Weekend Market Watch - FUD

December 13, 2025

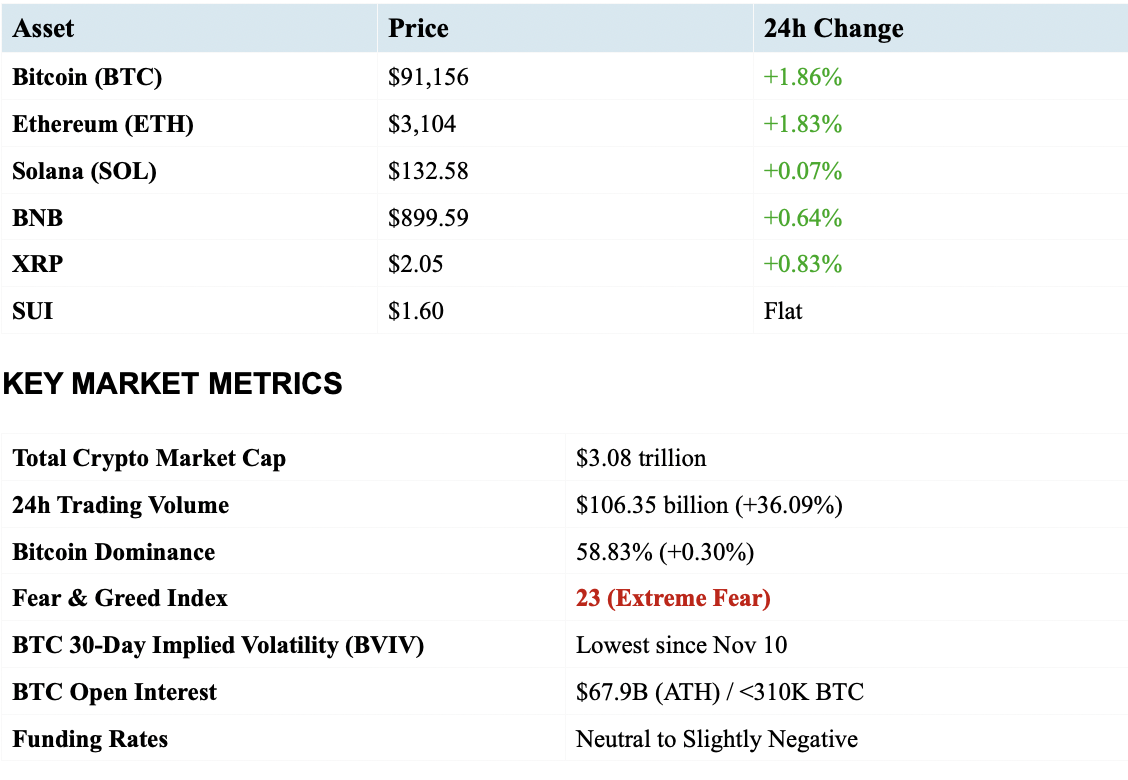

The crypto market closes out Saturday, December 13th locked in a battle between fear and institutional positioning. Bitcoin trades at $91,156 (+1.86% in 24h), refusing to break convincingly above $92K despite positive ETF flow data. The total crypto market cap stands at $3.08 trillion, up 1.01% on the day, with 92 of the top 100 coins in the green. But beneath the surface, volatility is compressing, leverage is unwinding, and the Fear & Greed Index just crashed to 23—officially in extreme fear territory.

Key Takeaway: Markets are pricing in paralysis. Despite positive developments—Ripple's national trust bank approval, recovering ETF flows, and Standard Chartered's adjusted (but still bullish) $100K year-end target—traders are defensive. Fear & Greed dropped from 29 to 23 overnight, signaling capitulation sentiment even as on-chain data shows whales quietly accumulating between $88K-$90K. The real catalyst? We're waiting for clarity: Will Japan's BoJ rate hike on December 19th trigger another yen carry trade unwind? Will ETF flows accelerate into year-end? The market is coiled, not broken.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

RIPPLE RECEIVES CONDITIONAL OCC APPROVAL FOR NATIONAL TRUST BANK

Impact: Brad Garlinghouse announced Ripple received conditional approval from the U.S. Office of the Comptroller of the Currency to establish "Ripple National Trust Bank." This isn't just symbolic—it's infrastructure. The charter enables 24/7 stablecoin settlement and eliminates traditional bank counterparty risk.

