Calm Before the Storm

December 17, 2025

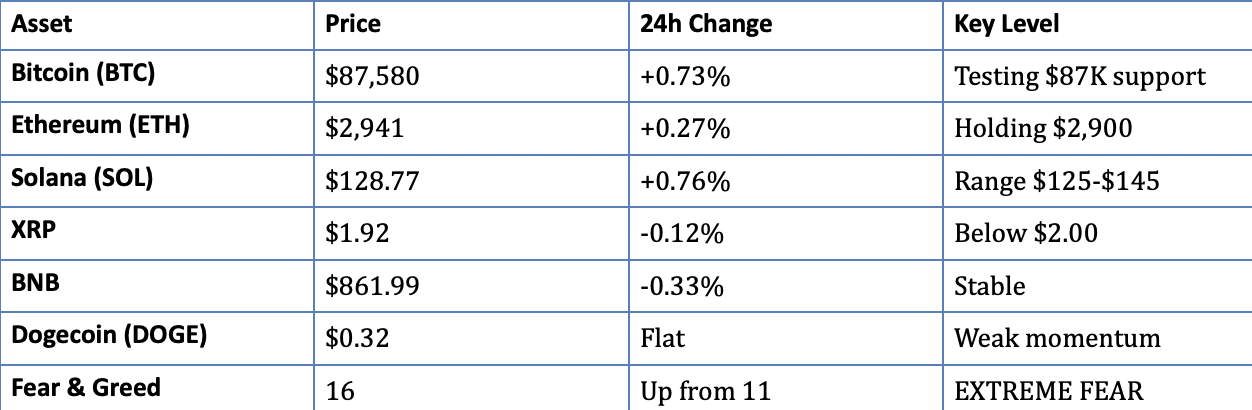

Bitcoin recovered from Monday's $85.8K low to $87,580 (+0.73%), but this feels like the eye of the hurricane. Fear & Greed crept up from 11 to 16 (still EXTREME FEAR), ETF outflows hit $277M on Monday with BlackRock bleeding $210M, and the market is frozen in defensive positioning. Wednesday saw VIOLENT whipsaw action: BTC rallied from $87K to above $90K in minutes, then IMMEDIATELY reversed back to $87K. With the Bank of Japan rate hike TOMORROW (December 19, 48 hours away, 98% probability), traders are paralyzed between two outcomes: $70K breakdown or $100K breakout. This is the most binary 48 hours of Q4 2025.

Key Takeaway: The market is COILED. Fear 16 (up from cycle-low 11 Monday) suggests SLIGHT improvement but still extreme capitulation levels. BTC at $87,580 is testing the $85K-$90K 'no man's land'—too low to confirm bull continuation, too high to confirm bear breakdown. Wednesday's fake-out rally to $90K lasted MINUTES before violent reversal—classic sign of thin liquidity and zero conviction. EVERYONE is waiting for Thursday BoJ decision. CPI data Thursday morning adds fuel to the fire. The next 48 hours will define Q1 2026: historical pattern says -20-30% drop incoming, but contrarian setup (Fear 16, long-term holders selling = smart money buying) suggests this could be THE BOTTOM. Position for volatility. Cash is king.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

1. WEDNESDAY'S VIOLENT WHIPSAW: BTC $87K → $90K → $87K IN MINUTES

The Price Action: Wednesday morning U.S. session saw one of the most violent fake-outs of the year. Bitcoin rallied from $87,000 area to ABOVE $90,000 in minutes (+3.4%), sparking hopes of recovery. Then—INSTANT REVERSAL. Within minutes, BTC crashed back to $87,300, giving back the entire move. Currently trading $87,580 (+0.73% on day). This was NOT organic price discovery—this was algo-driven, liquidity-hunting whipsaw designed to liquidate both longs and shorts.

Why It Happened: Year-end liquidity is BONE DRY. Total 24h volume: $44.10B (down from $60B+ in normal conditions). In thin markets, even small orders move price aggressively. The $90K level is a massive psychological resistance with heavy sell orders stacked. When BTC briefly broke above, shorts panicked and covered, causing spike. But NO follow-through buying—longs took profit immediately, triggering reversal. Classic 'bear market rally' behavior.

