Range-Bound Purgatory

December 12, 2025

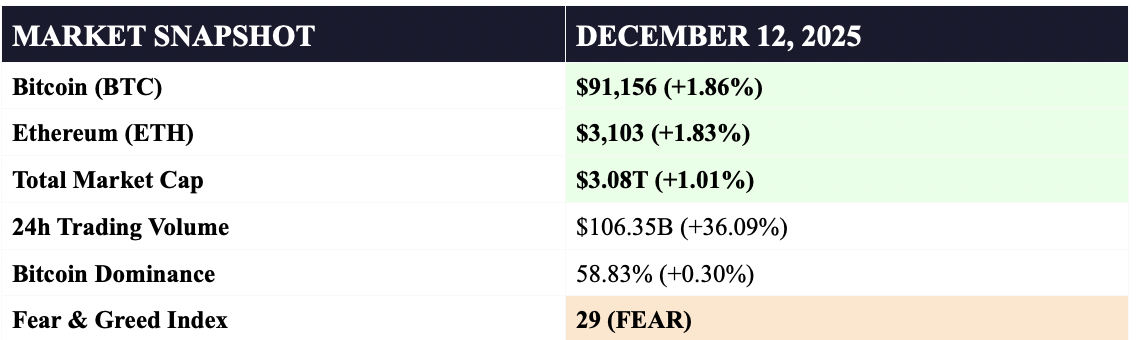

Bitcoin trades at $91,156 (+1.86% in 24h) as markets digest yesterday's Fed cut and hawkish guidance. The crypto market cap stands at $3.08 trillion, with the Fear & Greed Index clinging to 29 (still in fear territory but improving from yesterday's 26). The Nasdaq decided after the close to keep MicroStrategy—sorry, 'Strategy'—in the index, preventing $1.6B in forced outflows and giving Michael Saylor another reason to flex on Twitter.

Key Takeaway: Powell cut rates as expected but killed the vibe with hawkish 2026 guidance. BTC briefly kissed $95K before reality set in. We're now stuck in the $88-93K range, whales are distributing $3.4B while smaller players accumulate, and Japan's rate hike next week has everyone nervous about carry trade unwinds. The market's basically sitting on its hands waiting for a catalyst that doesn't involve central bank doomposting.

MARKET SNAPSHOT

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

1. FED DELIVERS CUT, KILLS RALLY WITH HAWKISH GUIDANCE

The Cut: 25bps as expected (87% probability priced in)

Powell delivered the rate cut everyone saw coming from a mile away, but his press conference was about as dovish as a hawk convention. Markets initially spiked—BTC briefly touched $95K—before reality crushed hopes faster than your portfolio during the FTX collapse.

The Guidance: Only TWO cuts expected in 2026

The dot plot showed only 2 more cuts next year instead of the 4 markets were pricing. Powell emphasized inflation risks and played the whole 'data-dependent' card, which is Fed-speak for 'we're making this up as we go.'

Market Reaction: Classic sell-the-news

BTC: $95K → $90K → currently $91K. The pattern is so predictable it's almost boring. Rate cut announced, price spikes on reflex, traders realize Powell's actually hawkish, sell button gets smashed. Rinse, repeat.

Market Intelligence: This marks the 6th time out of 7 FOMC meetings in 2025 where BTC sold off despite 'good news.' The market's learned that rate cuts don't matter if the forward guidance is garbage. Powell essentially said 'we'll cut when we feel like it, maybe twice, don't hold your breath.' Not exactly the rocket fuel crypto was hoping for.

2. $3.7B BITCOIN OPTIONS EXPIRING TODAY

Size: $3.7 billion in BTC options, $822M in ETH options

Massive options expiry hitting today with max pain clustered around $92K. For the uninitiated, 'max pain' is the price where option writers (usually market makers) lose the least money, which means prices have a gravitational pull toward that level.

Put/Call Ratio: Heavily skewed toward puts with 30-day BTC options showing double-digit premiums for downside protection. Translation: Everyone's hedged to the teeth expecting volatility.

What This Means: Expect pinning action around $92K today as market makers defend their positions. After 4PM EST when these expire, we could see a breakout in either direction as the gravity well disappears. The defensive positioning (all those puts) creates a coiled spring—if BTC doesn't break down, shorts get squeezed hard.