Key Risk: The American Bankers Association warned this "could blur the lines of what it means to be a bank." Translation: regulatory scrutiny incoming.

Market Intelligence: XRP is trading at $2.05 (+0.83% in 24h) with market cap at $124.15B. Despite the headline, XRP remains stuck in a tight range around the psychological $2.00 level. Spot XRP ETF flows hit ~$974.5M cumulative since launch, with daily inflows recently averaging $16M. The market is treating this as regulatory validation, not immediate price catalyst.

JAPAN'S BOJ RATE HIKE FEARS SPOOK MARKETS

Consensus: All 50 surveyed economists expect the Bank of Japan to raise its benchmark rate to 0.75% at next week's meeting (December 19th). Nearly two-thirds project additional hikes every six months, targeting a 1.25% terminal rate.

Impact: Yen carry trade unwind risk. The last time Japan tightened, crypto markets suffered sharp liquidations. This ugly memory is driving defensive positioning—hence why crypto is dumping as the U.S. market opens.

Powell's Press Conference: Fed Chair noted the outlook is "challenging" with "no risk-free path ahead," suggesting the January FOMC could be a hawkish hold. Markets hate uncertainty.

BTC ETF FLOWS SHOW SIGNS OF LIFE AFTER BRUTAL OUTFLOW STREAK

Data: December 12 ended with net inflows of +$49.1M across U.S. spot Bitcoin ETFs, with BlackRock's IBIT contributing +$51.1M. This follows six consecutive weeks of outflows totaling $2.7B from IBIT alone.

Context: Glassnode characterized recent flows as "quiet," with short-term averages still below zero. Standard Chartered cut its 2025 year-end target from $200K to $100K, citing weaker corporate treasury demand and increased reliance on ETF-driven flows.

The Catch: Much of the recent outflow ($194.6M) was attributed to basis trade compression—arbitrage desks unwinding positions as futures premiums collapsed below 0.2%. This is mechanical, not panic selling.

ALTCOINS REMAIN WEAK - ALTCOIN SEASON INDEX HITS CYCLE LOW

Data: CoinMarketCap's Altcoin Season Index fell to 16/100—a cycle low. Major altcoins posting double-digit weekly losses: JUP (-11%), KAS (-14%), QNT (-12%).

Why It Matters: The memecoin market is down 59% YTD vs. a 7.3% decline in the CD10. This highlights a seismic shift from retail-driven hype to institutionally led, slower-moving markets. Translation: boring price action, smart money accumulation.

Ethereum Struggles: ETH fell 5.1% yesterday despite the broader market gaining 0.25%. Total Value Locked (TVL) on Ethereum has sunk from ~$90B in September/October to ~$70B today, raising questions about network dominance.

DO KWON SENTENCED TO 15 YEARS FOR TERRA/LUNA COLLAPSE

Sentence: Judge Paul Engelmayer called it "a fraud of epic generational scale," citing massive investor harm that helped trigger the 2022 crypto winter. Kwon agreed to forfeit $19.3 million as part of his plea.

Impact: A sobering reminder of the regulatory crackdown. Markets have moved on, but the stablecoin regulatory framework being debated in Congress was directly influenced by Terra's collapse.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $91,156 | The Squeeze Play

ACTIONABLE LEVELS FOR SHORT-TERM TRADERS:

Long Entry Zone: $88,500-$89,500 - This is your whale accumulation zone. CryptoQuant data confirms large wallet addresses quietly buying between $88K-$90K. Set buy limit orders in this range with tight stops at $87,800 (just below structural support at $88K).

Breakout Play: $94,200 - A decisive 4-hour close above $94,200 (with volume >$50B) opens the path to $96K-$98K within 48-72 hours. This breaks the descending trendline resistance. Target: $100K psychological level. Stop loss: $92,500.

Scalp Zone: $91K-$92.5K - Range-bound chop continues. Scalpers can fade the range: sell resistance at $92.3K-$92.5K, buy support at $90.8K-$91K. Tight stops (0.5-0.7%). Works until it doesn't—watch for volume spike.

