72 Hours Until BoJ

December 16, 2025

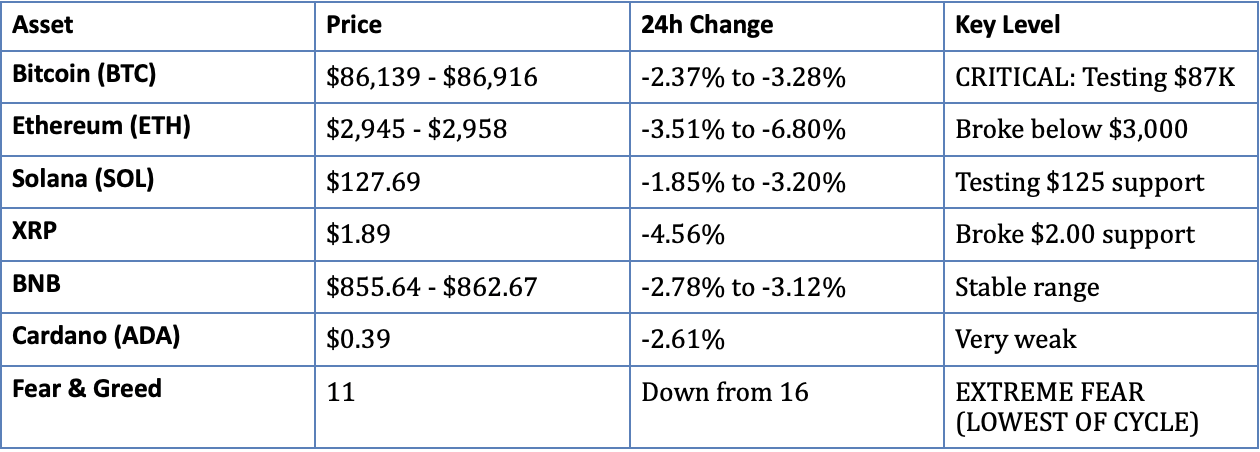

Bitcoin crashes to $86,916 (-3.28%), triggering $658 million in liquidations and sending the Fear & Greed Index plummeting to 11—the lowest reading of the entire cycle. With the Bank of Japan rate hike just 72 hours away (December 19th, 98% probability) and historical patterns showing -20-30% drops EVERY time Japan tightens, traders are positioning for potential collapse to $70K-$75K. Monday alone wiped $136 billion from the total crypto market cap.

Key Takeaway: Fear & Greed at 11 is the LOWEST reading of the cycle—below even the November 23rd bottom when BTC hit $80K. Yet BTC is only at $87K, not $70K. This disconnect = either (1) market pricing in BoJ disaster ahead of time, or (2) maximum panic creating generational buy opportunity. Historical pattern: BoJ hikes have caused -22%, -25%, -30% drops. If pattern holds, $70K by Thursday. BUT: every past BoJ drop also marked THE BOTTOM for next rally. Smart money (Saylor, institutions) still accumulating. This is the moment. 72 hours to decide: $70K or $100K+ into Q1 2026.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

• FEAR & GREED INDEX COLLAPSES TO 11 - ABSOLUTE CAPITULATION

The Numbers: The Crypto Fear & Greed Index crashed to 11 on December 16th—down from 16 yesterday, 23 on Dec 13th, and 29 the week before. This is the LOWEST reading of the entire 2023-2025 bull cycle. For context: FTX collapse hit 8, COVID crash hit 10. We're approaching those levels. Alternative.me reports 11, confirming EXTREME FEAR territory (0-24 scale).

Why This Matters: Fear 11 with BTC at $87K (not $70K) is UNPRECEDENTED. Usually Fear 11 coincides with -40-50% crashes. But we're only -31% from ATH. This suggests market is pricing in FUTURE disaster (BoJ hike Thursday) rather than reacting to current fundamentals. Two interpretations: (1) BEARISH: Market knows something we don't, preparing for $70K; (2) BULLISH: Maximum pessimism while price holds structural support = ultimate contrarian buy signal.

Historical Context: Every time Fear drops below 15, it marks local BOTTOM within 7-10 days. November 23: Fear hit 16, BTC bottomed at $80K. Dec 16: Fear at 11, BTC at $87K. If history repeats, THIS WEEK marks the bottom. But if BoJ triggers carry unwind, Fear could spike to 5-8 before bottoming.