3. AI BUBBLE JITTERS SPREAD TO CRYPTO

Oracle: -13% after earnings disappointed

Broadcom: -10% on weak guidance

Contagion: Tech weakness bleeding into crypto

Market Intelligence: Bitcoin's unfortunate role as 'leveraged Nasdaq' strikes again. When AI darlings get murdered on earnings, crypto catches a stray bullet. The selloff yesterday saw BTC briefly dip below $84K before recovering. The correlation is annoying but real—until crypto decouples from tech stocks (spoiler: it won't), we're along for the ride on their volatility.

4. MICROSTRATEGY SURVIVES NASDAQ PURGE

Decision came after close yesterday (Dec 11): Strategy stays in the Nasdaq 100. Markets were pricing in potential removal that would have triggered $1.6B in passive outflows. Michael Saylor presumably popped champagne while simultaneously buying more Bitcoin.

Latest Strategy Moves:

• Purchased 10,624 BTC at $90,615 average ($962.7M)

• Total holdings: 660,624 BTC (~$60B at current prices)

• Unrealized profit: ~$18B

Implications: Saylor buying at $90K sends a clear signal—he views these levels as value. The Nasdaq inclusion decision removes a major overhang. Strategy's relentless accumulation provides both psychological support and an actual bid in the market. Love him or hate him, he's the most convicted Bitcoin bull with a balance sheet to prove it.

5. ETF FLOWS: THE BLEEDING CONTINUES (BUT SLOWING)

Thursday's Damage:

BTC ETFs: $77.34M outflows

ETH ETFs: $42.37M outflows

BlackRock IBIT: Five consecutive weeks of bleeding

The Silver Lining:

Tuesday (Dec 10) saw $152M in BTC inflows led by Fidelity ($199M). This suggests the worst may be over and institutions are starting to nibble again. The five-week outflow streak for IBIT is noteworthy but represents less than 0.4% of total AUM—more noise than signal.

Market Intelligence: ETF flows are a lagging indicator, not a leading one. Institutions sell into strength and buy into weakness. The fact that we're seeing inflows at $90-92K after weeks of outflows above $95K is actually constructive. Smart money accumulates fear, distributes greed. The flows are normalizing.

II. MARKET SENTIMENT & POSITIONING

FEAR & GREED INDEX: 29 (FEAR ZONE)

Current Reading: 29/100 - Up from 26 yesterday

7-Day Average: 25

30-Day Average: 22

Status: Still in fear, but improving from extreme fear

Interpretation: We've been camping in fear territory for weeks. The slight uptick to 29 suggests the capitulation phase might be exhausting, but we're nowhere near greedy yet. Historical data shows readings below 30 have preceded major bottoms in 2018, 2022, and throughout 2025. When everyone's scared, smart money accumulates. When everyone's greedy, smart money exits.

Contrarian Signal Strength: 8/10. The market is defensively positioned with elevated put premiums, ETF outflows slowing, and sentiment beaten down. This creates asymmetric upside if we get any positive catalyst.

MARKET CAPITALIZATION BREAKDOWN

Total Crypto Market Cap: $3.08 Trillion

24h Change: +1.01% ($31B added)

7-Day Change: -1.2%

Bitcoin Market Cap: $1.81T (58.83% dominance)

Ethereum Market Cap: $371.77B (12.1% dominance)

Stablecoin Market Cap: $314B (10.2% of total)

Key Observation: Bitcoin dominance at 58.83% is up 0.30% on the day—slight capital flow back into BTC from altcoins. Not quite risk-off panic, but definitely not altseason euphoria either. We're in limbo.

III. TECHNICAL ANALYSIS & KEY LEVELS

BITCOIN (BTC) - $91,156

Chart Structure: Range-Bound Purgatory

BTC has been ping-ponging between $88K-$93K for the past week like a drunk person bouncing between walls. The $90K level has become the new Maginot Line—tested multiple times, held each time, but everyone knows it can break.

Moving Averages:

MA50: $94,200 - BTC trading below (short-term bearish)

MA200: $88,500 - BTC above (long-term structure intact)

Golden Cross: Still in effect, supporting bull thesis

Momentum Indicators:

RSI (14): 50.22 - Perfectly neutral, room to run either way

MACD: Flattening, no clear signal

Volume Profile: Strong accumulation at $90-91K zone

The Verdict: BTC is stuck in no-man's land. Above the 200-day MA (bullish), below the 50-day MA (bearish), RSI neutral, volume declining. This is consolidation disguised as indecision. The range is contracting—a breakout in either direction is coming. Break $93.5K with volume and we're off to $96-98K. Lose $90K decisively and we're retesting $85-87K.

