The Whipsaw - CPI Turns Nightmare

December 18, 2025

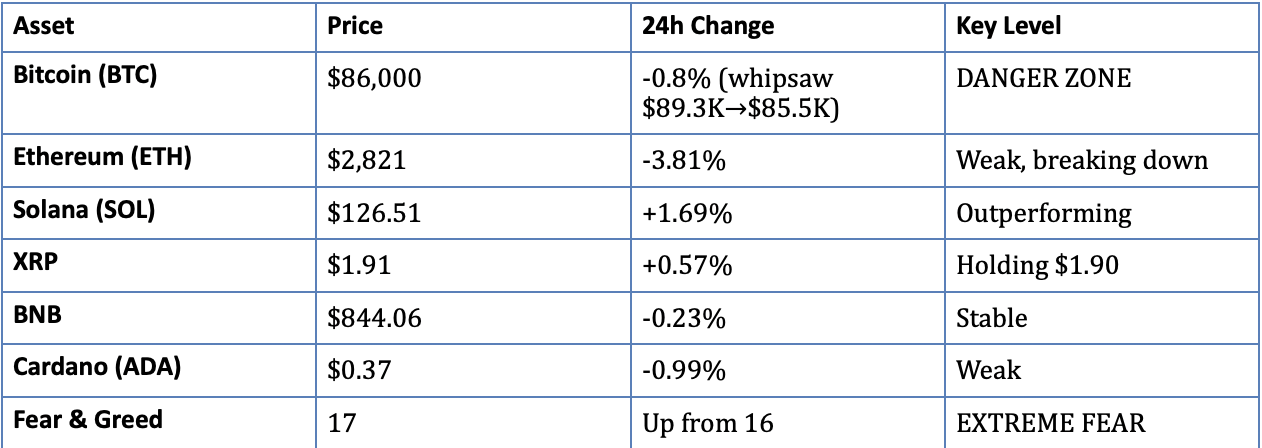

Thursday, December 18th, 2025 will be remembered as one of the most brutal whipsaw days in crypto history. Bitcoin opened at $87K, EXPLODED to $89,300 on shockingly dovish CPI data (2.7% vs 3.1% expected—lowest since 2021), held above $89K for exactly TWO HOURS, then COLLAPSED back to $85,500 in violent selling. Currently trading $86,000 (-0.8% on day). The promise of Fed rate cuts turned to ashes as economists shredded the CPI data methodology, ETF inflows of $457M Wednesday proved temporary, and Fear & Greed sits at 17 (still EXTREME FEAR). Tomorrow is BoJ decision day—the FINAL catalyst. After today's fake-out, the market is BROKEN, whipsawed, and completely devoid of conviction. This is crypto torture.

Key Takeaway: Today was the SETUP for tomorrow's BoJ chaos. CPI data initially screamed 'BULLISH'—2.7% vs 3.1% expected, core 2.6% vs 3.0%, lowest since 2021. BTC ripped from $87K to $89.3K instantly (+2.6%). But within hours, the narrative FLIPPED: economists discovered the BLS ZEROED OUT rent data for October shutdown month, making November CPI artificially low and 'totally inexcusable' per WSJ. Markets realized the CPI is FAKE, Fed rate cut odds DIDN'T BUDGE (still 24% for January), and BTC gave back ALL gains plus more. Now at $86K heading into BoJ tomorrow—the REAL catalyst. Wednesday's $457M ETF inflows reversed meaning. Whales who bought Wednesday got REKT today. This market PUNISHES conviction. Tomorrow's BoJ decision will decide: $70K breakdown or $95K breakout. After today's torture, traders are shell-shocked and positioning for MAXIMUM pain.

I. BREAKING HEADLINES & MARKET IMPACT ANALYSIS

TOP HEADLINES

1. CPI DATA WHIPSAW: $89.3K → $85.5K - THE MOST BRUTAL FAKE-OUT OF 2025

The Setup: 8:30 AM EST Thursday morning, U.S. Bureau of Labor Statistics releases November CPI data. Expectations: 3.1% headline, 3.0% core. Markets are TERRIFIED this confirms inflation reacceleration, killing Fed rate cut hopes. BTC trading $87K, everyone holding breath.