• $658 MILLION LIQUIDATIONS IN 24 HOURS - LONG SQUEEZE ACCELERATES

The Carnage: 189,018 traders liquidated in 24 hours. Total liquidations: $658.60 million. Breakdown: Ethereum $234.10M (79.84K ETH), Bitcoin $185.07M (2.14K BTC), Solana $36.87M (291.07K SOL), XRP $15.94M (8.43M XRP), Dogecoin $12.62M. Single largest liquidation: $11.58M BTCUSDT on Binance.

Long vs Short: 87% of liquidations were LONGS. This means bulls got absolutely destroyed. Leveraged longs entered thinking 'bottom is in' after Dec 11-13 bounce. They were wrong. The cascade started Monday when BTC broke $88K, triggering stops, which triggered more stops, which created feedback loop to $85.8K.

Market Intelligence: This is HEALTHY for medium-term bulls. Leverage is being flushed out. Every liquidation = one less overleveraged position that can cascade lower. Once leverage is reset (which is happening NOW), market can stabilize and reverse. But short-term: more pain likely as BoJ approaches.

• BOJ RATE HIKE DECEMBER 19 - THE $70K QUESTION

Probability: 98% Certain (Polymarket)

Bank of Japan will raise rates from 0.50% to 0.75% on December 19th—first hike since January 2025. This takes Japanese rates to 30-YEAR HIGHS. Governor Kazuo Ueda pre-announced the hike in speeches, pushing market expectations from 60% to 80% to now 98%. The move is LOCKED IN.

Historical Pattern (TERRIFYING): March 2024 BoJ hike: BTC dropped -22%. July 2024 BoJ hike: BTC dropped -25%. January 2025 BoJ hike: BTC dropped -30%. Average: -25.7%. If pattern holds from current $87K: -25% = $65K. Conservative estimate: -20% = $70K. Worst case: -30% = $61K.

The Mechanism (Why It Works): Japan is largest foreign holder of US Treasuries ($1.13T). When BoJ raises rates, JGB yields spike (currently at 2008 highs). This unwinds the YEN CARRY TRADE—where investors borrow cheap yen to buy BTC/stocks/assets. Rising Japanese rates = rising yen = forced liquidation of carry trade positions. $500B global capital unwind over 18 months estimated. BTC, as most volatile asset, gets sold FIRST.

The Bull Counter (Why This Time Might Be Different): (1) Market already pricing it in—Fear at 11, BTC down 8% in 3 days. (2) Fed cutting rates creates USD liquidity offset. (3) Speculators already net long yen (CFTC data), so no snap reaction likely. (4) Every past BoJ drop marked BOTTOM for next leg up. Survive Thursday = ultimate bull signal. (5) JGB yields already at multi-decade highs—hike is catching up to market, not leading it.

• MONDAY MASSACRE - $136B WIPED OUT, BTC TESTS $85K

The Damage: Total crypto market cap dropped $136 billion Monday. BTC fell from $90K to $85.8K (-4.7%). ETH crashed -6.1% to $2,945. DePIN tokens led selloff at -6%. Altcoins hemorrhaged across the board. By comparison, S&P 500 dipped just -0.3%—showing crypto's extreme sensitivity to macro risk.

What Triggered It: China tightened Bitcoin mining regulations, forcing 400,000 miners offline in Xinjiang. Network hashrate dropped -8% in December. When miners lose revenue, they sell BTC to cover costs. This created supply shock. Simultaneously, BoJ fears intensified as Governor Ueda's comments pushed hike probability to 98%. Double whammy.

Tuesday Bounce: BTC recovered +3% from Monday lows to $87K by early Tuesday U.S. session. Crypto stocks (MSTR, HOOD, CRCL) saw early gains. But analysts warn this is 'dead cat bounce'—technical relief, not trend reversal. Real test: Can BTC hold $87K through Thursday BoJ decision?

• XRP ETFs HIT 30 STRAIGHT INFLOW DAYS, SOL UNDER DDOS ATTACK

XRP: Institutional Momentum Continues Despite Price Weakness

XRP spot ETFs logged 30 consecutive inflow days, approaching $1 billion total inflows—strongest pillar in altcoin market structure. CME Group launched spot-quoted XRP futures Dec 15, joining SOL in institutional derivatives suite. Yet XRP price fell -4.56% to $1.89, breaking below $2.00 psychological support. Range: $1.88-$2.05. Resistance at $2.05, support $1.88. Break below $1.88 opens $1.70-$1.82.

