Multi-Year Trendline Test

December 15, 2025

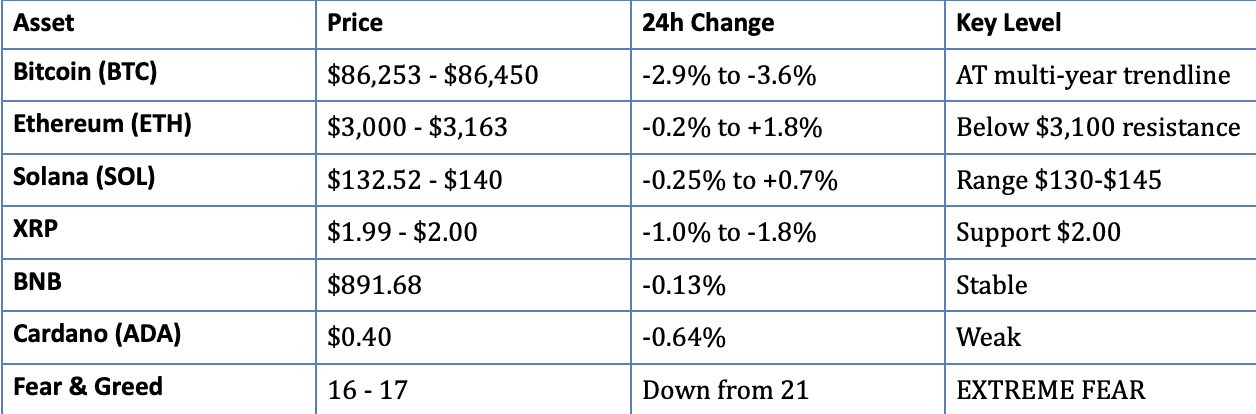

Bitcoin plunges to $85,600-$86,450—a two-week low and tests its multi-year support trendline. With Fear & Greed crashing to 16-17 (lowest since November's $80K bottom) and the Bank of Japan rate hike looming December 19th (98% certain), the market faces its biggest test since the October liquidation event. Bitcoin has lost $40K (31%) from its October ATH of $126,210. This is THE moment—hold the trendline or break to $70K-$80K.

Key Takeaway: This week will decide if this is accumulation opportunity or breakdown. MicroStrategy's 'Orange Dots' signal more buying. Smart money accumulates, retail panics. The next 4 days (Dec 16-19) define Q1 2026.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

• FEAR & GREED INDEX CRASHES TO 16 - DEEPEST CAPITULATION SINCE NOVEMBER

Data: The Crypto Fear & Greed Index fell to 16-17 on December 15th, down from 21 yesterday and marking the LOWEST reading since November 23rd when BTC bottomed at $80K. Alternative.me reports 16, CoinCodex 22, consensus ~17. This is extreme fear territory (0-24) and matches levels not seen since the FTX collapse aftermath. Bitcoin is trading 31% below its October 6th ATH of $126,210.

Impact: Extreme fear historically marks local BOTTOMS, not tops. When retail panics and Fear hits sub-20 levels, that's when smart money accumulates. Compare to October when Fear hit 75 (Extreme Greed) at $126K ATH—that was the top. Now we're at the opposite extreme. Every death cross this cycle (50-day MA crossing below 200-day MA) has marked a local bottom. November's death cross coincided with $80K—the pattern is repeating.

Market Intelligence: Fear at 16 with BTC at $86K (not cratering to $70K) is a SETUP, not a breakdown. This is textbook accumulation zone. On-chain data shows coins leaving exchanges, whale wallets accumulating, and funding rates neutral—no crowded longs to liquidate. But fear CAN go lower—FTX hit 8, March 2020 COVID crash hit 10. If BoJ triggers carry unwind Thursday, Fear could spike to single digits.

• BANK OF JAPAN RATE HIKE DEC 19 - 'BITCOIN'S BIGGEST ENEMY' RETURNS

The Setup: Bank of Japan is set to raise interest rates to 0.75% (from 0.50%) on December 19th—highest level in 30 years. Polymarket pricing 98% certainty. Markets terrified based on historical pattern: EVERY BoJ hike this cycle crushed Bitcoin. March 2024: -22%, July 2024: -30%, January 2025: -31%. If pattern holds, BTC could drop to $70K (-19% from current $86K).