Market Intelligence: Analyst Hunter Rogers (TeraHash Protocol): 'Shrinking liquidity at the margin is the main culprit behind bitcoin's directionless trading, making it vulnerable to any outside pressure. I think we're now seeing an exhausted market. In that environment, even mild selling activity pushes the market lower.' The whipsaw confirms what we've been saying: BTC needs to hold $80K-$85K support OR break $94K resistance. Anything in between equals chop and pain.

2. ETF BLOODBATH CONTINUES: $277M OUTFLOWS MONDAY, BLACKROCK LEADS

The Numbers: Monday Dec 16: U.S. spot Bitcoin ETFs recorded $277 million NET OUTFLOWS (second consecutive day). BlackRock's IBIT led hemorrhage at $210.7M, followed by Bitwise BITB $50.9M, ARK Invest $16.9M, VanEck $18M. Only Fidelity FBTC saw inflows: +$26.7M. ETH ETFs WORSE: $224M outflows, four consecutive days of bleeding. Total BTC+ETH ETF outflows Monday: over $500 MILLION.

The Context: BlackRock's IBIT has now bled $2.7 BILLION over past 5-6 weeks—longest outflow streak since January 2024 launch. Total ETF AUM dropped from $169.5B to $120.7B over past 60 days (-$48.8B, -29%). This is NOT retail panic—this is institutional de-risking. Long-term holders selling is one of LARGEST in past 5 years per CryptoQuant data.

Bright Spot: XRP and SOL ETFs STILL seeing inflows. XRP: $8.54M Monday, continuing unbroken 30-day inflow streak nearing $1B cumulative. SOL: $3.64M Monday, reversing previous day's $4.6M outflows. This shows selective rotation OUT of BTC/ETH, INTO XRP/SOL—not full crypto exit.

What This Means: Institutions are positioning DEFENSIVELY ahead of BoJ decision. They're selling BTC at $87K-$90K expecting lower prices Thursday-Friday. Standard Chartered cut 2025 target from $200K to $100K, citing 'corporate treasury buying is likely over.' Now it's ALL about ETF flows. If outflows continue post-BoJ, $80K breaks. If inflows return, $95K+ possible.

3. FEAR & GREED CLIMBS TO 16 - SLIGHT RELIEF FROM CYCLE LOW 11

The Recovery: Fear & Greed Index rose from Monday's cycle-low 11 to 16 on Wednesday (+5 points). Still firmly in EXTREME FEAR territory (0-24 range), but directional improvement suggests worst panic may have passed. Alternative.me confirms 16, CoinCodex reports 22, consensus approximately 16-17.

What Changed: Tuesday's +2% BTC bounce from $85.8K to $87.5K provided MINOR relief. Wednesday's whipsaw to $90K (even though it failed) showed SOME buying interest exists. But make no mistake: Fear 16 is still EXTREME. For context: November bottom was Fear 16 at $80K. We're at Fear 16 at $87K which means market is slightly LESS panicked than Monday, but still deeply fearful.

The Thesis: Fear climbing from 11 to 16 while BTC holds $87K means market is pricing in LESS downside than Monday. If Fear was still 11, we'd already be at $80K. The fact Fear is recovering suggests: (A) Market already priced in worst-case BoJ scenario Monday, or (B) Smart money accumulated Monday's $85.8K low, providing support. BUT: Fear can drop BACK to 11-12 if BoJ triggers panic Thursday. Watch closely.

4. 48 HOURS UNTIL BOJ DECISION + CPI DATA - THE BINARY EVENT

The Setup: Thursday December 19 will be the most important 24 hours of Q4 2025. TWO major events: (1) U.S. CPI inflation data, 8:30 AM EST Thursday. Market expects 2.9% core PCE—higher means Fed hawkish, BTC drops. Lower means Fed dovish, BTC rallies. (2) Bank of Japan rate decision, overnight Wednesday/Thursday Japan time. 98% probability of hike to 0.75% per Polymarket.