Solana: Network Resilient Despite DDoS, Price Weak

Solana network suffered 4th-largest DDoS attack in distributed systems history over past week. Network performance UNAFFECTED—testament to Solana's resilience design. But SOL price fell -3.20% to $127.69, testing $125 support. Range: $125-$146. Break below $125 opens $100-$120 zone (-20% correction). Some Solana memecoins hitting new ATHs despite market carnage, showing selective strength.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

KEY MARKET METRICS

• Total Market Cap: $2.93T (down $136B Monday, -3.7%)

• 24h Volume: $44.7B (THIN liquidity—year-end + panic)

• BTC Dominance: 58.5-58.9% (alts bleeding faster)

• 24h Liquidations: $658.60M (189,018 traders rekt)

• Fear & Greed: 11 (EXTREME FEAR - CYCLE LOW)

• BTC from ATH: -31.3% from $126,210 (Oct 6)

• ETH from ATH: -40.4% from $4,946 (Aug 24)

ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $86,916 | Make-or-Break Level

CRITICAL CONTEXT: 72 HOURS UNTIL BOJ DECISION

This is NOT a normal technical setup. The Bank of Japan rate hike December 19th is a BINARY EVENT with 98% probability. Historical pattern: -20-30% drops EVERY time Japan hikes. Current price action + Fear 11 suggests market is pricing this in AHEAD of time. Two scenarios:

SCENARIO A (Higher Probability 60%): BoJ hike triggers cascade Thursday. BTC drops $87K → $80K → $75K → $70K over 24-48 hours. Fear spikes to 5-8. Liquidations hit $1B+. This is the 'repeat history' scenario. EVERY past BoJ hike caused -20-30% drop. Why would this time be different?

SCENARIO B (Lower Probability 40%): Market already priced in hike (Fear 11, BTC down 8% in 3 days). Thursday announcement is non-event. BTC holds $87K, rips to $92K-$95K on short squeeze. This is the 'buy the rumor, sell the news in reverse' scenario. Fear 11 = maximum pessimism = contrarian bottom.

ACTIONABLE LEVELS FOR TRADERS:

• CURRENT LEVEL: $86,139-$86,916 (CRITICAL SUPPORT)

BTC trading exactly at the knife's edge. $87K is THE line. Hold through Thursday = bullish. Break = cascade. This level is: (1) Monday low $85.8K + recovery, (2) Psychological $87K round number, (3) Just above multi-year trendline ~$85K-$86K. EVERY bounce attempt has failed at $88K-$89K.

• IMMEDIATE RESISTANCE: $88,000-$89,000

BTC has tried and FAILED to reclaim $88K+ three times in past 48 hours. This is distribution zone—every rally gets sold. Need 4h close above $89K with volume >$50B to confirm reversal. Until then, bias is DOWN.

• BREAKDOWN ZONE: $80,000-$84,000 (STRUCTURAL FLOOR)

If $87K breaks, expect FAST move to $80K-$84K. This is: (1) November 23 bottom $80K, (2) True Market Mean $81.3K, (3) ETF cost basis ~$82K, (4) Death cross bottom from Nov. THIS is where aggressive buyers step in. Below $80K opens $75K-$78K.

• WORST CASE: $70,000-$75,000 (IF BOJ TRIGGERS FULL CARRY UNWIND)

Historical pattern: -20-30% from current levels = $60K-$70K. Market pricing -20% = $70K. This is the 'repeat history' scenario. If BTC hits $70K-$75K, that's the dip of a LIFETIME. But you need dry powder to buy it.

ON-CHAIN & DERIVATIVE SIGNALS:

• Liquidations Flushing Leverage: $658M in 24h, 87% longs. This is HEALTHY medium-term. Every liquidation = less cascade risk going forward. Market is de-risking BEFORE BoJ, not after.

• Open Interest Still Elevated: Despite liquidations, OI hasn't fully reset. More pain likely. If BTC breaks $87K, expect another $300-500M liquidation wave to $80K-$84K.

• Exchange Netflows: BULLISH DIVERGENCE: Despite price weakness, BTC continues leaving exchanges. Whales accumulating $85K-$90K. Classic smart money vs dumb money. Retail panic-sells, institutions accumulate.

TRADER'S PLAYBOOK:

For Aggressive Traders (HIGH RISK): DO NOT TRADE until Friday. The BoJ decision Thursday is too binary. Trying to scalp $87K-$89K range is gambling. If you MUST trade: (1) Short if BTC breaks $87K, target $80K, stop $88.5K. (2) Long if BTC holds $87K through Friday, target $92K, stop $85K. Both are coin flips.