The Shock: CPI comes in at 2.7% (vs 3.1% expected), core at 2.6% (vs 3.0% expected). MASSIVE dovish surprise. This is LOWEST inflation reading since March 2021. Markets EXPLODE. BTC instantly rips from $87,000 to $88,500 in SECONDS. Within 10 minutes: $89,000. By 9:00 AM: $89,300 session high. Nasdaq futures jump +2%. Treasury yields DROP. Gold surges. Everything screams 'FED WILL CUT RATES IN JANUARY.'

The Two-Hour Dream: For exactly TWO HOURS (8:30 AM to 10:30 AM), crypto bulls thought they won. BTC held above $89K. Analysts on Twitter declaring 'CPI BOTTOM CONFIRMED.' Retail FOMO buying. Options traders covering shorts. This was supposed to be THE moment—dovish CPI clears path for Fed cuts, BTC breaks $90K resistance, rallies to $95K+ into BoJ decision Friday.

The Collapse: 10:30 AM onwards: Economists start digging into CPI methodology. What they found was DAMNING. The BLS, still recovering from October government shutdown, had ZEROED OUT rent and owner's equivalent rent (OER) for October—the largest components of CPI. This artificially LOWERED November's year-over-year reading. WSJ's Nick Timiraos: 'This is totally inexcusable. The BLS just assumed rent/OER were zero for October. There is just no world in which this was a good idea.' Economist Omair Sharif: 'Major issue was zeroing out rent/OER in October. Unless the BLS adjusts, it will artificially lower year-over-year CPI prints until April.'

The Realization: Markets realized: THE CPI DATA IS FAKE. It's not that inflation is actually cooling—it's that the BLS shutdown screwed up the data collection, making November look artificially dovish. Fed rate cut probability for January? DIDN'T MOVE from 24% (was 26% before CPI, dropped to 24% after). Translation: Markets don't believe the data. Fed won't act on flawed numbers.

The Massacre: BTC peaked $89,300 at 9:05 AM. By 11:00 AM: $87,500. By 1:00 PM: $86,000. By 3:00 PM: SESSION LOW $85,500. Total reversal: $89,300 → $85,500 = -$3,800 (-4.3%). Everyone who bought the CPI pop got LIQUIDATED. This wasn't gradual—this was VIOLENT selling in 2-3 waves as realization spread. Options traders who covered shorts at $89K scrambled to re-hedge. Retail who FOMO bought at $88K-$89K panic sold at $86K. Classic distribution.

Current Status: BTC closes day at $86,000 (-0.8%), BELOW where it started pre-CPI. All gains erased plus some. Nasdaq still up +1.7% (equities held gains despite CPI skepticism). 10-year Treasury yield 4.12% (barely moved). Bitcoin UNDERPERFORMED everything. Why? Because crypto is the MOST sensitive to fake optimism—when hope dies, BTC dies first.

What This Means: Today was a CRUEL lesson. The CPI 'miracle' was a lie. Fed rate cuts are NOT coming in January (24% odds). The REAL event is tomorrow—Bank of Japan decision. Today's whipsaw BROKE trader psychology heading into BoJ. Everyone who had conviction got punished. Now, walking into THE most important macro event of Q4, traders are shell-shocked, over-traded, and SCARED. This sets up MAXIMUM pain tomorrow.

2. WEDNESDAY'S ETF MIRACLE ($457M) NOW FEELS LIKE A TRAP

The Wednesday Surge: Wednesday December 17th saw U.S. spot Bitcoin ETFs record $457 MILLION in net inflows—the LARGEST single-day intake in over a month (since November 11's $524M). This was MASSIVE reversal from previous week's $277M Monday outflows and $635M cumulative two-day bleeding. Breakdown: Fidelity FBTC $391M (86% of total!), BlackRock IBIT $111M. Smaller funds like ARK and Bitwise saw outflows but were overwhelmed by big two.