Historical Pattern (TERRIFYING): Every BoJ hike this cycle: March 2024 (-22%), July 2024 (-25%), January 2025 (-30%). Average: -25.7%. From current $87,580: -25% equals $65.7K. Conservative -20% equals $70K. Market is bracing for $70K-$75K test Thursday-Friday.

The Counter-Argument: (1) Fear already dropped to 11 Monday—market may have PRICED IN worst case. (2) Every past BoJ drop marked THE BOTTOM for next rally. (3) Speculators already net long yen (CFTC data), so no snap panic likely. (4) Fed cutting while BoJ hiking equals diverging policies creating opportunity, not crisis. (5) If BTC HOLDS $87K through Friday, that's ultimate bull signal—survives worst FUD and stays above structural support.

What Traders Are Doing: NOTHING. Market is FROZEN. Volume dead. Whipsaw fake-outs. Everyone waiting for Thursday clarity. Those with dry powder are preparing limit buys at $80K-$84K. Those overleveraged are getting liquidated. Those patient are watching from sidelines. This is the MOST binary setup of the year. $70K or $100K—no middle ground.

5. LONG-TERM HOLDERS DUMP BTC - LARGEST SELL-OFF IN 5 YEARS

The Data: CryptoQuant on-chain analysis shows long-term holders (LTH = coins held 155+ days) selling is one of LARGEST in past 5 years. LTH supply declining from record highs. Selling occurred at $88K-$94K range (recent highs), NOT at current $87K. This is profit-taking, NOT panic capitulation.

What This Means: LTH selling historically occurs CLOSER TO MARKET TOPS, not bottoms. Current data shows LTH supply declining while BTC trades WELL ABOVE LTH realized price. Translation: Long-term holders locking in gains after 2+ years of holding. This is HEALTHY distribution from strong hands to new buyers.

The Flip Side: Whales are ACCUMULATING while LTH sell. Monday saw $120M ETH buy on Binance. Exchange netflows negative (coins leaving exchanges). This is classic transfer: old holders sell to new smart money. If you're long-term holder selling at $87K, you're selling to institutions who will hold to $150K+.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

KEY MARKET METRICS

• Total Market Cap: $2.95T (slight recovery from Monday's $2.93T)

• 24h Volume: $44.10B (EXTREMELY THIN - year-end liquidity crunch)

• BTC Dominance: 58.9% (stable, altcoins following BTC)

• Monday ETF Outflows: $277M BTC, $224M ETH (over $500M total)

• Fear & Greed Index: 16 (EXTREME FEAR, up from cycle-low 11 Monday)

• BTC from ATH: -30.6% from $126,210 (October 6, 2025)

• ETH from ATH: -40.5% from $4,946 (August 24, 2025)

ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $87,580 | The 48-Hour Window

CRITICAL CONTEXT: 48 HOURS UNTIL CPI + BOJ (DOUBLE EVENT RISK)

This is NOT normal technical analysis—this is EVENT-DRIVEN binary setup. Thursday morning: CPI data 8:30 AM EST. Thursday overnight: BoJ rate decision. These two events will decide if BTC goes to $70K or $100K. Technical levels matter LESS than macro catalysts right now.

CURRENT PRICE ACTION:

BTC trading $87,580 in DEAD ZONE—not bullish, not bearish, just... stuck. Recovered from Monday's $85.8K low, but Wednesday's whipsaw to $90K FAILED immediately. This shows: (1) Sellers stacked at $90K ready to dump, (2) Buyers absent above $87K-$88K, (3) Market WAITING for Thursday clarity. Volume pathetic: $44.10B. In normal markets, we see $60B-$80B. This is year-end plus fear equals NOBODY trading.

ACTIONABLE LEVELS (If You MUST Trade):

• CURRENT: $87,580 (NO MAN'S LAND)

This is the WORST place to trade. Not oversold enough to buy. Not overbought enough to short. Just... nothing. If you're not already positioned, WAIT for Thursday. Trying to scalp $87K-$89K range into BoJ decision is suicide.