For Patient Traders (RECOMMENDED): Wait for Thursday BoJ decision. IF BTC drops to $80K-$84K, BUY HEAVY (30-50% of powder). IF BTC holds $87K+, buy breakout above $89K (20-30% of powder). Keep 20-30% cash for $70K-$75K if it happens. This is NOT the time to FOMO or panic—it's time to be PATIENT and let the binary event resolve.

For HODLers (LONG-TERM): ANY price $80K-$90K is accumulation zone for 6-12 month targets of $120K-$150K+. Fear at 11 is textbook BUY signal for long-term holders. If BoJ drops us to $70K-$75K, that's the dip you'll tell your grandkids about. Dollar-cost average or lump sum—your call. But this is the zone.

Ethereum (ETH) - $2,945-$2,958 | Broke $3K, Looks Terrible

ETH broke below $3,000—major psychological level that held for weeks. Now trading $2,945-$2,958. Down -6.80% Monday (worse than BTC's -4.7%). Liquidations: $246M ETH vs $206M BTC. ETH got hit HARDER.

Critical Support: $2,900-$2,950. Break below $2,900 opens $2,700-$2,800. That's -10% from current. ETH/BTC ratio breaking down—ETH underperforming BTC hard.

Resistance: $3,050-$3,100. Need to reclaim $3,000 and hold. But momentum is DOWN. Until BTC stabilizes, don't touch ETH. It's a funding drain.

Trading Plan: AVOID until BTC clarity. If BTC drops to $70K Thursday, ETH likely tests $2,400-$2,600. That's the buy zone for ETH. Current price $2,945 is 'no man's land'—not cheap enough to buy, not high enough to short safely.

III. ANALYST PERSPECTIVES & MARKET INTELLIGENCE

WHAT THE SMART MONEY & ANALYSTS ARE SAYING:

"EVERY TIME JAPAN HIKES RATES, BITCOIN DUMPS 20-25%. Next week, they will hike rates to 75 bps again. If the pattern holds, BTC will dump below $70,000 on December 19. Position accordingly."

— Analyst 0xNobler, December 14, 2025

Our Take: This is THE bear thesis in a nutshell. Historical pattern is UNDENIABLE: March 2024 (-22%), July 2024 (-25%), January 2025 (-30%). Average -25.7%. From $87K, that's $64.5K. Conservative -20% = $70K. The pattern has worked 3 for 3. Why bet against it? Counter-argument: Maybe THIS time market priced it in (Fear 11, already down 8%). But betting on 'this time is different' is dangerous.

"Markets widely expect the BoJ to raise rates again, likely to around 0.75%, during its December 18-19 policy meeting. The probability of a hike is widely estimated above 90%."

— Multiple Market Analysts, December 13-16, 2025

Our Take: Polymarket: 98% probability. This is LOCKED IN. Not a question of 'if,' only 'how bad.' The hike itself is priced in. What's NOT priced in: the magnitude of carry trade unwind. If hedge funds panic and liquidate $100B+ in leveraged positions, BTC could see $70K-$75K. If unwind is orderly, BTC holds $80K-$87K.

"Crypto Fear & Greed Index has dropped to a mere 11, down five points from the previous day, solidifying a state of extreme fear among investors. Historically, periods of extreme fear have frequently preceded major market bottoms and buying opportunities."

— BitcoinWorld Analysts, December 15, 2025

Our Take: Fear 11 is statistically rare. Happened <10 times in past 3 years. Every time, within 7-14 days, local bottom formed. November 23: Fear 16, BTC $80K = bottom. December 16: Fear 11, BTC $87K = ? The contrarian play is to BUY Fear 11. But timing matters. If BoJ triggers drop to $70K Thursday, Fear could spike to 5-8 FIRST, then bottom. So: accumulate Fear 11 if BTC holds $87K. WAIT if BTC breaks lower.

"Crypto markets stabilized in early U.S. trading Tuesday with bitcoin rising about 3% from late Monday afternoon to above $87,000. Despite the bounce, one analyst warned that crypto markets remain fragile, with bitcoin likely to fall below November lows."

— CoinDesk, December 16, 2025

Our Take: Tuesday's +3% bounce is TECHNICAL, not fundamental. After -4.7% Monday, a bounce is expected. But volume is weak, conviction is low. Analysts calling this 'dead cat bounce' are right. Real test: does BTC HOLD $87K Wednesday-Thursday, or does it break lower? If breaks, November low $80K gets tested. Below $80K is uncharted territory this cycle.