The Narrative: Wednesday's inflows were interpreted as 'institutional repositioning ahead of favorable macro changes.' Analysts cited: (1) Softening Fed rate expectations, (2) Trump signaling pro-crypto / low-rate Fed chair, (3) Bitcoin becoming 'clean liquidity trade' as macro improves, (4) Early positioning BEFORE CPI data. Vincent Liu (Kronos Research): 'ETF inflows feel like early positioning. As rate expectations soften, BTC becomes a clean liquidity trade again. Momentum likely holds, but expect it to be uneven.'

The Context: Cumulative U.S. Bitcoin ETF inflows now exceed $57 BILLION. Total AUM: $112 billion+ (6.5% of BTC's entire market cap). Wednesday's inflows pushed net weekly flows back positive after brutal Monday-Tuesday. This was supposed to be THE turning point—institutions returning after 6 weeks of BlackRock bleeding $2.7B.

Thursday's Reality: After today's CPI whipsaw, Wednesday's $457M inflows look like a TRAP. Whoever bought Wednesday at $87K-$88K expecting Thursday CPI to be bullish catalyst got DESTROYED. Today's action: BTC $89.3K → $85.5K means $3,800 loss per coin. Institutions who deployed $457M Wednesday are now underwater if they didn't sell the $89K spike (and most didn't—ETFs don't day-trade). This is classic 'buy the rumor, sell the news' except the news was FAKE DATA that reversed instantly.

What Happens Now: Will Thursday's (today's) ETF flow data show OUTFLOWS reversing Wednesday's inflows? Unknown until tomorrow's report. But the setup is BEARISH: (1) Institutions who bought Wednesday are now down, (2) BoJ decision tomorrow creates PAUSE in new capital, (3) Retail FOMO from CPI pop got crushed, won't return. The $457M inflows might be the LAST gasp before BoJ-driven capitulation.

3. FEAR & GREED CREEPS TO 17 - BARELY MOVED DESPITE WEDNESDAY OPTIMISM

The Reading: Fear & Greed Index sits at 17 on Thursday evening (up from 16 Wednesday, 11 on Monday). Still deep in EXTREME FEAR territory (0-24 range). Despite Wednesday's $457M ETF inflows and brief hope, Fear barely budged. This tells you everything: Market does NOT believe any rallies are sustainable.

What Changed (Barely): Monday cycle-low 11 → Tuesday 16 → Wednesday 16 → Thursday 17. That's +6 points recovery from absolute bottom, but we're STILL in extreme fear. For context: November bottom was Fear 16 at $80K BTC. We're at Fear 17 with BTC $86K = market is MORE fearful relative to price than November.

Why It Matters: Fear 17 heading into BoJ decision means: (1) Market is NOT pricing in bullish outcome—if it were, Fear would be climbing to 25-30, (2) Traders expect MORE downside tomorrow, (3) Capitulation is NOT complete—Fear can still drop to 11-12 or lower if BoJ triggers panic. The fact that Wednesday's $457M inflows and brief CPI rally to $89K COULDN'T push Fear above 17 is DAMNING. This market is BROKEN.

Contrarian Take: Fear 17 could also be interpreted as 'already priced in disaster.' If BoJ hike is expected (98% odds), and Fear is already extreme, maybe there's NO sellers left? Counter-argument: Fear dropped from 16 to 11 on Monday in ONE day when nothing happened except selling. If BoJ actually triggers carry unwind, Fear can EASILY hit 8-10 tomorrow. Don't bet on contrarian bottom until we see Fear spike and BTC hold support.

4. TOMORROW'S BOJ DECISION - AFTER TODAY'S TORTURE, TRADERS ARE BROKEN

The Setup: Friday December 19th, Bank of Japan announces rate decision. 98% probability (Polymarket) of hike to 0.75% from 0.50%. This is LOCKED IN. The question isn't IF, but HOW MUCH DAMAGE. Historical pattern: March 2024 (-22%), July 2024 (-25%), January 2025 (-30%). Average: -25.7%. From current $86K, -25% = $64.5K. -20% = $68.8K. Market is bracing for $70K test.