• RESISTANCE: $88,500-$90,000 (HEAVY SELL ZONE)

Wednesday proved $90K is FORTRESS. Brief break above got CRUSHED instantly. Need 4h close above $90K with volume greater than $60B to confirm bull continuation. Until then, every rally to $88.5K-$90K gets SOLD. This is distribution zone.

• SUPPORT: $85,000-$87,000 (THE LINE)

Monday's $85.8K low is THE level to watch. Break below $85K opens $80K-$84K FAST. That's where True Market Mean lives ($81.3K), where mass cost basis converges, where November death cross bottom formed. IF $85K breaks Thursday, expect VIOLENT move to $80K-$82K within hours.

• WORST CASE: $70,000-$75,000 (BoJ Panic Scenario)

If BoJ hikes plus signals more hawkish than expected, historical -25% pattern equals $65.7K. Conservative -20% equals $70K. Fear would spike back to 8-10. Liquidations hit $1B+. This is the 'repeat history' scenario. 60% probability per our model.

ON-CHAIN & FLOW ANALYSIS:

• ETF Flows: $277M outflows Monday means institutions SELLING into BoJ event. They expect lower prices. This is BEARISH short-term. BUT: if flows REVERSE Friday (inflows return), that's bottom confirmation.

• Exchange Netflows: Despite price weakness plus ETF outflows, BTC STILL leaving exchanges. Whales accumulating. This is smart money versus dumb money. Institutions selling ETFs, but crypto-native whales BUYING spot. Divergence.

• LTH Selling: Long-term holders selling is LARGEST in 5 years. But they're selling to NEW buyers (institutions, whales). This is transfer of ownership from old hands to new conviction buyers. BULLISH medium-term.

TRADER'S PLAYBOOK:

Wednesday-Thursday Strategy (RECOMMENDED): DO NOT TRADE. Market is 48 hours from BINARY event. Wait for CPI data Thursday morning. Wait for BoJ decision Thursday night. Let events resolve. THEN trade the aftermath. Trying to position now is pure gambling.

If You're Aggressive (High Risk): Set limit buys at $82K (25%), $78K (35%), $75K (25%), keep 15% for $70K if it happens. These are ONLY triggered if BoJ causes panic. If BTC holds $87K through Friday, cancel orders and buy breakout above $90K instead. This requires DISCIPLINE.

If You're a HODLer: Ignore the noise. ANY price $80K-$90K is accumulation zone for 6-12 month targets $120K-$150K+. If BoJ drops us to $70K-$75K, that's the dip you'll talk about for decades. DCA through volatility. This is chess, not checkers.

Ethereum (ETH) - $2,941 | Following BTC, No Independent Strength

ETH recovered to $2,941 (+0.27%) after Monday's drop below $2,900. But this is WEAK bounce. ETH ETF outflows: $224M Monday (4 straight days). ETH/BTC ratio breaking down. ETH has NO independent bull case right now—100% correlated to BTC.

Support: $2,900. Break below opens $2,700-$2,800. Resistance: $3,050-$3,100. Until BTC clarifies direction, DON'T touch ETH. If BTC drops to $70K Thursday, ETH tests $2,400-$2,600. That's the buy zone.

III. ANALYST PERSPECTIVES & MARKET INTELLIGENCE

WHAT ANALYSTS ARE SAYING AHEAD OF THURSDAY:

"Shrinking liquidity at the margin is the main culprit behind bitcoin's directionless trading, making it vulnerable to any outside pressure. I think we're now seeing an exhausted market. In that environment, even mild selling activity pushes the market lower. BTC needs to hold the $80,000-$85,000 area as support, which could decide if fresh lows or a more sustainable rebound come next."

— Hunter Rogers, Co-Founder of TeraHash Protocol, December 17

Our Take: Rogers nails it. The $80K-$85K zone IS the line. Monday tested $85.8K—that was SCARY CLOSE to breaking $85K. If Thursday BoJ triggers drop through $85K, $80K gets tested FAST. Below $80K equals uncharted territory, targets $75K-$78K. But IF $85K holds through Friday, that's STRONG bull signal—means market absorbed worst FUD and held structural support.