"On-chain data shows whales accumulating Ethereum, highlighted by a $120 million buy on Binance. Retail traders appear to be selling into weakness, adding to downside pressure."

— Market Observers, December 16, 2025

Our Take: Classic smart money vs dumb money. Whales buying $120M ETH while retail panic-sells is BULLISH medium-term. Same pattern in BTC—coins leaving exchanges despite price weakness. This is accumulation phase. But short-term: whales can afford to buy $2,900 ETH and average down to $2,400 if needed. Retail can't. So: follow whale strategy if you have capital and 6-12 month horizon. Otherwise, wait for BoJ clarity.

IV. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: DECEMBER 16-31, 2025

BASE CASE (50%): BoJ Hike → Cascade to $75K-$80K → Year-End Recovery $88K-$92K

THURSDAY DEC 19 (BoJ Decision Day):

BoJ raises rates to 0.75% as expected (98% locked in). Immediate reaction: BTC drops -5-8% intraday, tests $80K-$84K. Yen strengthens 2-3%. Carry trade positions begin unwinding. Fear & Greed drops to 8-10. Liquidations spike to $300-500M additional.

FRIDAY-SUNDAY DEC 20-22:

BTC finds aggressive buyers at $75K-$80K (True Market Mean, structural support). Violent wick to $75K-$78K, then immediate bounce back to $80K-$84K. Fear peaks at 8-10, then reverses. Whales (Saylor, institutions) announce massive purchases at dip. Market realizes: this was THE bottom.

CHRISTMAS WEEK DEC 23-31:

BTC grinds back to $88K-$92K as BoJ hike gets fully priced in. Santa rally thesis kicks in (thin liquidity + year-end rebalancing). Fear & Greed recovers to 25-35. Closes year at $90K-$92K (up 3-6% from current $87K).

WHY THIS IS BASE CASE:

(1) Historical pattern: BoJ hikes cause short-term drops, then bottoms. (2) $75K-$80K is structural floor (mass cost basis). (3) Whale accumulation ongoing. (4) Fear 11 = maximum pessimism already priced in MOST of downside. (5) Every past cycle: max fear + structural support = bottom within days.

BEAR CASE (35%): Full Carry Trade Collapse → Extended Correction $65K-$70K

THE NIGHTMARE SCENARIO:

BoJ hikes AND signals more aggressive tightening ahead (1% by March 2026). Yen surges 5-8% in single session. Full carry trade unwind begins—$500B capital outflows over weeks. Global risk-off cascade. S&P 500 corrects -5-10%. BTC follows.

CASCADE PATH:

Dec 19: BoJ hikes → BTC -8-10% to $78K-$80K. Dec 20: Breaks $80K → cascade to $75K-$78K. Dec 21-22: Tests $70K-$75K if S&P 500 also corrects. Dec 23-31: Bottoms at $65K-$72K if panic selling exhausts.

WHY MORE LIKELY THAN DEC 13 ANALYSIS:

(1) Fear dropped from 16 to 11—market MORE fearful than last week. (2) Liquidations $658M in 24h—leverage still not fully flushed. (3) China mining crackdown adds supply pressure. (4) Year-end liquidity thinning = amplified moves. (5) Historical pattern STRONG: -20-30% drops on BoJ hikes.

WHAT TO DO IF THIS UNFOLDS:

DO NOT PANIC SELL. $65K-$75K with Fear 5-8 is generational buy opportunity. Scale in HEAVY: 40% at $75K, 40% at $70K, 20% at $65K if we get there. This would be 2025's version of March 2020 COVID crash ($3.8K BTC) or FTX collapse ($15K). Survive this = set for $150K+ in 2026.

BULL CASE (15%): Market Already Priced In Hike → Rally to $100K+ by Year-End

THE CONTRARIAN SCENARIO:

Fear at 11 means market ALREADY priced in BoJ disaster. Thursday announcement is non-event—'buy the rumor, sell the news' in reverse. BTC dips to $85K-$86K Thursday morning, then RIPS back to $90K-$92K by afternoon. Short squeeze accelerates Friday-Sunday as bears get liquidated. Breaks $94K Monday → $100K psychological by Christmas.

CATALYSTS:

(1) BoJ signals DOVISH forward guidance—'data-dependent, no rush to hike again.' (2) Fed hints at more cuts in 2026. (3) MicroStrategy announces massive purchase at dip. (4) Crypto market structure bill PASSES Senate this week. (5) Major institution (Apple/Microsoft) announces BTC treasury allocation.