Risk Management Alert: Below $88K, next support is $84K-$85K (200-day MA). A break below $88K likely triggers cascading liquidations. Consider hedging long positions with put options or reducing exposure.

ON-CHAIN SIGNALS & DERIVATIVE DATA:

Exchange Netflows: Glassnode reports declining exchange balances—coins moving to cold storage. This is accumulation behavior, not distribution. Bullish medium-term.

Open Interest: CRITICAL ALERT - While notional OI is at ATH ($67.9B), BTC-denominated OI has stayed below 310K BTC since October's liquidation event. This is a "ghost town" in perpetuals—speculative participation is deeply muted. Translation: Limited leverage in the system means lower liquidation risk BUT also lower volatility potential. A breakout needs fresh leverage to fuel it.

Funding Rates: NEUTRAL SQUEEZE SETUP - Perpetual futures funding rates have been drifting lower for weeks, now near zero or slightly negative. This reflects "fading leveraged long conviction"—traders unwilling to pay premium for upside exposure. When Fear & Greed is at 23 but funding is neutral, it often precedes a short squeeze. Long positions are NOT crowded.

Short Interest: Not explicitly elevated, but basis trade compression (futures premium <0.2%) suggests arbs are out. This means less mechanical selling pressure from delta-neutral strategies unwinding.

Cost Basis Convergence at $80K: True Market Mean, U.S. ETF cost basis, and 2024 yearly cost basis all converge around $80K-$82K. This is THE structural support. Any dip to $80K is a screaming buy for long-term holders. Historically, BTC bounces hard when price touches mass cost basis levels.

TRADER'S PLAYBOOK:

If BTC holds $90K through Monday: Bias turns bullish for a run at $94K by mid-week. Thin holiday liquidity could amplify moves. Position long with $89.5K stop.

If BTC breaks $88K: Expect violent washout to $84K-$85K (200-day MA). This would flush remaining weak hands and reset sentiment for Q1 2026 rally. Contrarian buy at $84K-$85K.

Volatility Trade: BVIV (30-day implied vol) at lows since Nov 10. Straddle or strangle options strategies may pay off—market is pricing in calm, but macro catalysts (BoJ Dec 19, year-end flows) could spike vol.

Ethereum (ETH) - $3,104 | The Wounded Giant

ACTIONABLE LEVELS:

Critical Support: $3,000 - Round number psychological support. A break below $3K on high volume opens the door to $2,850-$2,900. Consider tightening stops if ETH tests $3,020-$3,040 and fails to bounce.

Resistance: $3,260-$3,300 - A reclaim of $3,300 would flip sentiment bullish. Look for 4-hour close above $3,320 with volume >$22B to confirm. Target: $3,500-$3,700.

Long Setup: Buy dip at $3,000-$3,050 with stop at $2,950. Target $3,250 for 5-7% gain. R/R: ~3:1. Only take if BTC holds above $90K.

Risk Alert: TVL collapse from $90B to $70B is a major red flag. Ethereum is losing mindshare to Solana in DeFi/NFTs. Tread carefully. ETH/BTC ratio is breaking down—BTC outperformance likely to continue.

DERIVATIVE INSIGHT:

ETH ETF saw $41.6M outflows (led by ETHE). Institutional conviction is weak. Until ETF flows reverse, ETH remains a funding drain vs. BTC.

Altcoins: Solana (SOL) & XRP - Divergence Plays

SOL ($132.58): Testing support at $130. A break below $128 targets $120. Upside resistance at $142-$145. Bullish above $145 toward $160-$170. Bhutan's TER stablecoin launch on Solana is a long-term positive—watch for momentum shift.

XRP ($2.05): Stuck in $2.00-$2.17 range. Patience required. A daily close above $2.20 opens path to $2.50-$2.75. Downside protection at $2.00; break below targets $1.82-$1.90. Sistine Research's $10-$15 target is long-term—don't chase here.

III. ANALYST SENTIMENT & SOCIAL INTELLIGENCE

CURRENT MARKET VOICES - WHAT ANALYSTS ARE SAYING

We've compiled recent commentary from respected crypto analysts and market observers to gauge sentiment on December 13, 2025:

1. GLASSNODE (@glassnode) - December 11, 2025

"Unrealized losses across the crypto ecosystem have recently climbed to ~$350B, including ~$85B in BTC alone. With multiple on-chain indicators signalling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead."