Why It Matters: Japan holds the most US debt globally ($1.13T). Rising JGB yields (2-year at 1.0%, 10-year at 1.95%—highest since 2008) are unwinding the $1.2 trillion YEN CARRY TRADE. For decades, hedge funds borrowed yen at near-0% to buy stocks/crypto. That trade is dying. BoJ holds ¥28.6T in unrealized losses (225% of capital)—technically insolvent. Yen carry unwind could trigger $500B in global capital outflows over 18 months.

The Bull Counter: Analyst Quantum Ascend argues Japan tightening + Fed loosening = 'EXTREMELY BULLISH' regime shift. Fed cuts inject dollar liquidity, weaken USD. Gradual BoJ hikes strengthen yen without destroying global liquidity. Capital rotates into asymmetric upside assets (crypto). But near-term: Dec 19-20 will be VIOLENT.

Trading Intelligence: Historical pattern is 3 for 3 on BoJ hikes causing -20-30% drops. But every drop also marked cycle bottom for next leg up. If BTC holds $80K structural support despite hike, that's ultimate bull signal. Trade plan: Expect extreme volatility Wed-Fri. Buy $80K-$85K zone aggressively if hit, stop $78K.

• MICROSTRATEGY SIGNALS FRESH BTC BUY - SAYLOR'S 'ORANGE DOTS' RETURN

Launch Details: Michael Saylor posted signature 'Orange Dots' chart Dec 15, captioned '₿ack to More Orange Dots'—widely interpreted as imminent massive BTC purchase. Strategy currently holds 660,624-671,268 BTC (largest corporate holder). Dec 14 disclosure: acquired 10,645 BTC for $980.3M at $92,098/coin. BTC yield 24.9% YTD. Despite market weakness, Saylor accumulates aggressively.

The Controversy: Saylor warned of 'chaos, confusion, harmful consequences' if Strategy removed from MSCI indices (proposed rule excludes companies with crypto >50% assets). Could trigger $8.8B outflows. The Kobeissi Letter noted Strategy market cap ($47.7B) fell $10B BELOW BTC holdings value ($55.6B)—stock trades at discount to NAV. With $8.2B debt, this is distressed signal OR value opportunity.

Market Intelligence: Saylor's conviction is signal, not noise. He treats dips as 5-10 year buying opportunities. Orange Dots = more accumulation. For long-term holders, validates thesis. For traders: Saylor buying $86K-$92K while retail panics = smart money vs dumb money. Follow the orange dots.

• BITCOIN PLUNGES TO $85.6K - TWO-WEEK LOW ON MACRO PRESSURE

The Price Action: BTC fell to $85,600-$86,450 during U.S. trading Monday Dec 15—two-week low. Intraday range $86,454-$89,948. Down 2.9-3.6% in 24h. 24h volume $43.7-$47.9B. Year-end liquidity thinning amplifies swings. BTC down 4.4% weekly, 6.8% monthly, 11.8% annually. Only 14-day: +3.7% (suggests short-term resilience).

Multi-Year Trendline Test: BTC returned to test multi-year trendline that supported EVERY major higher low since 2023. Hold = 'healthy reset.' Break = $70K risk. This is THE line. CoinDesk flagged 'crystal-clear pattern': BTC performs far worse during U.S. hours than overnight. Crypto stocks hammered: Strategy/Coinbase -5-7%, miners -10%+.

Fed Non-Event: Last Wed Fed cut 25bps to 3.5%-3.75% but BTC dropped 1.08%—NO reaction. Hawkish dot plot (only 2 cuts 2026 vs 4 expected) killed optimism. Powell signaled potential January pause, dampening risk appetite.

• WRAPPED XRP LAUNCHES ON ETHEREUM & SOLANA - $100M TVL DAY ONE

Launch Details: Hex Trust announced wXRP (1:1 backed) live on Ethereum, Solana, Optimism, HyperEVM. $100M+ TVL ensures liquidity. Tradable alongside Ripple's RLUSD stablecoin. 'Growing demand to use XRP across wider ecosystem,' said Markus Infanger (RippleX SVP). 'Fits with RLUSD—regulated DeFi access.'

Institutional Momentum: Ripple got conditional approval for National Trust Bank. US spot XRP ETFs: 15 consecutive inflow days (longest since launch). Total approaching $990.91M ($20.1M Friday). XRP ETFs = 'strongest pillar' of market structure. Price: $1.99-$2.00 (-1-1.8% 24h) despite news. Range $1.96-$2.35, resistance $2.05, support $2.00. wXRP launch didn't spark rally = 'sell news' or accumulation.