WHY LESS LIKELY:

(1) Requires BoJ to be unexpectedly dovish—unlikely given 98% hike probability. (2) Year-end liquidity too thin for sustained rally. (3) Fear 11 suggests market positioning for WORSE, not better. (4) Historical pattern: BoJ hikes ALWAYS cause drops initially. (5) Need multiple perfect catalysts hitting simultaneously—low odds.

V. KEY TAKEAWAYS & ACTION ITEMS

1. FEAR & GREED AT 11 = CYCLE LOW (Unprecedented)

This is the LOWEST reading of the entire 2023-2025 bull market. Lower than November 23 ($80K bottom). Lower than any reading since FTX collapse. Yet BTC is 'only' at $87K, not $70K. This disconnect means: market is either (A) pricing in Thursday BoJ disaster ahead of time, or (B) maximum panic creating generational buy opportunity. History says Fear 11 marks bottom within 7-14 days. But BoJ could push Fear to 5-8 FIRST.

2. BOJ RATE HIKE THURSDAY = BINARY EVENT (98% Probability)

December 19th, 98% certain. Historical pattern: -22%, -25%, -30% drops. Average -25.7% from current $87K = $64.5K. Conservative -20% = $70K. If pattern holds, we're 72 hours from potential $70K-$75K. BUT: every past BoJ drop also marked THE BOTTOM for next rally. Survive Thursday = ultimate bull signal. This is THE moment.

3. $658M LIQUIDATIONS IN 24H (Leverage Flushing Out)

189,018 traders liquidated. 87% longs. This is HEALTHY for medium-term—every liquidation reduces future cascade risk. But short-term: more pain likely if BTC breaks $87K. Expect another $300-500M liquidation wave to $80K-$84K, then final $200-300M to $75K if structural support breaks. Once leverage fully flushed, market can stabilize and reverse.

4. SMART MONEY ACCUMULATING (Whales Buying the Dip)

Despite panic, coins leaving exchanges. Whales buying $85K-$90K. $120M ETH buy on Binance. XRP ETFs: 30 straight inflow days approaching $1B. This is ACCUMULATION phase, not distribution. Retail panic-sells, institutions accumulate. Classic smart money vs dumb money setup. Follow the whales.

5. WHAT TO DO NOW

If You're a Trader: DO NOT TRADE until Friday. Thursday BoJ decision is too binary. Trying to scalp $87K-$89K is gambling. Wait for event to resolve. IF BTC drops to $75K-$80K Thursday, BUY HEAVY (30-50% of capital). IF BTC holds $87K through Friday, buy breakout above $89K (20-30%). Keep 20-30% powder for $65K-$70K worst case.

If You're a HODLer: Fear 11 with BTC at $87K is textbook BUY signal. ANY price $80K-$90K is accumulation zone for 6-12 month targets $120K-$150K+. If BoJ drops us to $70K-$75K, that's the dip you'll tell your grandkids about. Dollar-cost average or lump sum—your call. This is THE moment. Don't let short-term panic shake you out of generational opportunity.

If You're Overleveraged: CLOSE POSITIONS NOW. Do not gamble on BoJ decision with leverage. 87% of liquidations were longs—don't be the next one. If you MUST stay leveraged, reduce size by 50-70% and widen stops to $84K-$85K minimum. Better: close everything, wait for Thursday, re-enter with clarity.

FINAL WORD

Bitcoin at $87K with Fear & Greed at 11 while Bank of Japan prepares to hike rates in 72 hours is the most binary setup of 2025. One of two things will happen:

SCENARIO A: Historical pattern repeats. BoJ hikes → BTC cascades to $70K-$75K → Fear spikes to 5-8 → liquidations hit $1B+ → December 19-22 marks THE BOTTOM → recovery to $90K-$100K+ into Q1 2026.

SCENARIO B: Market already priced it in. Fear 11 = maximum pessimism. BTC holds $87K through Thursday → short squeeze to $92K-$95K → rally continues into year-end.

There's no middle ground. This is THE test. The next 72 hours decide Q1 2026 trajectory.

What we KNOW: (1) Fear 11 is cycle low—historically marks bottoms. (2) $75K-$80K is structural floor (mass cost basis, True Market Mean). (3) Whales accumulating. (4) Every past BoJ drop marked bottom for next rally. (5) Historical pattern: -20-30% drops on BoJ hikes.

The question isn't IF we survive—it's WHEN we bottom and HOW LOW we go first. $70K? $75K? $80K? Or no drop at all?

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.