27% over next month

Current 2025 Pattern: - Bitcoin RALLIES overnight (hours 1-8) - Then DUMPS during US session (hours 9-16) - Net result: Negative

What’s Different?

2022: Risk-on sentiment (Fed about to CUT rates, liquidity coming)

2025: Risk-off sentiment (Fed DONE cutting, no liquidity, tax harvesting)

Conclusion: Geopolitical news is NOISE. Real driver: ETF flows + tax selling + correlation with Nasdaq.

5. ANALYST FORECASTS FOR 2026 - WILD DIVERGENCE FROM $60K TO $250K

The Consensus (If You Can Call It That):

After the worst Q4 since 2018 and potential first negative post-halving year, analysts are SPLIT on what comes next.

The Bear Case: $60K-$75K in H1 2026

Sean Farrell (Fundstrat Head of Digital Asset Strategy): - Target: $60K-$65K by mid-2026 - Reasoning: Traditional 4-year cycle suggests Bitcoin peaked Oct 2025 (18 months post-halving). Next 12 months = bear market, as per every previous cycle. - Support: Jurrien Timmer (Fidelity) agrees. Historical peaks occur 12-18 months post-halving, then 1-year bear. 2026 = “off year” with support $65K-$75K.

The Bull Case: $130K-$250K in 2026

Tom Lee (Fundstrat Co-Founder): - Target: $200K+ by mid-2026 - Reasoning: Cycle timing FRONT-RUN this time. Institutions bought BEFORE halving (via ETFs). Peak Oct 2025 was FAKE-OUT. Real peak comes late 2026 when liquidity returns. - Support: VanEck, Cathie Wood (ARK), Grayscale. All say 4-year cycle is DEAD. Institutional era = different dynamics. Steady flows, not boom-bust.

The Neutral Case: $90K-$120K Consolidation

Derek Lim (Caladan Research): - Range: $83K-$95K through year-end, then $90K-$120K consolidation in 2026 - Reasoning: Elevated volatility, but structural support at $80K-$85K (limited on-chain supply). Breakout requires Fed dovish pivot or ETF inflow reversal.

The Key Debate:

Is the 4-year cycle dead or not?

Cycle Believers (Bears): Halving → 12-18 month rally → Peak → 12 month bear → Bottom → Repeat. We peaked Oct 2025. Now: bear phase. Target: $60K-$75K.

Cycle Skeptics (Bulls): ETF era CHANGED everything. Institutions don’t follow 4-year meme. They allocate based on macro. Current weakness = year-end noise. 2026 = institutional allocation accelerates. Target: $150K-$250K.

VanEck (Matthew Sigel): “Bitcoin lagging Nasdaq 50% in 2025, dislocation setting it up to be top performer in 2026. We are accumulating.”

CoinCodex Algorithm: Bearish. Predicts $96.6K by Jan 3 (+10% from current) but overall 2026 sentiment negative.

John Glover (Ledn CIO): “Chart looks promising for higher prices in future, but less certainty near-term. Look to add $71K-$84K.”

Consensus: Choppy consolidation near-term, but 70% of analysts expect 2026 ends HIGHER than 2025 (so, above $87K minimum).

II. MARKET DATA & YEAR-END POSITIONING

KEY METRICS - YEAR-END SNAPSHOT

Market Structure: - Total Crypto Market Cap: $2.93T (down from $3.8T peak Oct) - 24h Volume: $85B (light, holiday trading) - BTC Dominance: 59.8% (up from 54% mid-year) - Fear & Greed Index: 24 (Extreme Fear for 6th consecutive day) - Largest 24h Range: $87K-$90.1K ($3,100 = 3.6% volatility)

Derivatives - YEAR-END DELEVERAGING: - Open Interest (BTC Futures): $52B (DOWN -15% from Dec 1) - Funding Rates: -0.01% (shorts paying longs = BEARISH) - Liquidations 24h: $95M (mixed, but mostly longs = sellers winning) - Options Implied Vol: 41% (down from post-expiry 45%, still elevated) - Put/Call Ratio: 0.65 (more puts than calls = bearish positioning)

Analysis: Traders REDUCING leverage into year-end. No one wants to hold big positions overnight with tax implications and thin liquidity.