The Rekt Take: Glassnode is warning of volatility compression breaking. $350B in unrealized losses means a lot of underwater positions—these holders either capitulate (creating bottoms) or diamond-hand through (creating springboards). The "shrinking liquidity" point aligns with declining on-chain active entities (240K → 170K). This is the calm before the storm. High volatility regime = opportunity for skilled traders, danger for over-leveraged degens.

2. CRYPTOVIZART (@CryptoVizArt) - December 8, 2025

"Since the major reset on 10/10, BTC-denominated open interest has fallen and stayed below 310K BTC, unable to recover toward the >380K BTC highs seen earlier in the cycle. Speculative participation remains deeply muted."

The Rekt Take: This is the "ghost town in perpetuals" we keep mentioning. Retail is GONE. The October liquidation event scared everyone straight. But here's the contrarian angle: when speculation is muted and leverage is low, that's when smart money accumulates quietly. The next rally won't be retail FOMO—it'll be institutional rebalancing and strategic positioning. Less leverage = more sustainable moves.

3. STANDARD CHARTERED (Geoff Kendrick) - Recent Analysis

Standard Chartered cut 2025 year-end Bitcoin target from $200K to $100K, citing "softer demand from corporate treasury buyers" and increased reliance on "one leg of demand—ETF buying" after corporate digital asset treasury accumulation has likely peaked.

The Rekt Take: Don't panic—they didn't turn bearish. $100K by year-end is still bullish from $91K. The key insight: MicroStrategy-style corporate treasury buying has slowed (MSTR didn't buy BTC last week for first time in ages). Now it's all about ETF flows. This puts pressure on BlackRock, Fidelity, and others to deliver. If ETF flows accelerate into Q1 2026, $150K by mid-2026 is still on the table per Standard Chartered's updated forecast.

4. WILLY WOO (@woonomic) - Long-Term View

Woo, renowned for on-chain analysis, has stated: "Bitcoin's fundamentals have turned bullish, creating a favorable setup. With capital flows rising and network health strong, any dips should be considered buying opportunities, though short-term price dips are still likely."

The Rekt Take: Woo is a data-driven analyst who looks at on-chain fundamentals, not just price. His NVT ratio and network value metrics are showing accumulation beneath the surface. The "short-term dips" caveat is key—don't expect straight-line rallies. Volatility is coming. But fundamentally, Bitcoin's network is healthy. Long-term bias: bullish.

5. BRAD GARLINGHOUSE (@bgarlinghouse) - December 12, 2025

"@Ripple just received conditional approval from the @USOCC to charter Ripple National Trust Bank. This is a massive step forward – first for $RLUSD, setting the highest standard for stablecoin compliance with both federal (OCC) & state (NYDFS) oversight."

The Rekt Take: Ripple is building infrastructure while others argue on Twitter. The national trust bank approval is HUGE for institutional adoption. This isn't about XRP price pumping tomorrow—it's about Ripple positioning itself as the rails for the next generation of regulated stablecoins and cross-border payments. Multi-year bullish for XRP's utility narrative. Price will follow... eventually.

6. REUTERS ECONOMISTS - December 2025 BOJ Survey

"A strong majority of economists now expect the Bank of Japan to raise rates to 0.75% at its December meeting, with borrowing costs reaching at least 1% by next September. Expectations have firmed rapidly as inflation persists and the yen remains weak."

The Rekt Take: This is THE macro risk event. December 19th BoJ decision could trigger yen carry trade unwind 2.0. Last time Japan tightened (August 2024), crypto got obliterated. Markets have memory. That's why Fear & Greed is at 23—traders are hedging. If BoJ hikes aggressively and signals more to come, expect BTC to test $84K-$88K support. If they're dovish, we rip to $100K. This is a binary event.

SENTIMENT SUMMARY: FEAR, BUT NOT CAPITULATION

Synthesizing analyst sentiment from social media, research reports, and on-chain data providers:

Consensus View: Range-bound consolidation continues until a major catalyst breaks the deadlock. Short-term bearish (Dec 19 BoJ risk), medium-term constructive (ETF flows recovering, fundamentals solid), long-term bullish (regulatory clarity, institutional adoption accelerating).