Trading Intelligence: wXRP + RLUSD + bank charter = multi-year regulated DeFi infrastructure build. Not about XRP pumping tomorrow. Near-term: range-bound with macro headwinds. Range trade: buy $1.96-$2.00, sell $2.35-$2.50. Breakout: wait clean $2.50 break on volume.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

KEY MARKET METRICS

• Total Market Cap: $3.05-$3.08T (down ~1-2% from recent highs)

• 24h Volume: $43.7-$64.6B (THIN year-end liquidity amplifying moves)

• BTC Dominance: 58.5-58.9% (holding steady as alts weaken)

• BTC from ATH: -31% from $126,210 (Oct 6)

• ETH from ATH: -36% from $4,946 (Aug 24)

• Fear & Greed: 16-17 (EXTREME FEAR - 2nd lowest of cycle)

ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $86,450 | The Multi-Year Trendline Test

ACTIONABLE LEVELS FOR SHORT-TERM TRADERS:

• CRITICAL SUPPORT: $85,500-$87,000 - Multi-Year Trendline - This is THE line in the sand. Trendline has supported every major higher low since 2023. BTC is testing it RIGHT NOW. Traders watching VERY closely. Hold = constructive for Q1. Break = retest $80K structural floor. Stop loss for bulls: $85,000 tight, $83,000 loose.

• Breakdown Zone: $80,000-$82,000 (STRUCTURAL FLOOR) - If multi-year trendline fails, expect test of $80K-$82K zone. This is: (1) True Market Mean $81.3K per Glassnode, (2) Mass cost basis convergence, (3) ETF cost basis ~$82K, (4) November death cross bottom $80K. THIS is where buyers step in aggressively. Below $80K opens $75K-$78K.

• Resistance Levels: $89,000 → $91,500 → $94,200 - First resistance $89K (must reclaim). Then $91,500 (options max pain for Dec 26 expiry). Key breakout: $94,200 (descending trendline + symmetrical triangle top—4h close above = bullish, targets $96.5K then $100K). Major: $96,500 (counter-trend channel top).

• Scalp/Day Trade: HIGH RISK - BoJ hike Dec 19 creates too much uncertainty for tight ranges. Better to wait for Thursday event, then trade the aftermath. If you MUST trade: buy $86K-$86.5K with stop $85K (tight). Target $88K-$89K. R/R: 2:1. But this is gambling before BoJ.

ON-CHAIN SIGNALS & DERIVATIVE INTELLIGENCE:

• Exchange Netflows: BULLISH DIVERGENCE - Despite price weakness, BTC continues flowing OFF exchanges (supply shock). CryptoQuant shows wholecoiner inflows to Binance 'rapidly drying up.' Coins leaving = accumulation, not distribution. Classic bull divergence.

• Open Interest: LOW = Limited Liquidation Risk - BTC-denominated open interest suppressed <310K BTC (down from >380K cycle highs). Since Oct 10 liquidation event, leverage never rebuilt. This means: limited cascade risk if we break down. BUT also means: limited short squeeze fuel if we rally.

• Funding Rates: NEUTRAL = Potential Short Squeeze - Perpetual futures funding rates neutral 0.00-0.02%. No crowded longs to liquidate. No crowded shorts to squeeze. Market is BALANCED. But at Fear 16, this creates asymmetric setup: bad news priced in, good news isn't.

• Cost Basis Analysis: $80K-$82K IS THE FLOOR - Glassnode True Market Mean: $81.3K. U.S. Spot ETF average cost basis: ~$82K. 2024 yearly cost basis: ~$80K. All converge at $80K-$82K. This is THE structural support. Mass profit-taking above, mass buying below.

• Death Cross Pattern: Every One Marked Bottom - 50-day MA crossed below 200-day MA in November. Coincided with $80K local bottom. Historically: every death cross this cycle marked LOCAL BOTTOM for next leg up, not top. Current death cross reinforces $80K-$82K as accumulation zone.

TRADER'S PLAYBOOK:

For Bulls (Long Setup - WAIT FOR BOJ): Don't chase here. Wait for BoJ decision Dec 19. If BTC holds $85K-$86K through Thursday, enter long $86K-$87K with stop $84K. Targets: $89K (short-term), $91.5K (medium), $94.2K (breakout). R/R: 3:1. But this assumes BoJ doesn't trigger carry unwind. Size accordingly.