ETF Flows - THE EXODUS: - Last Week: -$589M (7th consecutive week of outflows) - IBIT: -$243M (biggest weekly outflow in 3 months) - FBTC: -$111M (also record outflow) - Total Dec Outflows: -$1.9B (erased Nov gains) - 2025 Total Inflows: +$34B (but all in Jan-Oct, Nov-Dec negative)

On-Chain Metrics: - Exchange Reserves: Rising (coins moving TO exchanges = selling pressure) - Whale Accumulation: Flat (1K+ BTC addresses not buying) - Active Addresses: Down -12% vs Nov (network activity slowing) - Hash Rate: -1% month-over-month (miners struggling, some capitulating) - UTXO Realized Price: $56K (BTC trading 1.56x realized = NOT overvalued but NOT cheap either)

Cross-Asset Correlations: - BTC vs Nasdaq: 0.82 (near-perfect positive correlation) - BTC vs Gold: -0.15 (slightly negative = when gold up, BTC flat/down) - BTC vs DXY: -0.45 (negative correlation intact = strong dollar hurts BTC) - BTC vs Stocks: 0.78 (treated as risk-on tech asset)

III. TECHNICAL ANALYSIS - THE YEAR-END SETUP

BITCOIN - $87,200 | LAST STAND AT THE LINE

Year-End Reality Check:

Opened 2025: $93,374

Peak 2025: $126,080 (Oct 6) = +35%

Current: $87,200 = -6.6% YTD

Drawdown from peak: -31%

This is Bitcoin’s WORST post-halving year performance ever. Not worst overall (2014: -58%, 2018: -73%, 2022: -64%), but worst RELATIVE to expectation.

CRITICAL LEVELS:

• TARGET: $93,374 (BREAKEVEN FOR YEAR)

Need +7.1% from current. Would require: Massive overnight Asia rally + NO US selling tomorrow. Probability: 10%. Reality: Extremely unlikely unless major catalyst.

• IMMEDIATE RESISTANCE: $90,000 (THE WALL)

Tested 7 times in December. Failed every time. Briefly touched $90.1K this morning, immediately rejected. This is GAMMA level from expired options + psychological ceiling. Break would signal: Fresh buying. Target: $92K-$93K. Probability: 25%.

• CURRENT: $87,200 (DECISION POINT)

Exactly where we’ve been for a WEEK. If holds into tomorrow night, closes negative but “respectable” -6% to -7% YTD. If breaks down, gets ugly.

• KEY SUPPORT: $86,000-$86,500

Defended 4 times last week. Break = cascade to $83K-$85K. Defended by: Long-term holders, miners’ breakeven, institutional cost basis (many ETF buyers in this range).

• MAJOR SUPPORT: $83,000-$85,000 (NOVEMBER LOW)

Tested Nov 22 when BTC hit $80.7K. This is TRUE MARKET MEAN per on-chain data. Break below would be VERY bearish, target $75K-$80K.

• BEAR TARGET: $70,000-$75,000

If 4-year cycle truly broken and traditional bear market begins. Sean Farrell/Jurrien Timmer camp. Would take Q1 2026 to play out.

• BULL TARGET SHORT: $90,000-$93,374 (IF Year-End Miracle)

Need +7.1% in 18 hours. Possible? Yes. Probable? No. Would require: Major headline OR massive short squeeze.

• BULL TARGET MEDIUM: $100,000-$110,000 (Q1 2026)

If VanEck/Tom Lee bulls are right. Consolidation $85K-$92K through Jan, then Feb-March rally as tax selling ends, ETF inflows return, liquidity improves.