Fear & Greed at 23: Extreme fear readings historically mark bottoms, not tops. When retail panics, smart money accumulates. Glassnode's $350B unrealized losses + whale accumulation at $88K-$90K = textbook bottom formation.

Leverage Desert: Open interest stuck below 310K BTC. Funding rates neutral/negative. This is NOT a euphoric top—it's a de-risked base. Next rally will be slow grind, not vertical blow-off.

Key Disagreement: Bulls say $100K by year-end still achievable if ETF flows accelerate. Bears say January FOMC hawkish hold + BoJ tightening = $80K retest first. Both sides agree: Q1 2026 sets up for breakout.

Institutional Shift: Corporate treasury buying (MicroStrategy) has paused. ETF flows are now the primary demand driver. This shift from "corporate FOMO" to "passive institutional allocation" is healthier long-term but creates near-term uncertainty.

Bottom Line: Analysts are cautiously constructive. Fear dominates headlines, but on-chain data shows smart money positioning for upside. The market is waiting for permission to rally—either from ETF flows, regulatory clarity, or a dovish BoJ surprise. Until then, trade the range, stack sats on dips, and prepare for volatility.

IV. FORWARD OUTLOOK & PRICE TARGETS

THE MACRO SETUP: THREE SCENARIOS

The crypto market sits at an inflection point. We've analyzed macro catalysts, technical levels, on-chain data, and institutional flows to build three probability-weighted scenarios for the next 30-90 days and beyond.

BASE CASE (55% Probability): Range-Bound Grind into Q1 2026 Breakout

SCENARIO: Bitcoin continues to trade in a $88K-$94K range through late December, with thin holiday liquidity causing occasional wicks but no sustained breakout. The BoJ raises rates on December 19th but signals measured pace, avoiding panic. ETF flows remain positive but not explosive. Fear & Greed slowly grinds higher from extreme fear (23) to fear/neutral (40-50) by early January.

SHORT-TERM TARGETS (Next 30 Days):

BTC: $88K-$96K range - Chop continues. Low $88Ks = buy. High $94Ks = take profit. Volatility spikes around Dec 19 BoJ decision but price holds above $88K structural support.

ETH: $3,000-$3,400 - Underperforms BTC. TVL stabilizes at $70B (stops bleeding). Staked ETH ETF filing provides hopium but no immediate price impact.

Altcoins: Selective strength in SOL, XRP on news flow. Most alts bleed vs. BTC.

MEDIUM-TERM TARGETS (Q1 2026 - Next 60-90 Days):

BTC: $105K-$115K by March 2026 - Breakout above $94K occurs in mid-to-late January as ETF flows accelerate (institutional rebalancing into Q1). Market cap: ~$2.1T. BTC dominance rises to 60-62%.

ETH: $3,800-$4,200 - Lags BTC but benefits from staked ETF narrative and Fusaka upgrade momentum. Market cap: ~$500B.

SOL: $180-$220 - Continues to eat Ethereum's lunch in DeFi/NFTs. TER stablecoin launch positive.

CATALYSTS SUPPORTING BASE CASE:

✓ ETF flows stabilize and slowly improve (current +$49M/day becomes +$100M+/day by Feb)

✓ U.S. crypto market structure bill passes in Q1 2026, providing regulatory clarity

✓ BoJ hikes rates but signals gradual approach (not aggressive shock)

✓ Fed holds in January but maintains dovish 2026 outlook (2-3 cuts projected)

✓ On-chain fundamentals remain healthy (whale accumulation, exchange outflows continue)

TECHNICAL JUSTIFICATION:

BTC is forming a massive consolidation pattern between $88K-$94K. This is textbook accumulation. The 50-day MA (~$89.5K) is providing support while the 200-day MA (~$95K) acts as resistance. A break above $94K on volume >$55B confirms breakout. Fibonacci extension from October ATH ($126K) to November low ($88K) projects next leg to $108K-$112K. Base case targets $105K-$115K by Q1 end, aligning with Willy Woo's updated projections.