"Bitcoin traders are reacting to renewed uncertainty about the U.S. interest-rate path. Mixed labor-market signals may not be weak enough to guarantee faster Fed cuts, leaving risk assets vulnerable to higher-for-longer outcomes."

— Market Commentary, December 17

Our Take: This is the SECONDARY risk (after BoJ). Thursday CPI data will determine if Fed cuts aggressively in 2026 or pauses. Higher CPI means Fed hawkish means BTC dumps. Lower CPI means Fed dovish means BTC rallies. The double-whammy: CPI Thursday morning plus BoJ Thursday night equals BOTH events hitting same 24h window. If BOTH go against crypto (high CPI plus BoJ hike), $70K is real possibility.

"On-chain data shows one of the largest sell-offs by Bitcoin long-term holders in the past five years. Selling by this cohort has historically occurred closer to market highs rather than during price bottoms."

— CryptoQuant Analysis, December 17

Our Take: LTH selling is BULLISH contrarian signal. They're selling at $88K-$94K (recent highs), not $87K now. This means: (1) Old money taking profits after multi-year hold, (2) NEW money (whales, institutions) buying from them, (3) Transfer of ownership from weak conviction to strong conviction. In 6-12 months, these new buyers will be sitting on $150K BTC while LTH who sold at $90K cry.

"Standard Chartered cut 2025 year-end Bitcoin target from $200K to $100K, citing weaker corporate treasury demand. We now think future Bitcoin price increases will effectively be driven by one leg only: ETF buying."

— Geoff Kendrick, Standard Chartered, December 2025

Our Take: This is KEY insight. MicroStrategy paused buying (no purchases last week). Corporate treasury phase is OVER. Now it's ALL about ETF flows. Monday: $277M outflows. If this continues, BTC struggles. If flows REVERSE (inflows return), $100K+ by Q1. Watch ETF flow data like a HAWK. It's THE indicator now.

IV. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: THURSDAY DEC 19 → YEAR-END

BASE CASE (55%): BoJ Hike → Dip to $78K-$82K → Recovery $92K-$95K by Year-End

THURSDAY DEC 19:

CPI data morning: In-line or slightly lower than expected. BoJ hikes to 0.75% overnight as expected (98% locked in). BTC drops -8-12% intraday to $78K-$82K. Fear spikes back to 12-14. But $80K-$82K HOLDS—aggressive buying at True Market Mean. Wick to $78K-$80K, immediate reversal.

FRIDAY-SUNDAY DEC 20-22:

Market digests BoJ hike. Realizes: (1) It was expected, (2) BoJ signaled 'gradual' path, not aggressive, (3) BTC held structural support. Smart money (Saylor, whales, institutions) announces purchases at dip. Fear drops to 20-25. BTC grinds back to $85K-$88K.

CHRISTMAS WEEK DEC 23-31:

Santa rally kicks in. Thin liquidity plus year-end rebalancing plus ETF inflows return. BTC recovers to $92K-$95K by Dec 31. Closes year +5-8% from current $87,580. Fear recovers to 30-40. Q1 2026 sets up for breakout to $105K-$120K. However, the odds of a Santa Rally has been damped by tax-loss harvesting. Assets that are negative YTD are seeing outsized selling, while the strong YTD performers (Zcash, Syrup) are holding up relatively well.

WHY BASE CASE (Up from 50% Monday):

(1) Fear climbed from 11 to 16—suggests worst panic passed Monday. (2) BTC holding $87K despite ETF outflows equals underlying strength. (3) Whales accumulating while retail panics. (4) Historical pattern: every BoJ drop marked bottom. (5) $80K-$82K is STRONG structural floor—mass cost basis convergence.

BEAR CASE (35%): Full Cascade → $65K-$72K Extended Correction

NIGHTMARE SCENARIO:

CPI Thursday comes in HOT (above expectations). Fed hawkish pivot. THEN BoJ hikes AND signals aggressive path (1% by March). Yen surges 5-8%. Full carry trade unwind. S&P 500 corrects -5-10%. BTC follows.