IV. WHALE ACTIVITY & ON-CHAIN INTELLIGENCE

THE GREAT WHALE DIVERGENCE

Here's Where It Gets Interesting:

We're seeing a fascinating split in whale behavior that tells two very different stories about where smart money thinks we're headed.

The Bears: Mega Whales Distributing

10K-100K BTC Holders: Dumped $3.4B in December

The biggest whales—entities holding 10,000 to 100,000 BTC (likely early miners, exchanges, or institutional custodians)—have sold or redistributed 36,500 BTC since December 1st. That's $3.37 billion in selling pressure.

What This Signals:

Could be profit-taking after the run to $126K in October. Could be year-end tax positioning. Could be smart money getting out before Japan's rate hike. Or could just be custody reshuffling. The data doesn't tell us intent, just action.

The Bulls: Smaller Whales Accumulating

10-1,000 BTC Holders: Absorbed 240% of Yearly Issuance

While mega whales distribute, smaller whales and 'sharks' are buying aggressively. Addresses holding 10-1,000 BTC have absorbed 2.4x Bitcoin's annual new supply. This is the fastest accumulation pace in Bitcoin history for this cohort.

What This Signals:

Conviction. These aren't traders flipping—they're building positions for the long haul. The fact that they're buying while mega whales sell suggests they view current prices as value.

The Takeaway: We're in a rotation, not a capitulation. Old money (early adopters, miners) is taking profits. New money (institutions, corporate treasuries, newer whales) is accumulating. This is healthy market structure—the baton is being passed from early believers to long-term holders.

EXCHANGE RESERVES: THE SLOW BLEED CONTINUES

Current Exchange Reserves: ~2.1M BTC (Lowest since 2021)

Peak (2020): 3.1M BTC on exchanges

Current: 2.1M BTC on exchanges

Trend: 1M BTC removed from exchanges in 5 years

Yearly Absorption Rate: Below -130%

What This Means: The structural supply squeeze is intensifying. Only 2.1M BTC readily available for trading out of 19.96M in circulation. That's 10.5% liquid supply. Any demand shock—dovish Fed, institutional FOMO, strategic reserve announcement—could drive violent price expansion due to lack of sell-side liquidity. This is the most bullish on-chain metric right now.

UNREALIZED LOSSES: PAIN EVERYWHERE

Total Unrealized Losses: $350 Billion

Bitcoin: $85B in unrealized losses

Source: Drop from $126K ATH to current levels

Short-Term Holders: Getting absolutely wrecked

Glassnode's Warning: 'The market is likely entering a high-volatility regime in the weeks ahead.' Translation: Buckle up. With $350B in paper losses, weak hands are close to breaking. But here's the thing—long-term holders aren't selling. The 74% of supply held by diamond hands is unfazed. This is a shakeout of recent buyers, not a structural breakdown.

V. THE ELEPHANT IN THE ROOM: JAPAN'S RATE HIKE

IS THE YEN CARRY TRADE UNWIND PRICED IN?

The Setup:

Bank of Japan meets December 18-19. Market pricing shows 90% probability of a 25bp hike to 0.75%—the highest rate since 1995. This isn't speculation. It's happening. All 50 economists surveyed by Bloomberg expect the hike. Japan's 2-year bond yield already hit 1% (highest since 2008). The 10-year? 17-year highs at 1.845%.

The Yen Carry Trade Primer:

For three decades, traders borrowed yen at near-zero rates, converted to dollars, and deployed into higher-yielding assets—US stocks, emerging market bonds, real estate, and yes, Bitcoin. As long as the yen stayed weak and Japanese rates stayed low, this was free money.

When Japan raises rates, the trade breaks down. Yen strengthens, funding costs rise, and traders are forced to unwind positions. They sell their assets, convert back to yen, and repay loans. This creates a cascade of selling pressure.

August 2024 Flashback:

Last BOJ hike (July 31, 2024): Rates went from 0.25% → 0.5%

Bitcoin crash: $92K → $49K (-46%)

Crypto market cap loss: $600 billion

Liquidations: $1.14 billion in 24 hours

So yeah, we've seen this movie before. It sucked.