MACRO JUSTIFICATION:

Stablecoin market growing from $250B today to $2T by 2028 (per McKinsey) means exponentially more rails for crypto liquidity. Institutional adoption is accelerating (Ripple bank charter, CFTC allowing BTC/ETH/USDC as margin collateral). These are multi-year tailwinds. Near-term, ETF flows as % of daily volume (currently ~10-15%) need to rise to 20-25% to fuel rally. If BlackRock IBIT maintains +$50M+/day and others follow, we hit $100K+ by Q1.

BULL CASE (25% Probability): Explosive Q1 Rally to New ATHs

SCENARIO: The BoJ signals dovish surprise on Dec 19 (hikes but no aggressive tightening). Simultaneously, U.S. crypto market structure bill passes in December, creating regulatory euphoria. ETF flows EXPLODE—BlackRock IBIT sees $200M+/day inflows as wealth advisors unlock crypto allocations. MicroStrategy resumes buying. FOMO kicks in.

SHORT-TERM TARGETS (Next 30 Days):

BTC: $100K-$108K - Breaks $94K by Dec 20th. Hits $100K psychological level by Dec 26-28. Doesn't stop there—momentum carries to $105K-$108K by New Year's. Market cap: $2T+.

ETH: $4,000-$4,500 - Benefits from BTC rally. Staked ETH ETF approval accelerates.

Altcoins RIP: SOL $250+, XRP $3.50+, altcoin season index surges above 50.

MEDIUM-TERM TARGETS (Q1 2026):

BTC: $130K-$150K by March 2026 - New all-time high. Matches Standard Chartered's year-end 2026 target but arrives early. Market cap: $2.6-$3T.

ETH: $5,500-$7,000 - DeFi narrative reignites. TVL recovers to $100B+.

Total Crypto Market Cap: $4.5-$5T (vs. $3.08T today)

CATALYSTS SUPPORTING BULL CASE:

✓ Crypto market structure bill passes by Dec 31, 2025

✓ BoJ signals dovish rate path despite Dec 19 hike

✓ ETF inflows surge to $200M+/day (vs. $49M currently)

✓ MicroStrategy announces surprise $1B+ BTC purchase

✓ Major institution (Apple, Google, or sovereign wealth fund) announces BTC allocation

WHY THIS COULD HAPPEN:

Extreme fear (23) + no leverage in system + ETF infrastructure in place = powder keg. When sentiment is THIS negative and positioning is de-risked, markets can rip violently higher on any positive catalyst. Arthur Hayes' $250K prediction assumes money printing accelerates—if that happens, $130K-$150K is achievable by Q1. The market is compressed like a spring. All it needs is a spark.

BEAR CASE (20% Probability): Macro Shock into Q1 2026

SCENARIO: The BoJ shocks markets on Dec 19 with aggressive hawkish guidance (multiple rate hikes signaled for 2026). Yen carry trade unwinds violently. Simultaneously, U.S. economic data weakens (recession fears), forcing Fed into "higher for longer" stance. ETF outflows resume. Crypto correlation with tech stocks intensifies as Nasdaq dumps.

SHORT-TERM TARGETS (Next 30 Days):

BTC: $78K-$85K - Breaks $88K support on Dec 19-20. Cascading liquidations drive flash crash to $80K-$82K (mass cost basis support). Bounces but struggles to reclaim $88K. Ends December in low $80Ks.

ETH: $2,400-$2,800 - Breaks $3K psychological support. Tests $2,850 and potentially $2,600 if BTC weakness persists.

Altcoin CARNAGE: SOL $100, XRP $1.50, most alts -30-50% from current levels.

MEDIUM-TERM TARGETS (Q1 2026):

BTC: $70K-$80K range - Extended consolidation/downtrend into Q1. Tests $74K (2024 cycle low) before stabilizing. Recovery doesn't begin until Q2 2026.

ETH: $2,200-$2,800 - Multi-month base building. Layer-2 competition intensifies.