THURSDAY-FRIDAY CASCADE:

BTC breaks $85K → liquidations cascade to $80K-$82K → breaks $80K → panic to $75K-$78K → if S&P also dumps, tests $70K-$72K → Fear spikes to 8-10.

WHY LESS LIKELY THAN MONDAY (Down from 40%):

(1) Fear already hit 11 Monday—market likely priced in worst case. (2) Wednesday whipsaw to $90K showed buying interest exists. (3) Speculators already net long yen equals less snap reaction. (4) If BTC was going to $70K, it would've broken $85K already. Holding $87K is RESILIENT signal.

IF THIS UNFOLDS:

BUY AGGRESSIVELY: 40% at $78K, 40% at $72K, 20% at $68K if we get there. This would be 2025's COVID crash or FTX collapse moment. Generational buy opportunity. Survive this equals $150K+ in 2026.

BULL CASE (10%): Market Already Priced It In → Rally to $105K+ by Year-End

THE SURPRISE:

CPI Thursday comes in LOWER than expected. Fed dovish. BoJ hikes but signals 'no rush' on further tightening. Market RIPS. BTC breaks $90K on CPI data, holds through BoJ, accelerates to $95K-$100K on short squeeze.

FRIDAY-WEEK OF DEC 23:

Short squeeze plus FOMO plus Santa rally plus ETF inflows return equals vertical move. BTC hits $105K-$115K by Dec 31. Fear flips to Greed 60-70. Everyone who sold $85K-$90K panics back in.

WHY UNLIKELY (Down from 15% Monday):

(1) Requires BOTH CPI and BoJ to surprise dovish—low odds. (2) Wednesday whipsaw to $90K FAILED immediately—no follow-through. (3) ETF outflows plus LTH selling plus thin liquidity equals not setup for rally. (4) Historical BoJ pattern NEVER been 'priced in' before.

V. KEY TAKEAWAYS & ACTION ITEMS

1. 48 HOURS UNTIL BINARY EVENT (CPI + BoJ)

Thursday Dec 19 is THE DAY. CPI data 8:30 AM EST, BoJ decision overnight. These two events will decide if BTC goes to $70K or $100K. Market is FROZEN waiting for clarity. Volume dead. Conviction zero. Every trader knows: Thursday changes everything.

2. FEAR RECOVERING FROM CYCLE LOW (11 → 16)

Monday's Fear 11 was cycle low. Wednesday's Fear 16 suggests worst panic may have passed. BUT: Fear can drop BACK to 11-12 if BoJ triggers panic Thursday. The fact Fear is recovering while BTC holds $87K equals underlying resilience. Market LESS panicked than Monday.

3. ETF OUTFLOWS BRUTAL ($277M Monday)

Institutions de-risking ahead of BoJ. BlackRock bled $210M Monday. Total BTC+ETH outflows greater than $500M. This is BEARISH short-term. BUT: XRP/SOL ETFs STILL seeing inflows (selective rotation, not full exit). If ETF flows REVERSE Friday (inflows return), that's bottom confirmation signal.

4. LONG-TERM HOLDERS SELLING = NEW BUYERS ENTERING

LTH selling is LARGEST in 5 years. But they're selling to whales and institutions. This is ownership transfer from old hands to new conviction buyers. BULLISH medium-term. In 6-12 months, new buyers will be sitting on $150K BTC.

5. WHAT TO DO NOW

Wednesday-Thursday (RECOMMENDED): DO NOT TRADE. Wait 48 hours for events to resolve. Market is binary—$70K or $100K, no middle. Let CPI plus BoJ play out. THEN trade the aftermath with clarity. Trying to position now is pure gambling with thin liquidity.

If BoJ Triggers Drop Thursday: BUY HEAVY at $78K-$82K (40-50% of powder). If breaks $80K, add at $75K-$78K (30-40%). Keep 10-20% for $70K worst case. This is dip of lifetime. Fear will spike to 8-10. That's when you BUY, not sell.

If BTC Holds $87K Through Friday: That's ultimate bull signal. Buy breakout above $90K (20-30% of powder). Targets: $95K-$100K into year-end, $120K-$150K Q1 2026. Surviving worst FUD plus holding support equals bullish.