THE BULL CASE: WHY IT'S DIFFERENT THIS TIME

1. It's Already Priced In

Unlike August 2024's surprise hike, this one has been telegraphed for weeks. Yields already spiked. Positioning already adjusted. Markets had time to prepare. The surprise factor—which caused the August panic—is gone.

2. The Rate Gap Still Favors Carry Trades

Even at 0.75%, Japanese rates are WAY below US rates (currently 4.25-4.5%). The interest differential that makes carry trades profitable still exists. It's narrower, but not dead.

Math: Borrow at 0.75% in Japan, invest in US assets yielding 4-5%. That's still 3-4% arbitrage.

3. Positioning Is Cleaner

In August 2024, speculators were massively short yen. The hike triggered panic buying that squeezed everyone. Now? Speculators are net LONG yen already. The positioning that caused the cascade isn't there. No fuel for a panic squeeze.

4. Controlled, Telegraphed Tightening

BOJ has been signaling this for months. Governor Ueda has been crystal clear. No surprises = no panic. Markets hate uncertainty, not rate hikes per se.

THE BEAR CASE: WHY YOU SHOULD STILL BE SCARED

1. The Real Risk Is Global Yields, Not Yen Itself

Here's the nuanced take from CoinDesk: The danger isn't carry trade unwinding—it's Japan anchoring global bond yields higher. If Japan's 10-year yield stays elevated (currently 1.845%), it puts upward pressure on yields worldwide. Higher yields globally = lower valuations for risk assets like crypto.

2. Coordinated Global Tightening

Japan tightening. US slowing cuts. China maintaining restrictive policy. For the first time in years, all three major economies are removing liquidity simultaneously. This is a global drought scenario.

3. Year-End Liquidity Thinning

Holiday markets = lower volume = higher volatility. Add forced deleveraging on top of thin liquidity and you get flash crashes. We've seen December wipeouts before.

4. BTC Trades Like Leveraged Tech Now

Bitcoin's correlation with Nasdaq is annoyingly high. If Japan's hike wobbles global equities (which it could), Bitcoin wobbles harder. We're not decoupled yet.

MY TAKE: 60% PRICED IN, 40% DANGER

The hike itself won't kill us—the reaction will. If Powell stays dovish, equities hold up, and Japan's hike goes smoothly, we're fine. Maybe even rally on relief.

But if something breaks—emerging market currency crisis, equity selloff, credit event—Bitcoin's getting dragged down regardless of what the charts say. The macro environment is fragile.

Recommendation: Hedge your bets. Don't go all-in long assuming everything's priced in. Keep 20-30% cash. Use tight stops. Volatility spikes next week are guaranteed.

VI. FORWARD OUTLOOK & PRICE TARGETS

SHORT-TERM (NEXT 7 DAYS): VOLATILITY INCOMING

Base Case (50% probability):

Range: $88K-$95K

Catalyst: Japan hike happens smoothly, markets digest

Action: Consolidation continues through year-end

Bull Case (30% probability):

Target: $96K-$101K

Catalyst: Benign Japan reaction + year-end Santa rally

Action: Break above $95K triggers short squeeze

Bear Case (20% probability):

Target: $84K-$87K retest

Catalyst: Japan hike causes equity selloff or EM crisis

Action: Break $88K triggers stop cascades

MEDIUM-TERM (Q1 2026): SPRING AWAKENING

Structural drivers all point up for Q1:

January historically BTC's best month (average +11%)

Trump inauguration Jan 20 (crypto-friendly administration)

ETF flows typically resume in January (year-end selling ends)

ETH staking ETF approvals likely

Strategic Bitcoin Reserve discussions intensify

Price Targets:

Conservative: $105K-$115K by March

Base Case: $115K-$125K by March

Bull Case: $130K+ if strategic reserve confirmed

Probability of Q1 Rally: 70%. The setup is highly favorable. New administration, institutional momentum, seasonal tailwinds, and improving technicals all align. Barring black swans, Q1 should be strong.

LONG-TERM (2026): THE SUPERCYCLE DEBATE

The market is divided on whether we're in a traditional 4-year cycle or an extended 'supercycle.' Here's the case for each:

Traditional Cycle Camp:

We peaked at $126K in October. Next stop: 40-60% correction to $50-75K in 2026, then new highs in 2027-2028. Cycles don't die, they just shift later.