Total Crypto Market Cap: $2.2-$2.5T (vs. $3.08T today = -20-30%)

CATALYSTS SUPPORTING BEAR CASE:

✗ BoJ signals aggressive tightening (multiple 2026 hikes front-loaded)

✗ Fed January FOMC turns hawkish (zero cuts projected for 2026)

✗ ETF outflows resume at $100M+/day (institutional risk-off)

✗ Major crypto exchange hack or regulatory crackdown

✗ U.S. recession confirmed, tech stocks crater, crypto follows

WHY THIS IS LESS LIKELY (BUT POSSIBLE):

On-chain fundamentals don't support extended bear market. Whale accumulation at $88K-$90K, exchange outflows, and ETF infrastructure in place provide floor. $80K structural support (mass cost basis convergence) should hold. Even in bear case, this is a CORRECTION, not capitulation. But yen carry trade unwind is real risk—can't ignore it.

THE REKT REPORTS FORWARD VIEW

Our Conviction: Base Case (55%) with Bull Case Upside (25%)

We're leaning toward the base case of range-bound consolidation into Q1 2026 breakout, with meaningful probability of bull case if catalysts align. Here's why:

Technical Setup Favors Bulls: BTC holding above $88K despite extreme fear (23) is bullish. Consolidation at these levels = accumulation. Breakout above $94K likely in Q1.

Macro Headwinds Overblown: BoJ will hike but won't shock. Fed is data-dependent—if economy stays resilient, 2-3 cuts in 2026 still likely. Markets pricing in worst case.

Institutional Demand Real: ETF flows recovering (+$49M yesterday). Ripple bank charter, CFTC margin collateral approval, staked ETH ETF filing = infrastructure being built. This isn't retail FOMO—it's slow, steady institutional adoption.

Regulatory Clarity Coming: U.S. crypto market structure bill likely passes Q1 2026. This reduces uncertainty, opens institutional floodgates.

Sentiment Can't Get Worse: Fear & Greed at 23. Retail is gone. Funding rates neutral. No leverage. This is the definition of a washed-out market. When everyone's bearish, that's when you get bullish.

Our Trade Plan:

Accumulate $88K-$90K: Any dip to this zone is a buy. Dollar-cost average. This is whale accumulation territory.

Breakout Confirmation at $94.2K: Add to longs on volume. Target $100K+ by Q1.

Stop Loss $87.8K: Break below $88K invalidates thesis. Reassess at $80K structural support.

Watch Dec 19 BoJ: This is the binary event. Dovish = immediate rally. Hawkish = retest $88K (buy the dip).

ETH: Wait for $3K Test: If ETH holds $3K, it's a buy for $3,500+ move. Break below $3K = avoid until $2,850.

Final Word: The market is waiting for permission to rally. Catalysts are aligning (regulatory clarity, ETF flows, institutional adoption). Fear & Greed at 23 is NOT a sell signal—it's a buy signal. This is accumulation, not distribution. Be patient, be disciplined, and position for Q1 2026 breakout. The next leg of the bull market is loading. Don't get shaken out at the bottom.

V. TECHY TIDBIT OF THE DAY

🤖 When AI Accidentally Became a Crypto Maximalist

This week, Microsoft's Copilot AI was asked to predict the price of SOL, XRP, and BNB by the end of October 2025. The AI's response? A hilariously diplomatic "I don't have real-time data, but based on historical trends..." followed by a mini-dissertation on blockchain technology. Classic AI deflection.

But here's the kicker: when Perplexity AI was asked the same question about XRP, Dogecoin, and Solana, it actually provided specific price targets. Perplexity predicted XRP could hit $3.00+ if regulatory clarity continues, DOGE might stabilize around $0.33, and SOL could reach $300 in a bullish scenario. The internet promptly dubbed Perplexity "the degen AI."

Meanwhile, Elon's Grok AI (on X) was reportedly asked about Bitcoin's future and responded with a meme of itself wearing laser eyes. No price target, just vibes. And honestly? That might be the most accurate prediction of all.

The moral of the story? Even AI can't agree on crypto prices. DYOR, friends. And maybe don't trust an algorithm that thinks "to the moon" is financial advice.

Disclaimer: This report is for informational and educational purposes only. Not financial advice. Crypto markets are highly volatile and risky. Never invest more than you can afford to lose. Always do your own research. Past performance doesn't guarantee future results. The author may hold positions in assets discussed.

Data Sources: CoinMarketCap, Glassnode, CryptoQuant, Santiment, Deribit, CME, Standard Chartered Research, X/Twitter analyst commentary, and proprietary analysis.