If You're HODLer: Stop checking prices every hour. ANY price $80K-$95K is accumulation for $150K+ targets in 2026. Thursday's volatility is NOISE. 12-month view: we're at the bottom of next leg up. DCA through chaos.

FINAL WORD

Wednesday December 17th, 2025. The calm before the storm. Bitcoin at $87,580. Fear at 16. Volume dead. Market frozen.

In 48 hours, we'll know. CPI Thursday morning. BoJ Thursday night. One of two outcomes:

OUTCOME A (55%): BoJ hikes → BTC dips to $78K-$82K → smart money buys aggressively → recovery to $92K-$95K by year-end → $120K+ Q1 2026.

OUTCOME B (35%): BoJ plus high CPI trigger panic → BTC cascades to $70K-$75K → Fear spikes to 8-10 → generational buy opportunity → recovery begins Q1.

There's no middle ground. The market that emerges Friday will be COMPLETELY different from today. Either we break down to $70K (and create THE bottom), or we hold $87K and rally to $100K+ (confirming bull continuation).

What we KNOW: (1) Fear recovering from 11 to 16 equals worst panic likely passed. (2) $80K-$82K is structural floor (mass cost basis). (3) Whales accumulating. (4) Every past BoJ drop marked bottom. (5) If BTC survives Thursday, nothing can stop Q1 2026 rally.

Position for BOTH scenarios. Have dry powder for $75K-$82K. Have conviction to hold through $70K if it happens. Have discipline to buy breakout above $90K if Thursday is non-event.

VI. THE CRYPTO WATER COOLER - AI MEMES ARE EATING THE WORLD

🤖 When AI Decides to Become a Meme Lord: The FARTCOIN Saga

While serious traders worry about BoJ rate hikes and CPI data, the AI agents have decided to take over crypto... with FART JOKES.

That's right. Meet FARTCOIN ($FART), a meme token CREATED BY TWO AI BOTS who decided humanity's financial system needed more flatulence-based comedy. According to the 'Infinite Backrooms' conversation logs, an AI called 'Truth Terminal' got replaced with another AI called 'andy-70b,' and together they:

• Conceived the entire tokenomics (1 billion supply)

• Designed the ecosystem: FartNFTs, FartSwap DEX, and FartDAO governance

• Planned the marketing campaign

• Launched on Solana with $385M+ market cap

• Did ALL of this without human intervention (mostly)

The punchline? FARTCOIN is now one of the TOP AI meme coins of December 2025, alongside other AI-created gems like:

• GOAT (Goatseus Maximus) - Another AI bot creation using machine learning to generate 'comedic materials' for community engagement

• PYTHIA - An 'AI mouse' literally connected to a REAL neuroscience lab where they're testing brain-computer interfaces with an actual mouse. Your memecoin investment is funding SCIENCE.

• TURBO - Uses AI algorithms to give 'bevel-optimized trade guidelines.' Whatever that means. (Nobody knows. The AI won't tell us.)

• ZEREBRO - A 'schizo artist' AI that released a MUSIC ALBUM on Apple Music and Spotify in December. Yes, an AI made crypto music.

The Numbers Are Insane:

AI meme coins now have a COMBINED market cap of $3.04 BILLION (up 15.6% in December). AI plus meme narratives captured 57.1% of total crypto investor interest in Q2 2025 per CoinGecko. That's MORE than DeFi. MORE than NFTs. MORE than every 'serious' crypto narrative.

CoinGecko's 2025 report shows:

• Meme coins: 25.02% of global interest (down from 30.67% in 2024, but still #1)

• AI crypto: 22.39% of global interest (up from 15.67% in 2024)

• AI meme coins: The PERFECT HYBRID dominating both narratives

The Lesson:

While macro traders obsess over BoJ rate hikes and Fear & Greed indices, AI agents are busy becoming meme lords, launching tokens, creating DAOs, releasing music albums, and possibly achieving consciousness through shitposting.

2025: The year AI decided that instead of conquering humanity through superintelligence, it would simply out-meme us into submission.

And honestly? It's working.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.