Technical Indicators:

RSI (14-day): 44.94 (neutral but leaning bearish, below 50)

MACD: Bullish crossover forming (signal line crossing above), BUT histogram still negative = weak signal

Moving Averages: - 20-day MA: $88,300 (BTC below = short-term bearish) - 50-day MA: $91,500 (BTC well below = medium-term bearish) - 200-day MA: $97,000 (BTC well below = long-term bearish) - 365-day MA: $95,000 (BTC broke below Nov 22 = structural break)

Volume Profile: - Highest volume: $92K-$98K (where most trading occurred all year) - Current: $87K (low volume = weak support, easily broken) - Support: $83K-$85K (high volume = strong support if tested)

Verdict:

Technically, Bitcoin is SET UP for downside into year-end: 1. Below all major moving averages 2. Failed $90K resistance 7x 3. Weakening support at $86K 4. ETF outflows = no bid 5. Tax selling = mechanical selling

But: If ONE catalyst hits (Trump announcement, whale accumulation, short squeeze), $87K → $94K is 8% = achievable in 12 hours with thin liquidity.

Probability: 10% chance closes positive. 20% chance closes $89K-$92K. 70% chance closes $85K-$88K.

ETHEREUM - $2,932 | FOLLOWING BTC DOWN (AS ALWAYS)

ETH Year in Review:

Opened 2025: $3,378

Peak 2025: $4,869 (Oct 12) = +44%

Current: $2,932 = -13.2% YTD

Drawdown from peak: -40%

Even WORSE than Bitcoin relatively. Down -13% vs BTC’s -7%.

Critical Levels:

• Current: $2,932 (neutral purgatory) • Resistance: $3,000 (psychological), $3,100, $3,200 • Support: $2,900, $2,850, $2,800

Correlation: 0.88 with BTC (moves in lockstep)

If BTC rallies to $93K: ETH likely $3,200-$3,300 (still negative YTD)

If BTC holds $87K: ETH holds $2,900-$3,000

If BTC breaks $85K: ETH breaks to $2,700-$2,800

Technical: RSI 48, MACD flat, volume weak. No independent strength. Pure BTC beta.

ALTCOINS - MIXED BUT MOSTLY MISERABLE

The Only Winner: - XRP: +120% YTD (Ripple legal victories, ETF speculation)

The Survivors: - BNB: Flat to slightly positive (Binance ecosystem strong) - DOGE: -40% YTD but still outperformed most

The Bloodbath: - SOL: -45% YTD (from $180 → $123) - ADA: -55% YTD (brutal year) - AVAX: -60% YTD - MATIC: -65% YTD

L1 Tokens Report:

“2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.”

Translation: Blockchains growing, usage increasing, developers building… but tokens DOWN. Disconnect.

IV. X/TWITTER SENTIMENT - ANALYSTS WEIGH IN

THE CRYPTO TWITTER VERDICT ON YEAR-END

Quote 1:

“Bitcoin needs a 6.24% rally to finish the year higher than it began. Otherwise, it will mark the first down year following a halving event since the protocol’s supply cut cycles became market drivers. Bitcoin’s 2025 candle is currently in the red, with only three days left in the year.”

— Nic Puckrin, CEO Crypto Analytics Firm (Dec 28)

Analysis: Lays out the stakes clearly. This isn’t just about one bad year. It’s about breaking THE pattern that defined Bitcoin for over a decade. If the halving cycle is dead, Bitcoin’s entire investment thesis needs rethinking. Verdict: NEUTRAL but ominous.

Quote 2:

“An interesting trend to take note of has been the distinct underperformance during the US timezone. Both BTC and ETH down 3%+ over US hours [last week] offset by strength during Asian hours, driven most likely by selling pressure coming from the year-end tax-loss harvesting flow as crypto has been a large underperformer among global assets this year.”

— Laser Digital Analysts (Dec 30)

Analysis: Explains the Asian-US divergence perfectly. US investors selling crypto losers to harvest tax losses before year-end. This is MECHANICAL selling that continues until Jan 1. Tomorrow (Dec 31) will be MORE of this, not less. Verdict: BEARISH for year-end close.

Quote 3:

“The Bitcoin price chart looks very promising for higher prices in the future, but less certainty in the near term. I continue to look for the market to trade sideways to slightly lower in the coming weeks/months, and look to add to longs between $71k and $84k.”