For Bears (Short Setup - VERY HIGH RISK): Only short if multi-year trendline breaks ($85K) on volume. Enter $84,500-$85,000, stop $87K. Targets: $82K, $80K. R/R: 2:1. WARNING: Shorting at Fear 16 extremely dangerous. One Saylor 'Orange Dots' buy = face-ripping rally. One positive BoJ interpretation = short squeeze. This is knife-catching.

For HODLers (Accumulation Strategy - RECOMMENDED): ANY price $85K-$95K is accumulation zone for 6-12 month horizon. If BoJ triggers drop to $80K-$85K, that's AGGRESSIVE buy zone—back up the truck. At Fear 16 with BTC at $86K, this is where fortunes are built. DCA or lump sum, your call. But $80K-$86K with Fear 16 = textbook entry. Stop worrying about $2-3K difference. Long-term: $80K-$90K is the same price.

Ethereum (ETH) - $3,000-$3,163 | Struggling vs. BTC

ACTIONABLE LEVELS:

• Critical Support: $3,000 - $3,050 - ETH briefly dipped to $3,000 today before recovering above $3,100. $3,000 is psychological support. Clean break below opens $2,950-$2,980. But $3,000 has held multiple times—strong floor.

• Resistance: $3,260 - $3,320 - ETH range-bound $3,050-$3,320 for weeks. 4-hour close above $3,260 needed for bullish confirmation. Then $3,320 breakout opens $3,500-$3,700. But weak momentum—needs BTC to lead.

• Trading Plan: ONLY Long ETH If BTC Confirms - ETH/BTC ratio weak. ETH won't rally if BTC breaks down. ONLY enter ETH longs if BTC holds $87K+ and confirms strength. Otherwise: avoid. If BTC drops to $80K, ETH tests $2,800-$2,900. Wait for BTC clarity first.

III. ANALYST PERSPECTIVES & MARKET INTELLIGENCE

WHAT THE SMART MONEY IS SAYING:

"Bitcoin testing the multi-year trendline that's held every major low since 2023. This is THE moment. Hold = constructive setup for Q1. Break = retest $80K structural floor. Bank of Japan hike Dec 19 will decide."

— Technical Analyst on X, Dec 15

Our Take: Spot on. Multi-year trendline is THE line. Not $90K, not $88K—the trendline matters most. It's currently around $85K-$87K depending on timeframe. Holding it means 2023-2025 bull structure intact. Breaking it opens the door to deeper correction. BoJ hike is the catalyst that will test this level.

"Fear & Greed at 16-17 with BTC trading $86K is textbook accumulation zone. We saw identical setup in November at $80K—that was the bottom. Smart money buys maximum pessimism. Retail panic-sells into it."

— Market Structure Analyst, Dec 15

Our Take: Absolutely. Fear 16 is contrarian buy signal. But contrarian doesn't mean 'buy immediately'—it means 'prepare to buy the dip.' Fear CAN go lower (FTX hit 8, COVID hit 10). If BoJ triggers carry unwind, Fear could spike to 5-12. That's when you buy aggressively. Fear 16 says 'get ready,' not 'go all-in right now.'

"Every BoJ hike this cycle: -22%, -30%, -31%. Pattern is 3 for 3. If history rhymes, $70K is in play this week. BUT every drop also marked the cycle bottom. Survive the hike = ultimate bull signal."

— Macro Trader tracking BoJ-BTC correlation, Dec 14

Our Take: This is THE trade of the week. Historical pattern is undeniable: BoJ hikes crush BTC short-term. But they also mark bottoms. The paradox: expect -20-30% drop Dec 19-20, BUT if $80K holds, that's the best long entry of Q4. This is why we say 'wait for BoJ' before going heavy. Let the event happen, see if $80K-$85K holds, THEN buy aggressively.

"Saylor posting Orange Dots during Fear 16 panic = ultimate conviction signal. He's buying $86K like it's $60K. For 10-year horizon players, this validates the thesis. For traders, recognize smart money accumulating while dumb money panics."

— Corporate Treasury Analyst, Dec 15

Our Take: Saylor is the ultimate conviction indicator. He doesn't time bottoms—he accumulates through cycles. Orange Dots at $86K means he sees this as cheap. For long-term holders, follow his lead. For traders: recognize this as smart money signal, but it doesn't prevent short-term volatility. Saylor can handle 30% drawdowns. Can you?