Supercycle Camp (Saylor, CZ, Bernstein):

ETFs, corporate treasuries, and institutional adoption have fundamentally altered Bitcoin's market structure. Instead of 80% drawdowns, expect 30-40% corrections. Instead of 12-month bulls, expect 24+ month sustained growth. The cycle is extended, not dead.

My View:

Supercycle has merit. The institutional bid is real. ETFs aren't going away. Corporate treasuries are accumulating. But markets don't move in straight lines. I expect 2026 to be choppy with a ceiling around $150K and a floor around $80K. Not a parabolic blow-off, but not a crash either.

2026 Year-End Targets:

Bear Case: $60K-$80K (recession, regulatory crackdown)

Base Case: $120K-$140K (steady institutional adoption)

Bull Case: $150K-$200K (strategic reserve + FOMO)

VII. ACTIONABLE TRADING PLAYBOOK

FOR TODAY (OPTIONS EXPIRY):

Conservative Traders:

Sit out the expiry volatility

Wait for post-4PM clarity before entering positions

Aggressive Traders:

Long entries at $90.5-91K with stops below $89.5K

Targets: $93.5K (take 30%), $95K (take 40%), let 30% run

Flip short if rejection at $93K

FOR NEXT WEEK (JAPAN HIKE):

Position Sizing:

Reduce to 50-70% normal size

Reserve 30% cash for dip buying or panic exits

Avoid leverage until volatility settles

Entry Zones:

Aggressive: $91-92K (current)

Conservative: $88-89K (if pullback)

Deep Value: $84-86K (if panic sell)

Risk Management: Use stops. Don't be a hero. This market will chop you up if you overstay your welcome. Take profits into strength. Add on weakness. Rinse, repeat.

VIII. THE CRYPTO WATER COOLER

AI PRICE PREDICTIONS: WHEN CHATBOTS BECOME FORTUNE TELLERS

So Perplexity AI—yes, the search engine—just released price predictions for XRP, Dogecoin, and Solana by end of 2025. Because when I think 'accurate financial forecasting,' I definitely think 'chatbot.'

The predictions themselves don't matter (they're probably wrong). What matters is that people are actually trading based on them. We've officially reached peak 2025:

AI telling us what crypto to buy

Which we discuss in AI-powered Telegram groups

While trading on AI-enhanced exchanges

Using AI-generated trading strategies

It's turtles all the way down, except the turtles are LLMs and they're all hallucinating.

Next up: AI creating its own memecoin, predicting its own price, and trading it against itself in a zero-sum game of artificial stupidity. At that point, we can all retire and watch the machines fight over who gets to lose money faster.

The Singularity isn't AGI. It's when AI gets degenerate enough to YOLO into shitcoins. We're almost there. 🚀

IX. FINAL SUMMARY

WHAT WE KNOW:

Sentiment: Fear (29) but improving from extreme fear (26)

Technicals: Range-bound $88-93K, RSI neutral, awaiting breakout

Whales: Mega whales distributing $3.4B, smaller whales accumulating

On-Chain: Exchange reserves at multi-year lows, supply squeeze intensifying

Catalysts: Japan rate hike next week, year-end positioning, Q1 2026 optimism

ETFs: Outflows slowing, institutional nibbling resumed

WHAT WE DON'T KNOW:

How markets react to Japan's hike

Whether $90K holds if tested

If year-end rallies or sells off

What black swans lurk in the shadows

HIGHEST CONVICTION CALLS:

Q1 2026 rally: 70% conviction

$90K support holds: 65% conviction

Japan hike mostly priced in: 60% conviction

Year-end consolidation: 50% conviction

The Big Picture: We're in a mature crypto market now. ETFs, corporate treasuries, and institutional flows have fundamentally changed the game. The Fear & Greed Index at 29 tells us sentiment is pessimistic, but the data tells us smart money is accumulating. Japan's rate hike is a near-term wildcard, but the multi-month trend is driven by structural forces, not central bank meetings.

Disclaimer: This report is for informational and educational purposes only. Not financial advice. Crypto markets are highly volatile and risky. Never invest more than you can afford to lose. Always do your own research. Past performance doesn't guarantee future results. The author may hold positions in assets discussed.

Data Sources: CoinMarketCap, Glassnode, CryptoQuant, Santiment, Deribit, CME, Standard Chartered Research, X/Twitter analyst commentary, and proprietary analysis.