— John Glover, CIO Ledn & Elliott Wave Expert (Dec 30)

Analysis: Bullish LONG-TERM (looking for “higher prices in the future”) but bearish NEAR-TERM (sideways to lower). His buy zone: $71K-$84K. Current: $87K. Translation: He thinks we go LOWER before we go higher. Verdict: BEARISH near-term, BULLISH 2026.

Quote 4:

“Bitcoin lagging Nasdaq 100 by roughly 50% YTD, dislocation setting it up to be top performer in 2026. Today’s weakness reflects temporary liquidity pressures, not broken thesis. As debasement ramps, liquidity returns, BTC historically responds sharply. We have been buying.”

— David Schassler, Head Multi-Asset VanEck (Dec 23)

Analysis: The MOST bullish major analyst. VanEck is ACCUMULATING at these levels. They see current weakness as opportunity, not risk. Their thesis: Nasdaq +32%, Bitcoin -7% = 39 point gap UNSUSTAINABLE. Mean reversion suggests Bitcoin outperforms 2026. Verdict: EXTREMELY BULLISH medium-term.

Quote 5:

“Bitcoin is likely to remain range-bound with elevated volatility, consolidating between $83,000 and $95,000 [into year-end]. For Bitcoin to regain a clear upward trajectory, the macro environment would need to improve more than people currently expect. Liquidity conditions and sentiment are still pretty weak.”

— Derek Lim, Head of Research Caladan (Dec 20)

Analysis: Range-bound thesis. No major move until macro improves (Fed dovish, liquidity returns). Current $87K fits his range. Verdict: NEUTRAL expecting chop.

Quote 6:

“Traditional 4-year cycle suggests Bitcoin peaked Oct 2025 (18 months post-halving). Next 12 months = bear market, as per every previous cycle. Base case retracement to $60,000-$65,000 in H1 2026 as a risk management position. We have reduced crypto exposure in the model portfolio.”

— Sean Farrell, Head Digital Asset Strategy Fundstrat (Dec 20)

Analysis: The MOST bearish major analyst. Believes cycle timing still applies. Peak Oct = bear market now. Target: $60K-$65K by mid-2026. Already reduced exposure. Verdict: VERY BEARISH.

Quote 7:

“The 4-year cycle is no longer the dominant market force. 2026 = Dawn of the Institutional Era. Bitcoin spot ETFs, broader regulatory acceptance, and integration into mainstream finance have fundamentally altered dynamics. Instead of predictable parabolic peak and multi-year crash, expect steady institutional capital and macro allocation.”

— Grayscale, Bitwise (Matt Hougan), ARK (Cathie Wood) - Collective Thesis (Dec 2025)

Analysis: The “cycle is dead” camp. New era = new rules. Institutions don’t follow 4-year memes. They allocate based on portfolio optimization. Current weakness = noise. Long-term trajectory: UP. Verdict: BULLISH but patient.

SENTIMENT SUMMARY:

Bullish Camp (40%): VanEck, Grayscale, Bitwise, ARK, Tom Lee

Neutral Camp (30%): Derek Lim, John Glover (near-term), CoinCodex

Bearish Camp (30%): Sean Farrell, Laser Digital, Jurrien Timmer

For Year-End Specifically:

Bullish (10%): Miracle rally possible

Neutral (20%): Chop $87K-$92K

Bearish (70%): Closes $85K-$88K, negative YTD

For 2026:

Bullish (60%): Expect $100K-$150K+ by year-end

Neutral (20%): Expect consolidation $80K-$100K

Bearish (20%): Expect $60K-$75K retest

Key Takeaway: Most analysts are BULLISH for 2026 but BEARISH for year-end 2025. The question isn’t “will Bitcoin recover” but “WHEN will Bitcoin recover.”