"Japan tightening + Fed loosening is EXTREMELY BULLISH for crypto. This isn't liquidity shock—it's regime shift. Fed cuts inject dollar liquidity, weaken USD. Gradual BoJ hikes strengthen yen without destroying global liquidity. Capital rotates into asymmetric upside assets."

— Macro Analyst Quantum Ascend, Dec 13

Our Take: This is the bull counter-argument to BoJ FUD. Long-term (6-12 months), he's probably right. Diverging central bank policies create opportunities. But short-term (next week), historical pattern says BoJ hikes = BTC drops. We're traders first, macro thinkers second. Trade the pattern, position for the regime shift. Expect pain Dec 19-20, buy the dip if $80K holds, then ride the 2026 bull.

IV. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: DECEMBER 15-31, 2025

BASE CASE (50%): BoJ Hike → Dip to $80K-$84K → Year-End Recovery to $92K-$95K

SHORT-TERM (Dec 16-20):

• BoJ hikes Dec 19 as expected (98% probability)

• BTC tests $82K-$85K as yen carry unwinds

• Fear & Greed drops to 10-14 (panic levels)

• Violent wick to $80K-$82K, finds aggressive buyers at True Market Mean ($81.3K)

• Multi-year trendline breaks but $80K structural floor HOLDS

LATE DECEMBER (Dec 21-31):

• BTC bounces $80K-$84K → $88K-$90K as BoJ hike gets 'priced in'

• Fear & Greed recovers to 25-35

• Santa rally thesis kicks in (S&P 500 rises 79% of time last 5 days Dec + first 2 days Jan)

• Year-end institutional rebalancing supports

• MicroStrategy announces another purchase at dip

• Closes 2025: $92K-$95K (up 7-10% from current)

Q1 2026:

• ETF flows improve post-holidays

• Crypto market structure bill passes Senate (attempting vote this week)

• BoJ hike fully absorbed, no follow-up hikes until March

• Target: $105K-$120K by March (22-39% from current)

WHY THIS IS BASE CASE:

• Historical pattern: BoJ hikes = short-term pain, then bottom

• $80K-$82K structural floor very strong (mass cost basis)

• Whale accumulation ongoing (MicroStrategy, American Bitcoin, institutions)

• ETF inflows $716M last week despite price weakness

• Fear 16 = contrarian setup, not breakdown

• Santa rally seasonal tailwind

BEAR CASE (35%): BoJ Triggers Full Carry Unwind → Extended Correction to $70K-$75K

TRIGGER: BoJ hike worse than expected OR cascades into broader market stress (S&P 500 correction >5%)

CASCADE PATH:

1. Dec 19: BoJ hikes → USD/JPY drops sharply → yen strengthens rapidly

2. Dec 19-22: Carry trade unwinds → hedge funds liquidate BTC/tech stocks

3. Dec 22-25: BTC breaks $80K → stops triggered → cascade to $75K-$78K

4. Dec 26-31: Tests $70K-$75K if S&P 500 also corrects

TIMELINE:

• Hits $70K-$75K by Dec 22-28

• Closes year at $72K-$78K

• Consolidates $70K-$85K through January

• Recovery begins Feb 2026

WHY MORE LIKELY THAN YESTERDAY:

• Already AT multi-year trendline ($86K), not above it

• Fear 16 = room to go lower (FTX hit 8, COVID hit 10)

• Historical pattern STRONG: 3 for 3 on BoJ hikes causing -20-30% drops

• Macro stress: Japan BoJ insolvent, $500B carry unwind, corporate bankruptcies 15-year high

• MicroStrategy index removal risk could force selling

• Tether depeg risk if Japan sells US bonds

WHY STILL NOT BASE CASE:

• Every past BoJ drop marked BOTTOM for next leg up

• Whale buying: Saylor, American Bitcoin, institutions accumulating

• $80K structural floor VERY strong (mass cost basis convergence)

• ETF inflows persistent despite weakness

• Low open interest = limited cascade risk

BULL CASE (15%): BoJ Hike Non-Event → Rally to $105K-$115K by Year-End

SCENARIO: Market has already priced in BoJ hike (98% certain = no surprise). BTC dips to $84K-$85K Dec 19, immediately bought. Reverses to $92K-$95K by Dec 22. Short squeeze kicks in above $95K.