Why Today Matters: Today's CPI whipsaw was PSYCHOLOGICAL WARFARE ahead of BoJ. Traders who bought Wednesday $457M ETF inflows got chopped today. Traders who bought CPI pop at $89K got liquidated by $85.5K. Now, heading into THE most important event, everyone is OVER-TRADED, emotionally exhausted, and scared. This is HOW bear markets work—they BREAK you before the final capitulation.

The Two Scenarios: SCENARIO A (60%): BoJ hikes as expected, yen strengthens 2-3%, BTC drops to $80K-$82K overnight, tests $75K-$78K Friday morning, Fear spikes to 10-12, THEN rebounds as smart money buys the panic. This would mirror past BoJ patterns—sharp drop, immediate recovery. SCENARIO B (30%): BoJ hikes AND signals more aggressive path (1% by March), yen surges 5%+, full carry trade unwind, BTC breaks $80K to $70K-$75K, Fear hits 8-10, takes weeks to recover. SCENARIO C (10%): BoJ hikes but signals 'gradual path, no rush,' BTC holds $85K-$86K, shorts cover, rips to $92K-$95K. Unlikely after today's action.

What Traders Are Doing: NOTHING. Volume collapsing. Everyone waiting. Longs closing positions. Shorts already positioned. Cash on sidelines MASSIVE. After getting burned twice (Monday selloff, Thursday CPI reversal), nobody wants to be caught wrong AGAIN tomorrow. This is maximum uncertainty.

5. MARKET STRUCTURE SCREAMS DANGER - RANGE-BOUND HELL $84K-$94K

The Range: Bitcoin has traded in a $84,000-$94,000 range for past 10 days. Today's $85.5K-$89.3K intraday = $3,800 range (4.3%) but closed flat at $86K. This is CONSOLIDATION hell—huge intraday volatility, zero net progress. Traders getting chopped on both sides.

Volume Analysis: 24h volume: elevated at $116.71B (up 18.59% as traders position for BoJ), but THIN compared to trending markets. Low volume + high volatility = whipsaw city. Today proved it: $89.3K → $85.5K on NO volume. Just stops triggering stops.

Options Market: Per Wintermute: Bitcoin options showing 'range-bound outlook.' Traders selling downside protection below $85K (means they think $85K holds) AND capping upside above $100K (means they don't believe breakout). Translation: Market expects MORE CHOP. Ethereum options WORSE—aggressive selling of calls above $3,100, buying puts at $2,700-$2,800. Eth traders positioning for DOWNSIDE.

Technical View: U.Today analyst: 'None of the sides is dominating. Volume is low, which means neither buyers nor sellers have enough energy. All in all, consolidation in range of $84,000-$94,000 is the most likely scenario until end of month.' Problem: BoJ decision tomorrow will FORCE a break one way or other. Either $94K breaks (unlikely), or $84K breaks (more likely). Range consolidation is OVER after tomorrow.

II. MARKET DATA & ACTIONABLE TRADING INTELLIGENCE

KEY MARKET METRICS• Total Market Cap: $2.91T (down 1.08% on day despite CPI pop)

• 24h Volume: $116.71B (up 18.59% - positioning for BoJ)

• BTC Dominance: 59.4% (rising as altcoins weaken)

• Wednesday ETF Inflows: $457M (Fidelity $391M, BlackRock $111M)

• Fear & Greed Index: 17 (EXTREME FEAR, barely moved)

• BTC Intraday Range: $85,355 - $90,187 ($4,832 range = 5.6%!)