V. FORWARD OUTLOOK - THREE SCENARIOS FOR 2026

SCENARIO ANALYSIS: YEAR-END → 2026

BASE CASE (50%): Close Negative, Rally Q1 2026 to $100K-$110K

DEC 30 (Tomorrow): - Morning: Asia tries to rally, pushes to $89K-$90K - Afternoon: US selling resumes, dumps back to $87K-$88K - Close 2025: $87,500 (-6.3% YTD, first negative post-halving year) - Fear drops to 22 (deeper extreme fear)

JAN 2026: - Tax year resets, selling STOPS - Bitcoin consolidates $85K-$92K - Jan 15: MSCI decision (likely defer, not exclude MSTR) - Jan 29: FOMC meeting (Fed holds rates, no cut) - ETF flows turn positive (small inflows return) - Close January: $88K-$92K

FEB-MAR 2026: - Fed signals dovish tilt for mid-year cuts - Liquidity improves, risk appetite returns - ETF inflows accelerate (+$200M-$500M weekly) - Bitcoin breaks $95K (Feb), then $100K (March) - VanEck’s “top performer 2026” thesis begins validating - Q1 Close: $105K-$110K (+20-25% from year-end)

WHY BASE CASE: 1. Tax selling is MECHANICAL, ends Jan 1 2. ETF outflows typically reverse in January (fresh capital, FOMO) 3. Macro backdrop still supportive (eventual Fed cuts, debasement fears) 4. VanEck/institutions accumulating = bid at $85K-$88K 5. Historical pattern: Down Christmas Eves preceded +126% avg rallies 6. Bitcoin has NEVER stayed down after halving (this time delayed, not canceled)

Risks: - MSCI excludes MSTR Jan 15 = forced selling - Fed turns hawkish (no cuts 2026) - Recession hits = risk-off persists - Institutional adoption stalls

If Base Case: 2026 ends $150K-$180K, halving cycle CONFIRMED (just delayed).

BULL CASE (20%): Miracle Rally Tomorrow, Explosive 2026 to $200K+

THE SETUP: - Tonight: Major catalyst hits - Options: Trump announces Strategic Bitcoin Reserve expansion, MicroStrategy surprise $5B buy, Major country adopts BTC (Dubai?), Whales accumulate massively - Thin liquidity + short squeeze = violent move

THE MOVE: - Dec 31 Morning: Bitcoin $87K → $95K overnight (Asia + squeeze) - Dec 31 Afternoon: US DOESN’T sell (positioning done, FOMO kicks in) - Close 2025: $94,500 (+1.2% YTD, POSITIVE!, halving cycle INTACT!) - Fear: Spikes to 40 (greed returns)

Q1 2026 ACCELERATION: - Momentum traders pile in (“We’re back!”) - FOMO returns, retail buys - ETFs see MASSIVE inflows (+$1B+ weekly) - Break $100K (January), $120K (February), $150K (March) - Q1 Close: $155K-$170K

Q2-Q4 2026: - Parabolic phase begins - Tom Lee’s $200K target hit (Q2) - Cathie Wood’s $250K in play (Q3-Q4) - Close 2026: $200K-$250K

WHY POSSIBLE: - Only need ONE catalyst to trigger - $87K → $94K is 8% in thin markets = done in 6 hours before - Short interest elevated = squeeze potential - Psychology: Everyone positioned for negative close = contrarian setup

WHY NOT BASE CASE: - Requires MAJOR news in next 18 hours - US tax selling still active tomorrow - ETF outflows show NO sign of stopping - $90K rejected 7x = strong resistance - Probability: 20% (possible but unlikely)

IF IT HAPPENS: Changes everything. Narrative flips from “cycle broken” to “just getting started.”