CATALYSTS:

• Crypto market structure bill PASSES Senate this week (attempting vote)

• Major institution announces BTC purchase (Apple, Google, Amazon treasury allocation)

• Fed signals more cuts than expected in Jan/Feb 2026

• Santa rally in equities lifts all boats

• Short squeeze above $95K triggers gamma squeeze to $100K+

• MicroStrategy announces massive purchase, catalyzes FOMO

TARGETS:

• Dec 31: $105K-$115K (22-33% rally from current)

• Q1 2026: $130K-$150K as momentum builds

WHY LESS LIKELY:

• BoJ hike historically NEVER been 'priced in'—always causes drop

• Year-end liquidity too thin for sustained rally

• Macro headwinds: Japan stress, corporate bankruptcies, geopolitical risk

• Fear 16 suggests market NOT positioned for rally

• Need multiple positive catalysts hitting simultaneously (unlikely)

V. KEY TAKEAWAYS & ACTION ITEMS

1. DECEMBER 19 BOJ RATE HIKE = THE EVENT OF THE WEEK

98% certain to happen. Historical pattern: -20-30% drops EVERY time (March -22%, July -30%, January -31%). If pattern holds, $70K-$75K possible. But EVERY past drop also marked the cycle bottom for the next leg up. This is binary: survive the hike at $80K+ = ultimate bull signal. Break below $80K = extended correction to $70K-$75K.

2. FEAR & GREED AT 16 = MAXIMUM PESSIMISM

Lowest since Nov 23 ($80K bottom). BTC at $86K (not $70K) with Fear 16 = contrarian BUY signal. BUT fear CAN go lower (FTX hit 8, COVID hit 10). If BoJ triggers panic, Fear could spike to 5-12. Don't confuse 'maximum pessimism' with 'can't go lower.' Wait for BoJ, then buy the dip aggressively if $80K-$85K holds.

3. SMART MONEY ACCUMULATING, RETAIL PANICKING

Saylor posting Orange Dots. American Bitcoin crossed 5,000 BTC. ETFs saw $716M inflows last week. Exchange inflows drying up. Whales buying $86K-$90K. This is ACCUMULATION phase, not distribution. Follow smart money. When retail panics at Fear 16, that's when fortunes are built.

4. TECHNICAL SETUP: MULTI-YEAR TRENDLINE + $80K FLOOR

BTC testing trendline that held EVERY major low since 2023. This is THE line. Death cross active but historically marked bottoms. $80K-$82K is structural floor: True Market Mean, mass cost basis, ETF average, November bottom. Hold these = bullish. Break = test $70K-$75K. But even at $70K, buyer conviction should be massive.

5. WHAT TO DO NOW

For Aggressive Buyers: DCA $86K-$88K NOW with tight stops $84K. If breaks, reload $80K-$84K AGGRESSIVELY. Stop $78K. This is for traders who can handle 5-10% stop-outs. Expected targets: $95K-$105K by Q1 2026. R/R: 4:1.

For Conservative Traders: WAIT for Dec 19 BoJ decision. Let the event happen. If BTC holds $85K-$86K through Thursday/Friday, enter longs $86K-$88K. If it drops to $80K-$84K, BUY HEAVY. That's the dip of Q4. Don't try to catch the exact bottom—$80K-$85K is ALL buy zone.

For HODLers: ANY price $85K-$95K is accumulation zone for 6-12 month targets of $120K-$150K+. This is noise. BoJ hike is a gift if it drops us to $80K-$85K. Dollar-cost average or lump sum, your choice. The point: $80K-$90K in December 2025 will look identical 12 months from now. Stop trying to time $2-3K differences.

FINAL WORD

Bitcoin at $86K with Fear & Greed 16 while Bank of Japan prepares to hike rates is the ULTIMATE TEST. The next 4 days (Dec 16-19) will define the trajectory for Q1 2026. Historical pattern says -20-30% drop likely Dec 19-20. But historical pattern ALSO says every BoJ drop marked the cycle bottom.

The setup is binary: hold $85K-$86K (multi-year trendline) → rally to $95K-$105K+ into Q1. Break $80K → correction to $70K-$75K, then consolidation. There's no middle ground. This is the moment.

Smart money (Saylor, institutions, whales) buying while retail panics at Fear 16. Multi-year trendline + $80K-$82K structural floor creates POWERFUL support. But yen carry unwind + $500B outflows is real systemic risk. We could see $70K before $100K.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.