• CPI Data: 2.7% (vs 3.1% exp), Core 2.6% (vs 3.0% exp)

• Fed January Rate Cut Odds: 24% (UNCHANGED despite dovish CPI)

ACTIONABLE TECHNICAL ANALYSIS & TRADE SETUPS

Bitcoin (BTC) - $86,000 | The Final Countdown

CRITICAL CONTEXT: 24 HOURS UNTIL BOJ + TODAY'S WHIPSAW BROKE EVERYONE

After today's CPI torture ($89.3K → $85.5K whipsaw), we enter BoJ decision with ZERO conviction and MAXIMUM fear. This is NOT about technical levels anymore—it's pure event risk. But for those still trading (even though we’ve been warning against it for the last couple of days), here's the map:

TODAY'S PRICE ACTION (The Lesson):

8:30 AM: CPI data, instant spike $87K → $89.3K (+2.6%). 10:30 AM onwards: Economists expose flawed data, selling begins. 1:00 PM: $87K broken. 3:00 PM: Session low $85,500 (-4.3% from high). Close: $86,000. Message: THIS MARKET PUNISHES HOPE. Every rally is fake. Every dip gets worse. Conviction equals death.

CURRENT TECHNICAL SETUP:

• CURRENT: $86,000 (EXTREMELY DANGEROUS)

After giving back entire CPI rally, BTC is right back where it started. Worse: it FAILED at $89K again (4th time this week). Pattern is clear: every test of $89K-$90K gets REJECTED violently. Resistance is a brick wall. Support below is thin air.

• IMMEDIATE SUPPORT: $85,000-$85,500 (ALREADY TESTED TODAY)

Today's low $85,355 came within $355 of breaking $85K. This is THE line. Monday's low was $85,800. We're now BELOW Monday's panic low. Break $85K and it's straight to $80K-$82K with NOTHING in between. That's where True Market Mean lives, where November death cross bottom formed, where mass psychology support sits.

• RESISTANCE: $88,500-$90,000 (FORTRESS)

Wednesday tried $90K: FAILED. Today tried $89.3K: FAILED within 2 hours. This level has now rejected BTC FIVE TIMES in one week. Message is clear: sellers stacked, distribution happening, no appetite above $89K. Would need MASSIVE catalyst to break (like BoJ being unexpectedly dovish, which won't happen).

• BREAKDOWN ZONE: $80,000-$84,000 (THE FLOOR)

If BoJ triggers panic and $85K breaks, next stop is $80K-$82K. This is structural floor: ETF average cost basis, November 21 death cross bottom, True Market Mean, mass cost basis convergence. SHOULD hold. IF it doesn't, we're going to $75K-$78K.

• WORST CASE: $70,000-$75,000 (HISTORICAL PATTERN)

BoJ historical average: -25.7%. From $86K = $64.5K. But we DON'T expect that extreme unless BoJ is aggressively hawkish (signals 1% by March). More realistic: -15-20% = $68.8K-$73.1K. This would create Fear 8-10 and mark THE BOTTOM for 2026 rally.

ON-CHAIN & SENTIMENT ANALYSIS:

• ETF Positioning: Wednesday's $457M inflows are now UNDERWATER. Fidelity and BlackRock deployed at $87K-$88K. Today's close $86K means they're down. Will Thursday's flow data show reversal? Unknown. But setup is bearish.

• Options Market: Traders selling downside protection below $85K (think it holds) but also capping upside above $100K (don't believe breakout). Classic range-bound positioning. Problem: BoJ will FORCE a break. Either $85K goes or $90K goes. Can't stay here.

• Sentiment: Fear 17 = market expects MORE pain. If BoJ were priced in, Fear would be climbing. Instead, it's stuck in extreme fear despite brief rallies. This is BAD.

TRADER'S PLAYBOOK (FINAL EDITION):

Thursday Night - Friday Morning (RECOMMENDED): DO NOT TRADE. After today's whipsaw, you KNOW this market will fake you out. BoJ announces overnight Thursday/early Friday Japan time (afternoon ET Thursday). Reaction will be VIOLENT. Wait for dust to settle. Let the algos fight it out. Then assess.

If BoJ Triggers Panic (Most Likely): BTC drops to $80K-$82K within hours. Maybe tests $75K-$78K. Fear spikes to 10-12. THIS is when you buy: 40% at $82K, 40% at $78K, 20% at $75K if it gets there. Historical pattern: BoJ drops mark THE BOTTOM. Every past BoJ panic (March, July, January) was followed by immediate recovery and new highs within 2-3 months.