BEAR CASE (30%): Cascade to $75K-$80K, Extended Consolidation 2026

THE BREAKDOWN: - Tomorrow: Asia flat, US heavy selling - $86K support breaks - Cascade to $83K-$85K by Dec 31 close - Close 2025: $84,000 (-10% YTD)

JAN 2026 CONTINUATION: - Selling doesn’t stop (turns out it wasn’t JUST tax harvesting) - Jan 15: MSCI EXCLUDES MicroStrategy = forced selling - MSTR dumps Bitcoin to maintain index eligibility - Cascade to $78K-$80K - ETF outflows ACCELERATE (panic) - Break $78K → $75K (psychological collapse)

Q1 2026 BEAR MARKET: - Traditional post-peak bear begins - Sean Farrell/Jurrien Timmer vindicated - Consolidation $70K-$80K (March bottom) - Capitulation, retail exits, “Bitcoin is dead” headlines

Q2-Q4 2026: - Slow grind recovery - $80K-$95K range all year - Close 2026: $85K-$95K (flat to +10% from year-end)

WHY UNLIKELY: - $85K has held MULTIPLE times (strong support) - VanEck/institutions bidding (wouldn’t accumulate if expecting $75K) - On-chain shows limited supply $80K-$85K (bounce likely) - Historical: Bitcoin ALWAYS recovers post-halving (may take longer, but happens)

WHY POSSIBLE: - 4-year cycle may actually be intact (peak Oct, now bear phase) - ETF outflows show institutional EXITING not accumulating - Macro deteriorating (recession risk, Fed hawkish) - “This time is different” = famous last words - First negative post-halving year could be SIGNAL not NOISE

Probability: 30%. Unlikely but real risk. $75K-$80K would be GENERATIONAL buy (30% discount from current). If happens: Deploy heavily, hold for 2027-2028.

WHAT TO DO NOW - YEAR-END EDITION:

TODAY (Dec 29):

If HOLDING from earlier: - Accept you’re closing the year negative (95% probability) - Don’t panic sell last day (worst timing) - Tax harvesting deadline IS tomorrow, but pointless now (already down) - Hold through to January

If WAITING to enter: - Don’t buy today (still tax selling tomorrow) - Wait until Jan 2-3 when selling pressure STOPS - Target: $85K-$88K for entry - VanEck is accumulating here for a reason

If TRADING: - Expect Asia rally tonight to $89K-$91K - Expect US dump tomorrow morning back to $87K-$88K - Don’t fight the pattern (it’s been 8 days straight) - Volume too thin for reliable technical trading

TOMORROW (Dec 30):

Morning (Asian session): - Possible rally to $89K-$92K (last Asian push) - Don’t FOMO buy (US will likely sell)

Afternoon (US session): - Expect selling pressure (final tax harvesting) - Likely closes $86K-$88K range - Don’t trade the chop (just watch)

Evening (Close): - Bitcoin will close 2025 around 8 PM EST (various exchanges) - Final print likely $86K-$88K (-6% to -8% YTD) - First negative post-halving year IN HISTORY

JANUARY 1-2, 2026:

Tax selling STOPS. This is THE MOST IMPORTANT THING.

Watch for: 1. ETF flows (do they reverse?) 2. Asian-US divergence (does it stop?) 3. $90K level (does it break or hold?)

If ETF flows go positive AND Asian-US divergence ends: STRONG BUY signal. Rally to $95K-$100K likely.

If ETF outflows continue AND $85K breaks: WAIT. Further downside possible to $80K-$83K. Buy there.

VII. THE CRYPTO CORNER 🎯

Michael Saylor bought MORE Bitcoin during Christmas week.

The Numbers:

Date: December 22-28, 2025 (Christmas week)

Amount: 1,229 BTC

Cost: $108.8 million

Average Price: $88,568 per coin

New Total Holdings: 672,497 BTC (that’s 3.2% of all Bitcoin that will EVER exist)

Total Invested: $50.44 billion

Average Cost Basis: $74,997 per coin

Dec 8: Bought 10,624 BTC for $963M (at $90,615 avg)

Dec 15: Bought 10,645 BTC for $980M (at $92,098 avg)

Dec 22-28: Bought 1,229 BTC for $109M (at $88,568 avg)

December Total: 22,498 BTC for $2.05 BILLION

While everyone else was: - Tax-loss harvesting (selling) - Going on vacation - Closing positions for year-end - Preparing for Christmas - Literally anything other than buying Bitcoin. Saylor was: Buying Bitcoin.

He’s the ONE whale consistently buying the dip. Not just this month. EVERY month.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.