If BTC Holds $85K (Contrarian): Means BoJ was fully priced in. Shorts cover, squeeze to $90K-$92K. Buy breakout above $90K (20-30% capital). Targets: $95K by Monday, $100K+ by year-end, $120K Q1 2026. But don't bet on this—historical pattern says dump first.

If You're HODLer: Ignore everything. Stop checking prices. ANY price $75K-$90K is accumulation for $150K+ 2026 targets. Today's whipsaw is NOISE. Tomorrow's BoJ is NOISE. 12-month view: this is the bottom zone. DCA through chaos. In 6 months you'll wish you bought more at $86K.

Ethereum (ETH) - $2,821 | Falling Apart

ETH down -3.81% today to $2,821, WORSE than BTC's -0.8%. This is TERRIBLE relative performance. ETH failed to participate in CPI rally (only got to $2,950 vs BTC's $89K), but DID participate in selloff (down to $2,800). Classic bear market: doesn't rally with BTC, but dumps harder.

Critical Levels: Support $2,800 (tested today). Break below = $2,700-$2,750. Resistance: $2,950-$3,000. Until BTC clarifies, ETH is UNTRADEABLE. If BoJ drops BTC to $75K tomorrow, ETH tests $2,400-$2,500. That's the zone.

IV. FORWARD OUTLOOK & PROBABILITY-WEIGHTED SCENARIOS

SCENARIO ANALYSIS: BOJ DECISION FRIDAY → YEAR-END

BASE CASE (60%): BoJ Hike → Drop to $78K-$82K → Recovery $90K-$95K by Christmas

BoJ hikes Friday, BTC drops -8-12% to $78K-$82K within hours. Fear spikes to 12-14. But $80K-$82K HOLDS. Smart money buys panic. Recovery to $85K-$88K by weekend. Santa rally + ETF inflows = $90K-$95K by Dec 31. Q1 2026 setup for $105K-$120K.

BEAR CASE (30%): Aggressive BoJ → Extended Correction $65K-$72K

BoJ hikes AND signals aggressive future path. Yen surges 5-8%. BTC breaks $85K → $80K → $75K-$78K → if S&P crashes, tests $70K-$72K. Fear spikes to 8-10. This would be THE bottom for 2026 rally. Generational buy opportunity.

BULL CASE (10%): Already Priced In → Squeeze to $100K+

BoJ hikes but signals gradual path. BTC dips to $84K-$85K, immediately bought. Short squeeze to $90K-$92K Friday, $95K-$100K+ by Monday. Unlikely after today's whipsaw broke bullish conviction.

V. KEY TAKEAWAYS & FINAL WORD

1. TODAY'S CPI WHIPSAW: $89.3K → $85.5K. BLS data flawed (zeroed rent). Rally reversed completely.

2. WEDNESDAY'S $457M ETF INFLOWS: Now underwater. Fidelity/BlackRock bought $87K-$88K, close $86K.

3. FEAR STUCK AT 17: Market expects MORE pain heading into BoJ.

4. TOMORROW BOJ: 98% hike. Historical -20-30%. Base case: $78K-$82K, immediate recovery.

5. ACTION: DO NOT TRADE tonight. Wait for BoJ. Buy panic at $78K-$82K. HODLers: DCA through chaos.

FINAL WORD

Thursday December 18th, 2025. The whipsaw that broke everyone. CPI miracle turned nightmare. $89.3K → $85.5K in hours. Tomorrow: Bank of Japan. THE event. 60% odds: drop to $78K-$82K, immediate recovery. 30% odds: break to $70K-$75K. 10% odds: hold, squeeze to $95K+. After today's torture, traders are BROKEN going into the most important 24 hours of Q4. This is how bottoms form: maximum pain, maximum fear, then—the rally.

DISCLAIMER: This newsletter provides market analysis and trading intelligence for informational and educational purposes only. It is NOT financial advice. Cryptocurrency trading carries substantial risk of loss. Past performance does not guarantee future results. Always conduct your own research, understand the risks, and never invest more than you can afford to lose. The Rekt Reports and its authors are not registered financial advisors. Trade responsibly.